Bitcoin is trading above $18,500, having charted a minor pullback to $17,800 over the weekend. The cryptocurrency’s one-month implied volatility metric has jumped to four-month highs, suggesting increased expectations for price turbulence over the next four weeks.

“It’s likely the week ahead is filled with volatility with the possibility of a trading range between $19,000 and $17,000 the likely outcome. However, if the bulls take charge, then we could be discussing new all-time highs for BTC,” noted crypto exchange EQUOS in its daily bitcoin analysis email.

In traditional markets, safe havens such as the U.S. dollar and gold are trading heavily alongside stock market gains. Risk appetite has been boosted by more positive news on the coronavirus vaccine front, this time from AstraZeneca and Moncef Slaoui, head of the U.S. government’s Operation Warp Speed. “Vaccinations against COVID-19 will ‘hopefully’ start in less than three weeks,” Slaoui said on Sunday.

Market moves

That said, when it comes to bitcoin this year, some of the biggest names in global finance were WRONG and LOSERS, as (lame duck?) U.S. President Donald Trump might put it.

JPMorgan CEO Jamie Dimon, Berkshire Hathaway CEO Warren Buffett, Bridgewater Associates CEO Ray Dalio, Goldman Sachs. All of these Wall Street titans steered investors away from the largest cryptocurrency this year as its price soared more than 150%.

Even if bitcoin’s price once again plunged 39%, as it did in March when the deep economic toll of the coronavirus became clear to global investors (before the Federal Reserve bailed out financial markets), the price would still be roughly $11,370, up some 59% from the Dec. 31, 2019, price of $7,168. For comparison, the Standard & Poor’s 500 is up 11% this year and gold has gained 24%.

Few of the biggest banks and brokerage firms even had bitcoin on their radar at the start of this calamitous year. Some investors came around to the concept sooner than others.

In just 11 years, bitcoin has gone from nothing to an awe-inspiring creator of wealth. At this point, whether prices go to the moon or stagnate or correct, the cryptocurrency is becoming impossible to ignore in an increasingly dysfunctional global financial and monetary system.

Bitcoin watch

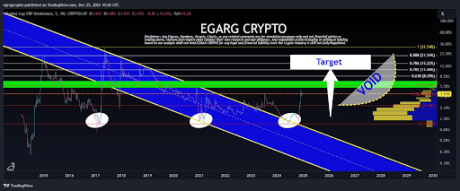

There seems to be no stopping the bitcoin freight train.

The cryptocurrency jumped over 15% in the seven days leading up to Nov. 22 to register its biggest weekly gain since October 2019. That was also the seventh straight weekly rise.

What’s more, prices ended last week (Sunday, UTC) above $18,400 – the second-highest weekly close on record. Bitcoin is now just 6.5% short of challenging the record high of $19,783 reached in December 2017.

A move to record highs could easily happen in a matter of a few hours, given the recent strong momentum.

That said, a metric from bitcoin’s perpetual futures market now suggests the market is getting excessively skewed to the bullish side and could experience a rise in volatility.

The average level of the “funding rate” across major exchanges has risen sharply from 0.023% to a five-month high of 0.087% in the past 48 hours, according to data source Glassnode.

“Rising funding rates have in the past been associated with a larger portion of the market utilizing leverage via perpetuals,” Matthew Dibb, CEO of Stack Funds, told CoinDesk. “The high funding rate can cause somewhat of a ‘shakeout’ due to increasing margin liquidations.”

So far, pullbacks have been shallow and restricted near the ascending 10-day simple moving average (SMA), currently at $17,640. As such, the SMA line is a key support to watch out for in the short-term. Bitcoin has immediate resistance at $19,000, followed by the record high of $19,783.

What’s hot

- Crypto Long & Short: 4 Metrics That Show How the Current Bitcoin Rally Is Different From 2017 (CoinDesk)

- John Lennon’s Son Says Bitcoin ‘Empowers’ People Like Never Before (CoinDesk)

- China to Hold Second Lottery Trial of the Digital Yuan (CoinDesk)

- CipherTrace Says Homeland Security Work Gave Rise to Monero-Tracking Patent Filings (CoinDesk)

- Bitcoin Is the Biggest Big Short (CoinDesk)

- China Construction Bank Pulls Planned Listing of Bitcoin-Tradable Bond (CoinDesk)

Analogs

The latest on the economy and traditional finance

- Vaccine developments keep dollar down; Kiwi hits two-year high (Reuters)

Risk appetite in currency markets was boosted by progress towards a COVID-19 vaccine rollout even as PMI data showed a sharp contraction in euro zone business activity as a result of lockdown restrictions. - Five crypto bulls predict what’s next for bitcoin as it closes in on an all-time high (CNBC)

As bitcoin gets closer to its record high of almost $20,000, CNBC asked five crypto experts for their take on the rally. - ‘Big War’ in Bonds Escalates as Treasury Rift Puts Fed in Play (Bloomberg)

Expectation for Fed action “is keeping bonds from selling off.” - The Stocks the Pros Own Usually Beat the Market. Here’s a List of Their 10 Most Popular Bets. (Barron’s)

“Quarterly baskets of the 10 (plus) most owned stocks by mutual funds and hedge funds outperformed the S&P 500 six and 12 months later,” Citigroup equity strategists said. - Bank Stocks Already Had a Wild 2020. Then November Got Even Crazier. (WSJ)

The day after the election was one of the worst ever for bank stocks; three trading sessions later, they had one of their best days.