Stablecoins have seen their utility climb dramatically in recent months, partially thanks to the explosion of innovation in the decentralized finance (DeFi) industry.

In the last year, the market capitalization and daily trading volume for most major stablecoins have skyrocketed as demand for price-stable crypto assets increased dramatically at this time.

Stablecoins are now used by several million cryptocurrency holders, and account for almost 40% of all cryptocurrency trading volume, while both the number and variety of different stablecoins has grown considerably in recent years – with USD-pegged, BTC-pegged, and a variety of synthetic stablecoins now in common usage.

There are multiple reasons behind the meteoric rise of stablecoins in 2020. Let’s take a look at three of the main ones.

Perfect Escape from Volatility

Though it might seem obvious, stablecoins are designed to experience far less volatility than regular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). This is because they’re pegged to the value of an underlying asset – most commonly the US dollar (USD) or gold – and tend not to deviate too far from the market price of this underlying asset.

This property makes stablecoins the ideal escape from volatility for cryptocurrency traders, allowing them to exit their positions into a price-stable asset as and when necessary to lock in profits or avoid losses.

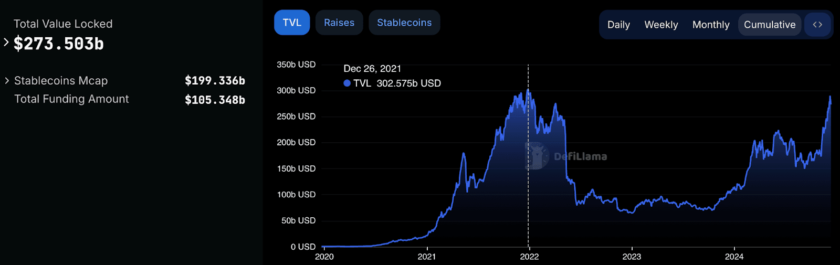

The total market capitalization of the 12 most popular stablecoins has more than tripled in 2020. Photo: The Stablecoin Index.

Prior to the popular usage of stablecoins, cryptocurrency traders would only be able to exit one volatile asset by buying another not-so-volatile one. This represented a sub-optimal solution at times the when vast majority of assets were losing value, since traders had essentially no way to lock in the value of their portfolio without cashing out entirely.

Moreover, as the cryptocurrency industry grew in popularity among institutional investors, stablecoins represented a simple way for these major market players to maintain the value of their portfolio during times of decline, and entirely exit their position when needed by redeeming their stablecoins for the underlying asset with the stablecoin issuer.

This process can be far cheaper than exchanging crypto to fiat and then withdrawing – but high minimum redemption limits restrict this option to traders dealing with significant volumes, such as crypto funds and high networth traders.

Stablecoins Are the Safest Way to Gain a Yield

Cryptocurrencies are frequently touted as one of the most profitable asset classes of all time since many of the largest and most successful cryptocurrencies have experienced dramatic price growth over the long term.

But this profitability also comes with its fair share of risks. For one, not all cryptocurrencies have performed well and investors can be subject to devastating losses if they make the wrong investment. Meanwhile, the extreme volatility of many assets experience can make them unsuitable for those with a low-risk tolerance, since there is a significant risk of at least short-term losses.

This has led many cryptocurrency holders to seek out less risky investments with the aim of gaining a positive yield without taking on the extreme volatility risk that comes with holding most regular cryptocurrencies. Stablecoins represent the ideal solution in this scenario since they can now be used to turn an extremely low-risk yield that far exceeds that offered by most banks.

Photo: BXTB

The need for risk-free ways to turn a yield has also led to the elaboration of the first yield-generating stablecoin, known as CHIP. Unlike other stablecoins, which need to be invested in a variety of potentially risky platforms to generate a yield, BXTB’s CHIP stablecoin instead enables users to generate a safe passive income without losing custody of their assets.

BXTB achieves this with its unique transaction fee distribution mechanism. When users mint CHIP stablecoins by combining it with a second token known as BXTB, they received an activated form of BXTB (known as yBXTB). By holding these yBXTB tokens, users are entitled to a share of the transaction fees generated on the network in CHIP tokens, earning a safe passive yield.

Ethereum’s DeFi Explosion

Stablecoins have also seen their utility climb dramatically in recent months, thanks to the explosion of innovation in the decentralized finance (DeFi) industry.

With automated market makers (AMMs), yield-farming platforms, and DeFi investment protocols cropping up an increasing pace, stablecoin users now have more ways than ever before to put their funds to use – and potentially earn a yield while doing so.

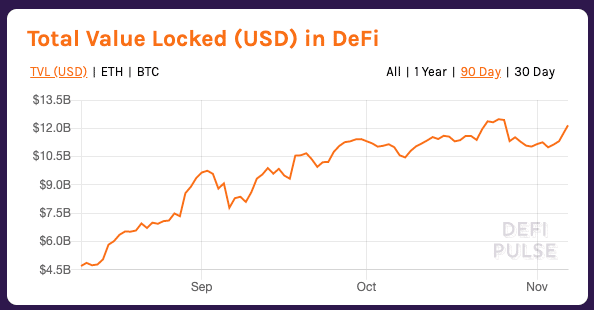

Photo: DefiPulse

In total, more than $12 billion worth of crypto assets is now locked up in DeFi platforms – a large chunk of which is in the form of stablecoins like Tether (USDT) and True USD (TUSD), as well as wrapped assets like Wrapped Bitcoin (WBTC).

With a large amount of stablecoins locked up in DeFi platforms and protocols, DeFi has become the second most popular use for stablecoins after trading.

Having obtained a diploma in Intercultural Communication, Julia continued her studies taking a Master’s degree in Economics and Management. Becoming captured by innovative technologies, Julia turned passionate about exploring emerging techs believing in their ability to transform all spheres of our life.