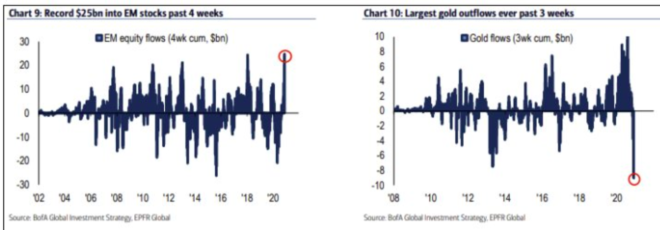

Dan Tapiero, the co-founder of 10T Holdings, said weak hands have been shaken out in the gold market. This raises the probability of a gold rally in the near term, especially as it comes off of an 80-day pullback period.

A rally in gold and the dollar may dampen Bitcoin price

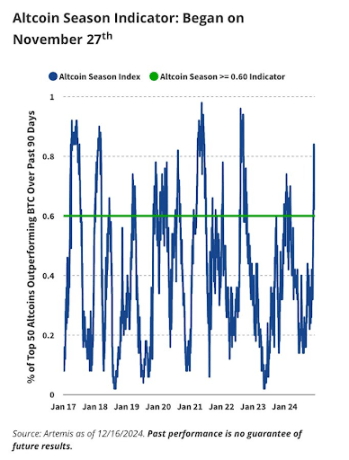

Bitcoin has seen strong momentum in the past three months, as it achieved an all-time high on Coinbase and a number of other major exchanges.

Despite this, the threat of a correction for Bitcoin is a real possibility if gold begins to rebound in tandem with the U.S. dollar.

According to Tapiero, the largest ever three-week liquidation in the gold market increases the probability of an uptrend. He wrote:

“Very bullish for #gold. Largest EVER 3 wk liquidation just occurred. Weak hands cleaned out. $25 bil went into EM equity, much more into US equity. Only $8 bil out of gold. Maybe tiny amount into #bitcoin. #BTC not yet big enough to be a macro asset class…but coming soon.”

Some might consider the recovery of gold a positive factor for Bitcoin in the medium term. Since more investors are starting to acknowledge BTC as a store of value, the uptrend of gold could benefit the cryptocurrency.

Still, there is a stronger case to be made that the rally of Bitcoin coincided with large gold outflows, as Cointelegraph reported. That means a major gold rally could impact the near-term momentum of BTC.

The parabolic uptrend of U.S. stocks is another factor

The U.S. stock market is continuing to rally due to unprecedented liquidity from the central bank. The combination of average inflation and relaxed financial conditions have been pushing stocks to all-time highs.

Best month since 1987 for stocks. #DowJones pic.twitter.com/SMslJLXwHS

— Jan Nieuwenhuijs (@JanGold_) December 1, 2020

As a result, Jan Nieuwenhuijs, an independent financial researcher at The Gold Observer, reported that U.S. stocks had their best month since 1987.

There is a possibility that the continuous uptrend of U.S. stocks makes other risk-on and risk-off assets less compelling in the near term. It could also make BTC a less urgent trade for both retail and institutional investors in the foreseeable future.

At the moment, many traders believe that Bitcoin is at risk of seeing a deeper pullback to $18,600 following its recent rejection.

Michael van de Poppe, a full-time trader at the Amsterdam Stock Exchange, said that BTC’s fall from $19,100 with a strong reaction from sellers makes a larger drop likely. He wrote:

“Couldn’t break through $19,400 as the crucial breaker, after which a drop occurred towards $18,800. $19,100 area instantly rejected and the likelihood of a drop towards $18,600 increases.”

Bitcoin (BTC) is at risk of a pullback as analysts anticipate gold to see a major recovery. The precious metal has underperformed against BTC in recent weeks as the dominant cryptocurrency saw an institution-led rally.