Bitcoin has wholly sidelined its widely-covered correlation with the US stock market.

On Thursday, the benchmark cryptocurrency sustained its weekly gains as its price surged by more than 1 percent. The move briefly pushed the price above $13,000 before a modest pullback turned it back below the level. But overall, the bias appeared extremely bullish for Bitcoin.

Bitcoin retests $13,000-resistance in the latest sign of extended upside momentum. Source: BTCUSD on TradingView.com

That is because the price retested the $13K-level twice in over the previous 24 hours. At the same time, Bitcoin showed extreme resilience against sell-off attempts near $12,550, confirming that bulls want to hold the price floor in anticipation of a medium-term upside run.

Bitcoin-Stock Correlation

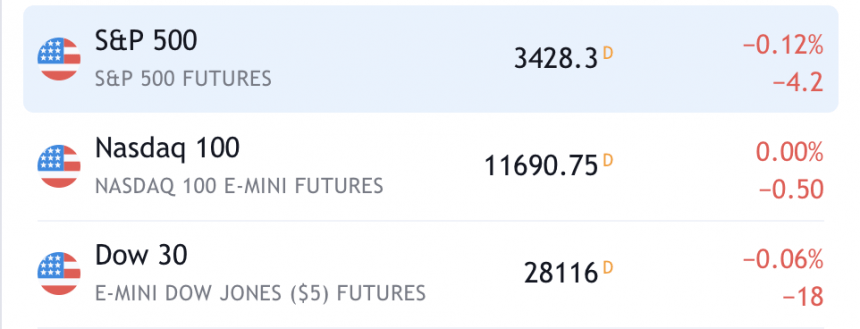

Conversely, such a bullish momentum was missing across the US stock market. The last 24 hours witnessed the top Wall Street indices closing a daily session in red, and further hinting bearish continuation ahead of the New York opening bell on Thursday.

Futures tied to the S&P 500, the Dow Jones, and the Nasdaq Composite fell in the pre-session trading. While the first two were down 0.12- and 0.06-percent, respectively, the third slipped 0.15 percent.

The US Stocks Futures slipped on stimulus worries. Source: TradingView.com

The Wall Street Journal reported that investors are waiting for more signals from the US Congress on a long-delayed fiscal stimulus. Despite several rounds of negotiations between the Democrats and the Republicans, the deal remains stuck.

Earlier, the Federal Reserve Chairman Jerome Powell has warned that the delay in passing the stimulus bill would further decelerate the US economy as it attempts to recover from the aftermath of the coronavirus-induced lockdown.

The US stock market also expects the stimulus as their next catalyst to start a bull run. Even Bitcoin, a non-mainstream financial asset, swelled its market after Congress’s $2 trillion aid in April 2020. That explains the positive correlation between the two.

The Dollar Factor

The most common denominator between Bitcoin and the US equities is the US dollar index (DXY). This year, a drop in the greenback helped in driving investors away from cash and cash-based instruments to riskier assets. That benefited Bitcoin and Wall Street – all at the same time.

But the last two days were different. The DXY declined on Wednesday but it didn’t translate into a rally in the US stock market. Bitcoin, on the other hand, rose from lower $12Ks to as high as $13,200.

The situation was similar on Wednesday. The DXY rebounded on stimulus uncertainty. As a result, the S&P 500, the Dow Jones, and the Nasdaq Composite declined. But Bitcoin remained at higher levels, unaffected by the renewed appetite for the dollar.

Stocks are flat pre market, but Bitcoin doesn’t seem to care.

It does what it wants.

Correlation can exist for short periods of times, but Bitcoin historically continues to be uncorrelated to the stock market.

— The Wolf Of All Streets (@scottmelker) October 21, 2020

Part of the reason is PayPal. The global payments giant tailed its rival Square in voyaging into the cryptocurrency space. It announced on Wednesday that its new services will include the options of buying, selling, storing, and spending Bitcoin.

That somewhat explains why Bitcoin decided to go its own way [for now].

“This pump is organically spot driven,” said Charles Edwards, founder of Capriole Investments. “There is almost no order book resistance. Yes, things can change quickly, it’s crypto. But this is a very healthy move. Something we have never seen before at 12K plus.”

Fin.