Bitcoin (BTC) has had a great November so far and many analysts believe the future remains bright for the top-ranked cryptocurrency.

Currently sitting at $16,000 the price has surged by 23% since the start of the month, rallying mostly after the completion of the U.S presidential election. Now, Bitcoin spot volume has passed all previous records in 2020, showcasing the growing demand for acquiring BTC.

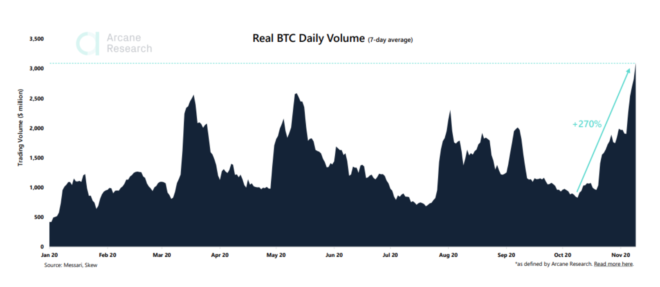

The strong rally to $16,200 led Bitcoin spot volumes to rise by more than 270% in the past month. According to a recent report from Arcane research, the daily volume on Nov. 5 was the highest since the Black Thursday crash which brought BTC price below $4,000 on March 13.

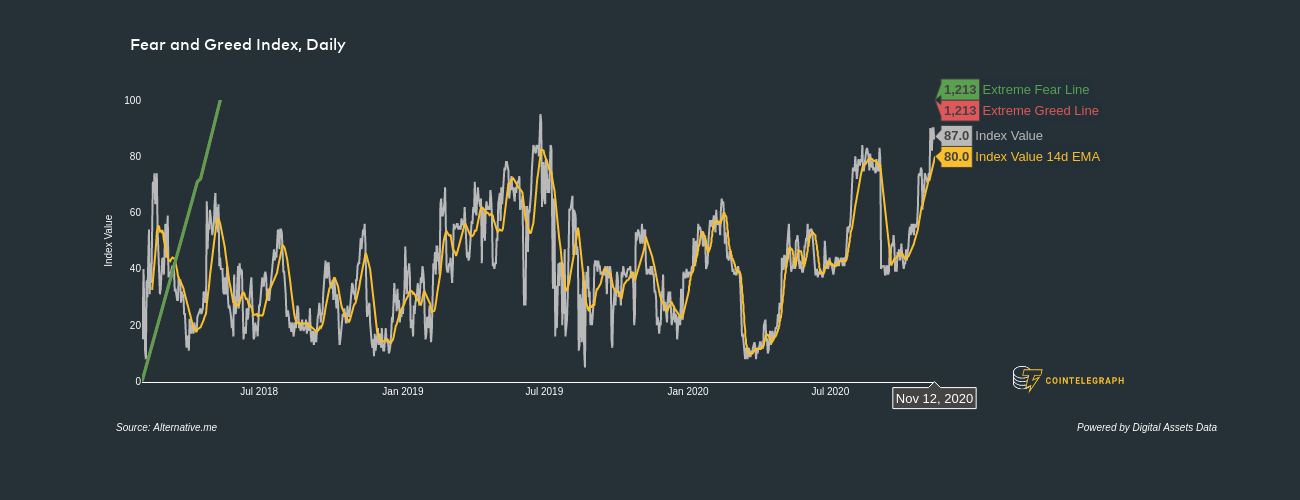

Market sentiment is also reaching record-breaking numbers and this is clearly reflected in the the Crypto Fear and Greed Index which is currently at 86, a reflection of extreme greed in the market.

Many seasoned investors counter-trade the signal coming from the index as ‘extreme greed’ is reflective of FOMO or euphoric sentiment in the market and a sign to take profits.

Institutional volume continues to rise

Not only is spot volume for Bitcoin reaching 2020 highs, institutional interest has also been rampant throughout November, with multiple high profile companies and high-net-worth individuals investing Bitcoin.

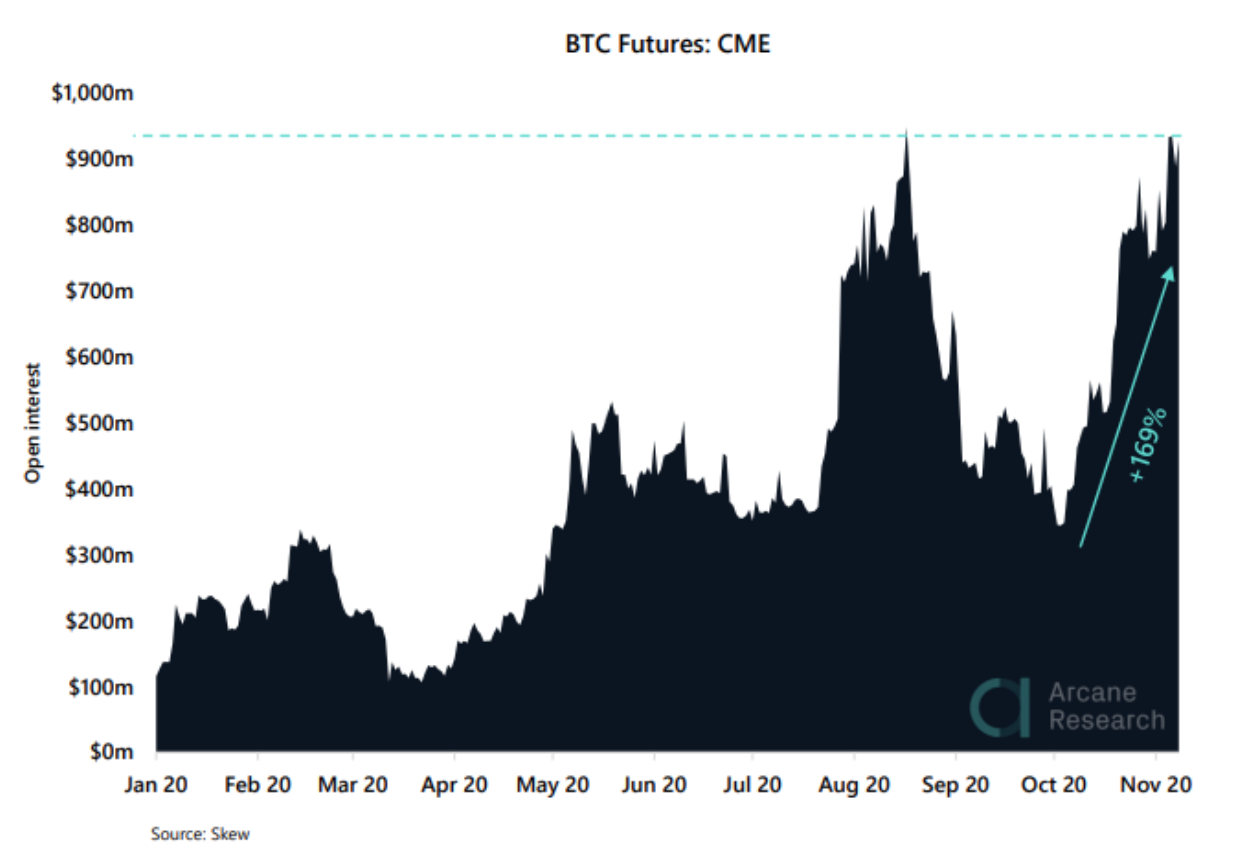

Open interest for Bitcoin futures at CME also surged to near all-time highs last week at $934 million. The figure has been growing since the start of October and increased 169% in the last month.

According to Arcane Research, the growth in the number of participants may be the main reason for the steep increase in open interest. Reports from the Commodity Futures Trading Commission (CFTC) show that there are now 102 large traders holding positions (the minimum size is 25 BTC) and this is a 126% increase from the average figures seen throughout 2019.

Will Bitcoin price rise as more participants enter the market?

Increasing participation in both spot trading and regulated Bitcoin products are clearly impacting Bitcoin current bullish trend and possibly altering how the digital asset is perceived by institutional and traditional retail investors.

As volumes at top tier exchanges and regulated derivatives markets continue to grow, it is possible that a Bitcoin Exchange Traded Fund (EFT) will finally be approved and this would really open the gates for institutional investors to engage with Bitcoin and other crypto-assets.