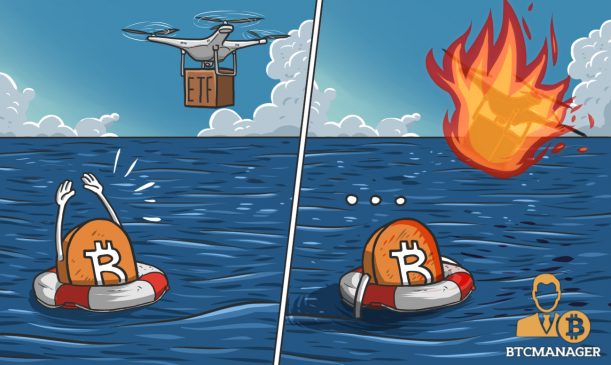

The price of bitcoin dropped by over 15 percent versus last week’s close after it became clear that the crypto markets will have to wait longer for a potential Bitcoin ETF to be approved in the U.S.

“Crypto Mom” Provides Insights

Hester Peirce, a commissioner of the SEC often referred to as “crypto mom” for her positive stance towards cryptocurrencies, spoke at the Digital Asset Investment Forum held in Washington D.C. where she stated on the topic of Bitcoin ETF approval: “Don’t hold your breath.”

“I do caution people not to live or die on when a crypto or bitcoin ETF gets approved. You all know that I am working on trying to convince my colleagues to have a bit more of an open mind when it comes to [crypto]. I am not as charming as some other people,” she added.

Since the Bitcoin ETF story has been a significant driver for the price of bitcoin, it came as no surprise that the market continued its correction further as investors were clinging on the possibility of an ETF rally on which they will know need to wait for a little longer.

In the altcoin market, the big story was the price rally of Bitcoin SV (the bitcoin cash fork supported and financed by CoinGeek’s Calvin Ayre), which saw BSV rally to briefly surpass the market value of bitcoin cash (BCH), which dropped by around 35 percent week-on-week.

This price movement suggests that BSV backer Calvin Ayre may be pumping up the value of “his” coin in a final attempt to win the bitcoin cash hash war despite having lost the bitcoin cash name to the Bitcoin ABC camp, which had the majority of the BCH community behind it since the start of the dispute.

This week’s contributions were provided by Aisshwarya Tiwari, Cindy Huynh, and Rahul Nambiampurath.

The U.S. Securities and Exchange Commission (SEC) released an official statement on December 6, 2018, postponing the decision on VanEck’s Bitcoin ETF until February 27, 2019. The extension of review period by the financial watchdog didn’t bode too well for the already reeling crypto markets, as bitcoin’s value has since fallen by more than nine percent.

The tug-of-war related to VanEck’s bitcoin exchange-traded fund (ETF) started on June 20, 2018, when the CBOE BZX Exchange Inc. filed a proposed rule change with the SEC to list and trade shares of SolidX Bitcoin Shares, issued by VanEck SolidX Bitcoin Trust.

Since then, little progress has been made as the SEC continues to delay making the final call on the ETF.

What separates the VanEck/SolidX ETF application from the other nine applications is that its Bitcoin ETF’s value will be determined by the price of actual bitcoin, contrary to the Bitcoin futures market. Notably, the Chicago Mercantile Exchange (CME), and the CBOE deal in bitcoin futures which don’t require actual BTC to back them up. Rather, they are settled in fiat. The latest statement by SEC reads in part:

“The Commission finds it appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider this proposed rule change.”

It’s worth pointing out that the SEC cannot possibly extend the decision on VanEck’s ETF beyond February 27, 2019. Jake Chervinsky, a lawyer who takes a keen interest in the world of cryptocurrencies, tweeted that February 29 is the “absolute final deadline” to decide on the approval or rejection of the ETF.

Nasdaq will list Bitcoin futures from early 2019, confirmed Express UK on December 3, 2018. The premier cryptocurrency is set to find its way through the robust New York-based exchange markets after obtaining clearance from the Commodity Futures Trading Commission (CFTC).

In January 2018, Nasdaq chief executive Adena Friedman went on record stating the world’s second-largest stock exchange is contemplating launching Bitcoin futures. At the time, Friedman mentioned that the exchange is assessing how it can differentiate its product from the ones offered by CBOE and CME.

Although reports were claiming that Nasdaq is working towards launching its own futures product, there was no official word from the stock exchange to confirm the same.

However, official confirmation from Joseph Christinat, vice president of Nasdaq’s media team, is seen as a bullish sign by many in the cryptosphere and could play a considerable role in increased adoption of cryptocurrencies the world over. Speaking with Express UK, Christinat stated:

“We’ve put a hell of a lot of money and energy into delivering the ability to do this and we’ve been all over it for a long time — way before the market went into turmoil, and that will not affect the timing of this in any way. No. Period. We’re doing this no matter what.”

According to an article published by Reuters, on December 4, 2018, VC arms of Nasdaq and Fidelity Investments have funded a new cryptocurrency exchange named ErisX. The startup successfully raised a total of $27.5 million during its Series B funding round.

Per sources close to the matter, ErisX will provide users the opportunity to trade major cryptocurrencies like bitcoin (BTC), litecoin (LTC), and ether (ETH) on futures and spot markets from Q2 2019.

The derivatives and digital asset trading platform will commence its operations after securing necessary approval from regulatory bodies. While Nasdaq has confirmed its participation in the Series B funding round, it has, however, declined to disclose the amount invested. Similarly, Fidelity’s VC arm has not replied on the subject matter either.

Thomas Chippas, CEO of ErisX, stated the funds received would be used to hire staff and develop the necessary infrastructure to ensure an efficient, transparent, and regulated market for digital assets.

Long-term plans of the company include becoming a fully-regulated futures market and offering clearinghouse services. However, the firm is yet to register for clearinghouse operations.

According to MIT Technology Review on December 4, 2018, security researchers have discovered a machine learning algorithm that can spot cryptocurrency pump-and-dump schemes in advance, which can help prevent and stop any pump-and-dump projects from developing further.

Jiahua Xu and Benjamin Livshits from the Imperial College of London are the security researchers responsible for developing the machine learning algorithm. Xu and Livshits have been studying how cryptocurrency pump-and-dump scheme operates and have recently published the first in-depth account of these scams. They’ve managed to construct an algorithm that can detect these pump-and-dump scams early.

Xu and Livshits used historical data from over 236 pump-and-dump events that occurred between July 21 and November 18, 2018, to train a machine-learning algorithm to spot the signs of a pump-and-dump scam. To understand the scheme in detail, the researchers went into an in-depth study of a single pump-and-dump scam and recorded the change in price and trading volume of the specific cryptocurrency.

Although the machine-learning algorithm can help undermine or prevent future cryptocurrency pump-and-dump schemes, MIT Technology Review believes that, in the event where a machine learning algorithm can discover these scams, the organizers will quickly change their activities so it will be harder for the algorithm to detect.

Matthias Steinig, a German programmer, has developed a new mechanism that allows e-bikes to be rented in exchange for payments on the bitcoin Lightning Network. A prototype built using a modified bicycle is already fully functional and has been demonstrated in a video posted on Twitter.

The project involves a device connected to the bike that controls the flow of electricity depending on whether or not a payment has been made. The payment process only requires the user to scan a QR code with their mobile phone and can be completed without any technical knowledge.

In its current state, Steinig’s e-bike implementation allows users to pay for temporary electricity replenishments via bitcoin microtransactions. The primary advantage of the Lightning Network is the ability to complete bitcoin transactions within a few seconds instead of several minutes or even hours. Since the payment mechanism has been built on top of the same infrastructure, there is very little delay between an individual initiating payment and being granted access to the bike’s full potential.

The payment mechanism has been designed to be simple and easily accessible. From the project’s official documentation, “You select on the display how long you want to drive, get a QR code that you scan and pay for with your lightning mobile app, after that the power for the selected period is turned on.” Once the time runs out, the user can pay for another refill or pedal the bike at no charge.

Category: Altcoins, Bitcoin, Blockchain, News, Platform, Tech

Tags: bitcoin, bitcoin payments, blockchain technology, cryptocurrency, erisX, exchange, Fidelity, Lighting Network, machine learning, scams

Thanks for sharing excellent informations. Your web-site is very cool.

I am impressed by the details that you have on this web site.

It reveals how nicely you understand this subject.

Bookmarked this website page, will come back for more

articles. You, my friend, ROCK! I found simply the info I already searched everywhere and

simply couldn’t come across. What a perfect site.