The total crypto market cap added $19.4 billion to its value for the last seven days and now stands at $463.3 billion. The top 10 currencies showed mixed results for the same time period with Litecoin (LTC) adding 10.4 percent to its value while Bitcoin Cash (BCH) lost 8.8 percent. By the time of writing bitcoin (BTC) is trading at $16,257, ether (ETH) stabilized around $454 Ripple (XRP) skyrocketed to $0.271.

BTC/USD

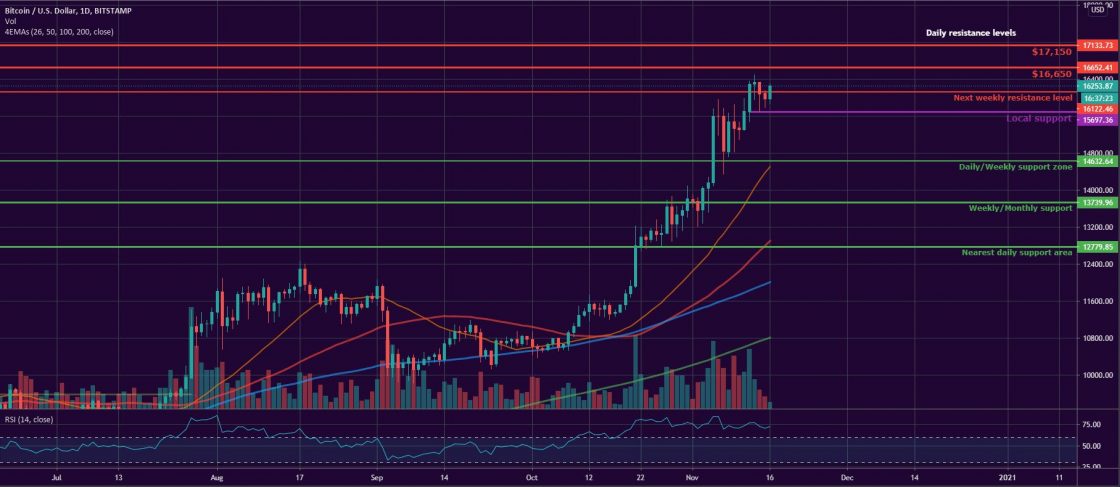

Bitcoin moved up to $15,507 on Sunday, November 8 after correcting its price down to $14,832 the day before. The leading cryptocurrency added 12.7 percent to its value and successfully resumed the uptrend.

On Monday, we saw the BTC/USD pair moving in the $15,840 -$14,830 range before closing with a short red candle to $15,330. The zone around $15,850 was hit for the second time in the last few days and bulls seem to struggle surpassing it.

The trading day on Tuesday, November 10 was a relatively calm one. BTC continued to hover around the above-mentioned zone and closed flat at the end of the session.

The mid-week session on Wednesday, however, was marked by a new wave of buy orders hitting the market. Bitcoin extended its gains and climbed further to $15,720 and gaining yet another 2.7 percent.

On Thursday, November 12, the BTC/USD pair surpassed the next resistance level on the weekly chart closing at $16,307. Another 3.8 percent were added to the coin’s value.

The Friday session was a relatively calm one as BTC stabilized above the important horizontal line. It formed a short green candle to $16,345.

The uptrend started showing signs of exhaustion on the first day of the weekend. On Saturday, November 14, the leading cryptocurrency corrected its price down to $16,100 and even hit the local support at $15,700 during intraday.

On Sunday, it extended the losses and fell to $15,977.

The 24-hour trading volumes moved up to $29 billion on Tuesday then fell to $21 billion on the next day just to recover back to $29 billion on Friday. They started falling during the weekend and reached a weekly low of $18 billion on Sunday.

ETH/USD

The Ethereum project token ETH moved above the next weekly resistance zone on November 7 and hit $470, but was not able to keep up with the momentum. Still, it closed the week at $454 on Sunday and added 15 percent to its value for the period.

On Monday, the ETH/USD pair made a short pullback to $443 and fell as low as $434 during intraday trading. The coin found support at the weekly/monthly horizontal line.

The ether followed the example of BTC and revived the uptrend on Tuesday, November 10 climbing to $450.

The third day of the workweek came with a continuation of the trend and a sudden jump to $477 in the early hours of trading Buyers, however, only managed to ensure a presence in the next weekly resistance zone around $460 (closing at $463).

On Thursday, November 12, the ETH/USD pair was trading in the $450-$470 zone but remained flat at the end of the session thus proving how solid the resistance level is as neither bulls nor bears were able to take over control.

Nevertheless, buyers formed a solid green candle to $477 on Friday and breached the $470 line, adding 3 percent to ETH’s value on the way up.

The weekend of November 14-15 started with an expected pullback down to $461 on Saturday as the uptrend started losing its momentum. The drop resulted in erasing all gains from the previous session.

Then on Sunday, the ether fell further to $447 forming its second consecutive red candle on the daily chart.

The 24-hour trading volumes were hovering around $11 billion during the workweek then decreased to sub-$7 billion levels on Sunday.

XRP/USD

The Ripple company token XRP closed the trading day on Sunday, November 8 at $0.253 confirming its presence above the $0.25 horizontal support. Bulls could not surpass the monthly resistance zone situated near $0.259 during the previous session but managed to close the week with a 5.4 percent price increase.

On Monday, the XRP/USD pair was trading as low as $0.245 in the morning, but found stability at the 50-day EMA and recovered later, in the evening part of the session. Nevertheless, it closed with a loss to $0.25.

The “ripple” was quite volatile on Tuesday, November 10, moving up and down in the wide range between $0.248-$0.264 before forming a green candle to $0.254.

It continued to rise on Wednesday and reached $0.256. Buyers were even able to push the price up to the already-mentioned resistance level, which was now in synch with the 100-day EMA creating a resistance cluster zone.

We saw a short pullback to $0.255 on Thursday, November 12, but the general uptrend was not impacted. The confirmation for that came on the last day of the workweek when the XRP token skyrocketed to $0.266. The move resulted in a 4.3 percent jump and the coin closed above the $0.259 line for the first time since September 3.

The “ripple” continued to surge on the first day of the weekend and reached $0.268. On Sunday, November 15, it made one more step up and ended the seven-day period at $0.269.

Altcoin of the Week

Our Altcoin of the week is AAVE (AAVE). One of the leading DeFi projects out there, AAVE was previously known as ETHLend, bur rebranded itself in late 2019 and early 2020. The idea of the company founders is to create a decentralized money market that enables users to lend and borrow crypto funds utilizing the benefits of blockchain technology.

AAVE grew by 42 percent for the last seven days and it’s also 114 up on a biweekly basis. The coin reached an all-time high on Sunday, November 15, and hit $71.5 climbing up to #30 on CoinGecko’s Top 100 list with a total market capitalization of approximately $750 million.

By the time of writing, AAVE is trading at $68.5 against USDT on Binance. Below is the 4-h chart:

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4