The price of Bitcoin (BTC) is experiencing a volatile time. After achieving $14,100 for the first time since 2017, a sharp pullback followed. Yet, key on-chain data and whale clusters show that high-net-worth individual investors are holding onto their positions.

This trend shows that whales are not expecting a major pullback in the near term. A low level of activity from whales is a positive metric following a large uptrend. It shows that whales are not interested in selling BTC just yet and are likely anticipating a broader rally.

In the near term, the support areas of Bitcoin are found at $12,900 and $13,300. The stability of the dominant cryptocurrency above the two levels despite various macro factors is an optimistic trend. The United States election is ongoing, and while BTC saw a 4% drop, it has been relatively resilient.

Investors seem confident

Two key on-chain indicators show that whales and retail investors, in general, are not actively selling Bitcoin. First, the BTC estimated leverage ratio shows that trades in the derivatives market are not decreasing. This shows that investors are not proactively closing their positions or trades amid the uncertainty around the U.S. presidential election.

However, after the election results come out, the high BTC estimated leverage ratio poses a risk of increased volatility. Ki Young Ju, CEO of CryptoQuant, told Cointelegraph: “The BTC Estimated Leverage Ratio on derivative exchanges is increasing till the election day. It might cause high volatility on BTC price due to cascade liquidations.”

The term “cascading liquidations” refers to a situation where futures contracts get liquidated consecutively in a short period. As an example, if short-sellers are increasingly betting against Bitcoin, yet BTC price increases, it can cause shorts to be liquidated one after another. When that happens, it causes cascading liquidations, causing volatility to surge.

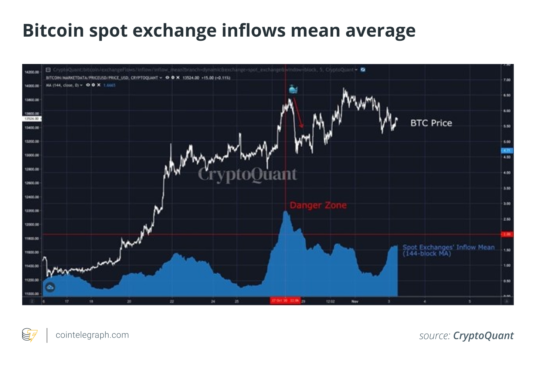

Second, there are fewer whales selling on exchanges in the U.S. that are typically used by whales, such as Coinbase Pro and Gemini. According to data from CryptoQuant, there is a low inflow of Bitcoin into exchanges in the U.S., meaning there is a lower risk of short-term selling from whales in the foreseeable future. Ju explained:

“Whales in US spot exchanges are not active for now. Spot Exchanges’ Inflow Mean is the average amount of bitcoin deposited on the spot exchanges, including US exchanges such as Coinbase Pro, Gemini, Bittrex, and others. It’s helpful to see the short-term dumping risk of whales.”

On Oct. 12, for example, inflows into U.S. exchanges suddenly spiked over the danger zone. As soon as they did, Bitcoin fell steeply in a short period. Throughout the past two weeks, exchange inflows have been considerably below the danger zone. This decreases the probability of an abrupt correction in the near term.

Whale clusters show that Bitcoin is oversold

Whalemap found that there are two technical levels in the near term that serve as important areas. Based on whale clusters, the $12,987 and $13,650 levels are critical. Whale clusters form when newly purchased BTC stays in place. Clusters show areas where whales bought Bitcoin previously and are often considered to be support levels.

Because the price of Bitcoin is hovering below $13,650 as of Nov. 3, reclaiming $13,650 and staying above it would confirm it as a support level. Hence, in the short term, rising past $13,650 is important for buyers to continue the rally. Bitcoin has established a positive technical trend in the past week by defending the $13,000 macro support area. As long as BTC remains above the $13,000–$13,500 range, the short-term bull trend is intact.

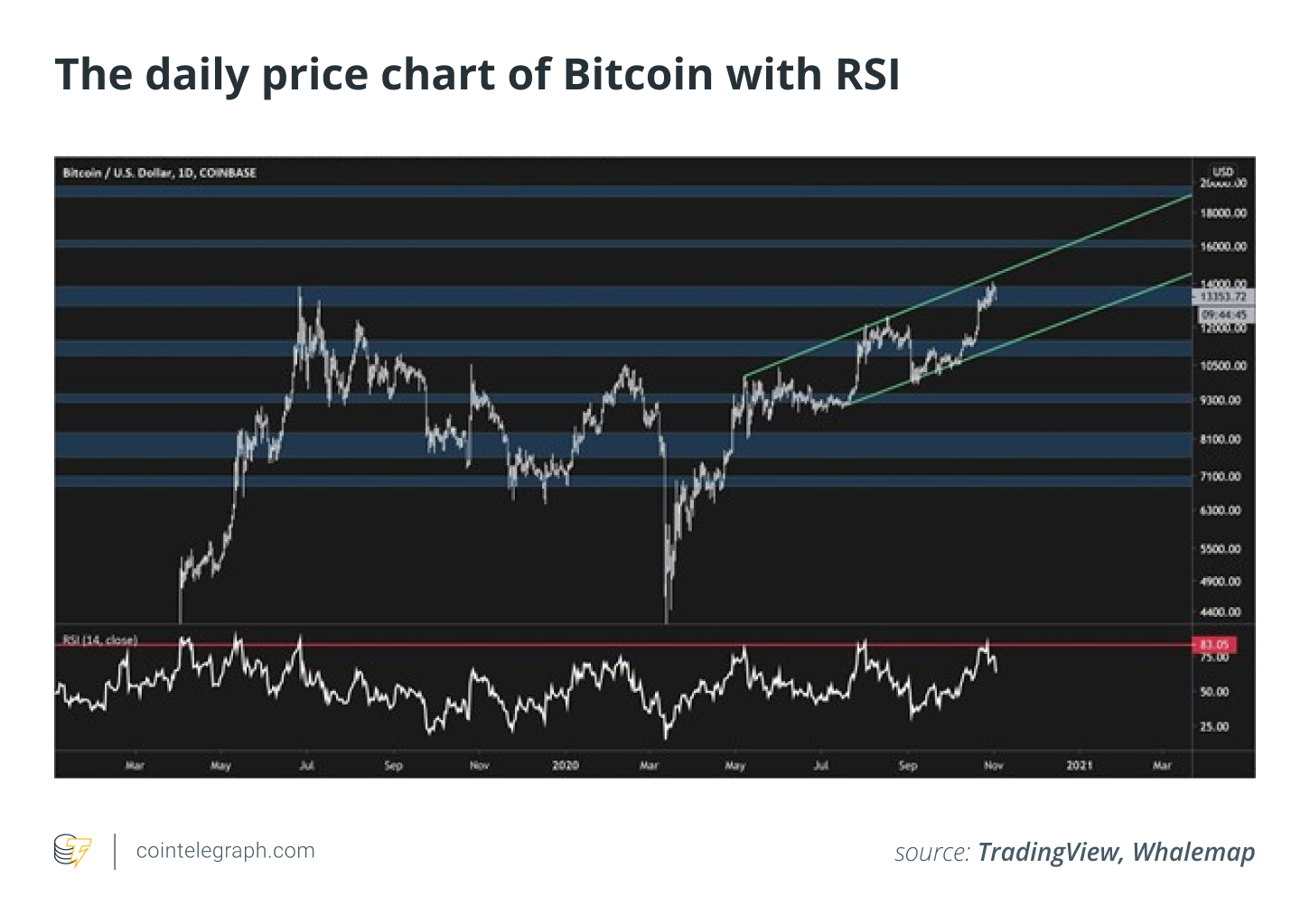

In technical terms, Whalemap explained that the daily chart of Bitcoin indicates the cryptocurrency is oversold. The relative strength index, or RSI, is an indicator that measures the momentum of Bitcoin and whether it’s overbought or oversold. On the daily candle log chart, the RSI shows BTC is currently oversold, Whalemap said. “Monthly candle sweeped 2019’s high and closed below it. Blue areas [$16,000] signify important macro fibs. I am expecting big guys to be taking profits there.”

Based on the daily chart, the $13,000–$14,000 range is an area of interest to sellers. As such, if Bitcoin remains stable above $13,000 and reclaims $14,000, the next resistance level is $16,000. For the short-term bull case of BTC to strengthen, the daily chart marking a close above $14,000 is critical in the month of November. If that occurs, as in December 2017, BTC could hit a new all-time high in December.

Two major variables to the short-term price trend of Bitcoin

Since mid-October, Bitcoin miners have increasingly sold large amounts of Bitcoin. During the rainy season in northern China, which usually begins during the fall, miners increase their capacity to take advantage of cheaper electricity. Because areas like Sichuan rely on hydropower, the rainy season results in lower electricity costs. But when the rainy season comes to an end, many miners abruptly stop mining BTC.

According to data from ByteTree, miners have sold a lot of Bitcoin in the past week. In the last seven days, there was a miner net-inventory change of negative 1,060 BTC, meaning miners have sold 1,060 BTC more than they have mined, placing significant selling pressure on the market. Consequently, Bitcoin saw its second-biggest negative mining difficulty adjustment change in history as miners stopped mining BTC en masse. Glassnode wrote:

“We just observed the 2nd largest negative #Bitcoin mining difficulty adjustment in history: -16%. It topped the -15.9% change in March this year. The only other time difficulty saw a larger downwards adjustment (-18%) was over 9 years ago, in Oct 2011.”

There is a possibility that the lower selling pressure coming from miners could allow the momentum of Bitcoin to strengthen. Atop the likely drop in miners selling BTC, the U.S. election will start having more of an impact. Analysts, including Alex Krüger, have said that a Democratic sweep of Congress or the election of Joe Biden would likely buoy the sentiment around Bitcoin.

If Biden is elected, Krüger said that gold, Bitcoin and safe-haven assets would likely increase in value on the back of significant uncertainty in the stock market, which would brace for additional regulation and potentially higher tax rates.

If President Donald Trump gets reelected, it would cause risk-on assets to rally, which might cause BTC to surge in tandem as well. Barry Silbert, CEO of Grayscale — a cryptocurrency investment firm — said that both a Trump or a Biden win would benefit Bitcoin.