It is frustrating. But at the same time, interesting.

Over the past couple of weeks, I’ve heard two well-respected investment managers say that they don’t believe in bitcoin’s supply limit. If it’s easy to spin up another Bitcoin, they claim, then there is really no limit. Most of you reading this will be rolling your eyes at this stage, but since it seems to be a firmly held view by some smart people, we should dig deeper.

We’ll find that it’s about more than a lack of research.

First, let’s look at what the two investment managers I’m referring to actually said.

This is from investment researcher and former hedge fund manager Jesse Felder’s blog post of a few weeks ago (my emphasis):

“Bitcoin believers rely entirely on the idea that bitcoin is limited in supply making it far more attractive than fiat currencies that are being printed like mad by central bankers around the world. However, Bitcoin has already hard forked several times, multiplying the number and type of bitcoins in circulation. In fact, if you put together all the hard forks Bitcoin has undergone since it was first created, the number of total bitcoins has actually grown faster than the number of dollars. That’s a fact.”

And on the markets and investment podcast The End Game this week, investment manager and writer Fred Hickey said (again, my emphasis):

“The number five cryptocurrency is Bitcoin Cash! The number 12 biggest is Bitcoin SV – there’s no limit to these things. If bitcoin got too expensive, they would just go to another one. These are speculators, they pile into anything that’s cryptocurrencies.”

For now, we’ll ignore the snide implications that bitcoin’s market is entirely speculator-driven, and that speculators don’t know how to do research (because those assertions are just too flimsy to even bother with). Instead, let’s focus on the misguided idea that new Bitcoin blockchains can be spun up whenever we want.

And let’s go deeper as to why this misunderstanding persists, and what that says about Bitcoin’s role in our evolution.

Not so fast

Most of you are familiar enough with crypto markets to know that Bitcoin is unique. But have you thought much about why?

It’s only partly the technology. The blockchain code is open-source and can be copied and tweaked to make new bitcoin-like assets. But, no matter what they call themselves, they are not Bitcoin. Bitcoin Cash increased the block size, allowing for larger throughput at the expense of a higher degree of centralization. Bitcoin SV increased block size again by multiples more.

The market tells us that investors prefer the original Bitcoin:

But have you ever heard an institutional investor talk at length about how Bitcoin’s SegWit scaling solution gives them more confidence as to the security of decentralization than Bitcoin SV’s whopping 128MB blocks? I’m sure that has happened; but I don’t think the scalability is a key investment criterion. It’s not the Bitcoin-specific characteristics that keep funds flowing into BTC.

It’s the network effects. I’m not referring to the Metcalfe’s Law effect of each additional node. Nor am I talking about the advantages of having more people to send bitcoin to (although that is not insignificant). I mean the market infrastructure and services that spring up around the asset with the highest volume: the on-ramps, sophisticated platforms, professional custody, complex derivatives and, even more important, the liquidity. Smaller assets, no matter how impressive their block size, are riskier. Investors care about that, and so, no matter how expensive BTC gets, I very much doubt they’ll just rotate into BCH or BSV.

Those market network effects, combined with the underlying technology’s characteristics and potential, are behind the current professional investor focus on BTC.

Trying to understand

Why is it hard for otherwise smart investors to see that? Here it gets interesting.

To see why, we need to look beyond the lack of research and the absence of interest. Underlying those is the assumption that traditional investment paradigms still hold.

Chief among these is the not-unreasonable conviction that technology is replicable, and that network effects early on are not necessarily permanent. MySpace lost out to Facebook, Google was not the first search engine. It’s hard for traditional investors to understand that Bitcoin is not a business, and better marketing from rivals is unlikely to make a material difference.

It’s also hard for traditional investors to think about technology in the same framework as natural elements. After all, elements just are. Their composition can never change. What’s more, their use can be discouraged, but they can never be eradicated.

Technology, on the other hand, is created by someone, according to chosen specifications, to fulfill a specific role. We can make it do one thing or another, and sometimes it gets used for something totally different than what we intended, but that’s the market for you. Technology is almost infinitely malleable in its composition and purpose. It’s also fickle, generally subject to the whims of the powerful, and driven by the conflicting urges of control and empowerment.

Bitcoin was created by someone, but we don’t know who, so there is no one we can point to as responsible. Bitcoin is constantly being updated and tweaked by a small army of developers with diverse backgrounds and funding sources, but it cannot be fundamentally changed without network consensus, which would only be possible if its size shrunk to a small fraction of today’s. And its use can be discouraged, but Bitcoin cannot be turned off. All this gives Bitcoin – a technology – a curiously elemental status.

Here lies a not-too-ridiculous mental disconnect. Both of the above-mentioned investors have written extensively on gold, and instinctively understand the value of natural immutability and scarcity. Accepting that a technology can have similar properties is a stretch for most.

But understanding the difference between Bitcoin and other technologies, and the similarities between bitcoin and gold, is essential for grasping how significant its development is. It’s not just about the inflation hedge offered by bitcoin’s scarcity and decentralization. It’s about civilization.

The emergence of metallurgy was, according to many theories, a trigger for the development of a complex society. It is entirely possible that the emergence of crypto technologies will be the catalyst for another societal restructuring. We’ve heard those outrageous claims before from technology advocates. But we haven’t before had a technology with element-like properties, that emerged in a technology-rich era ripe for catalysts, at a time buffeted by so many other society-transforming trends and events.

This confusion as to what Bitcoin is is shared by many, but by no means all. Renowned investor Paul Tudor Jones showed this week that he gets it when he said:

“If really I had to guess what the future [of crypto] was going to be, I’d guess it was going to be a lot like the metals complex – where you have “precious crypto” which might be bitcoin … And you’re going to have transactional cryptocurrencies, along with the sovereigns, and they may be more like the industrial metals.”

Throughout history, profound transformations are usually not noticed by the mainstream until well after the changes are under way. When traditional investors confound us with their ignorance and lack of research, we should try to understand why. And more importantly, we should appreciate what that says about the depth and subtlety of new definitions and new paradigms that will define value and society in the turmoil to come.

Anyone know what’s going on yet?

U.S. stocks climbed to all-time highs and Treasury yields jumped while the dollar fell, after worsening COVID-19 statistics and still-high U.S. unemployment bolstered expectations for more federal stimulus.

This relentless rise irrespective of a bad economic outlook makes me nervous. It’s not just the disconnect of markets from main street reality; it’s also that market consensus is generally a sign that things are about to turn. However, with so much different about this year, who knows when investors will realize this, or even if they will care when they do.

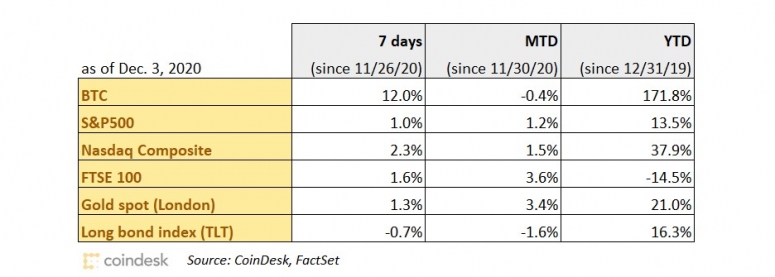

Bitcoin also continued its rally, recovering from the slump seen a week ago to yet again post gains that made stocks look anemic. The feeling still seems to be that this rise is nothing like the hype-filled and speculation-driven rally of 2017. (Our Monthly Review for November looks at some of the differences.)

There will be ups and downs, for sure. But this time around, the market is very different: more mature, more liquid and more diverse. Much like its new participants.

CHAIN LINKS

Maybe I should start a new section of this newsletter that just lists crypto-related statements and actions by institutional investors. This kind of news until very recently happened only once every few months. Now it’s almost daily.

Here are few of notable ones from this week:

· Paul Tudor Jones, speaking on Yahoo Finance, gave an enchanting analogy for how the crypto markets could evolve:

“If really I had to guess what the future was going to be, I’d guess it was going to be a lot like the metals complex – where you have “precious crypto” which might be bitcoin – it’s the first crypto, the first mover … and has that historical integrity amongst digital currencies. … And you’re going to have transactional cryptocurrencies, along with the sovereigns, and they may be more like the industrial metals.”

He also said that he believes that bitcoin has “the wrong price for the possibilities it has.”

· Larry Fink, CEO of BlackRock, the largest asset manager in the world, acknowledged that bitcoin has “caught the attention” of many people, and that the nascent cryptocurrency asset class could “evolve” into a global market asset.

· The research arm of New York-based AllianceBernstein, a global investment manager with $631 billion in assets under management, produced a research note for clients that acknowledged that its initial rejection of bitcoin as an investment asset back in January 2018 was wrong.

· Guggenheim Partners, with over $230 billion in assets under management, has filed an amendment with the U.S. Securities and Exchange Commission to allow its $5 billion Macro Opportunities Fund to invest up to 10% of its net asset value in the Grayscale Bitcoin Trust (GBTC – Grayscale is owned by DCG, also parent of CoinDesk).

· A research note from Bloomberg Crypto posits that bitcoin could more than double its current value in 2021, reaching $50,000, based largely on demand-supply mechanics.

· Fidelity Digital Assets’ CEO Tom Jessop said this week that bitcoin is an “aspirational” store of value, but that its volatility prevents it from being one now.

· Steve Forbes agrees, saying that bitcoin could potentially become the “new gold,” but it’s not there yet.

· PayPal CEO and President Dan Schulman told the audience at tech conference Web Summit that, for cryptocurrency, “the time is now.” He also insisted that “you can do more with [bitcoin] than just ride the ups and downs.”

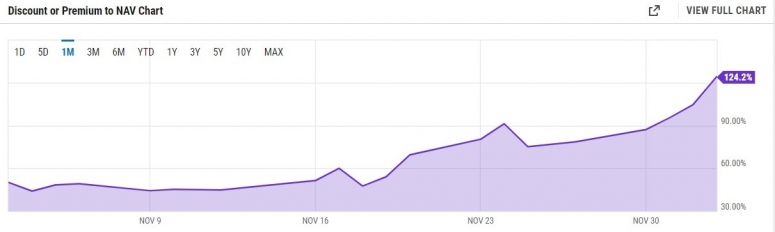

Grayscale Investments (a subsidiary of DCG, also parent of CoinDesk) announced on Wednesday that shares of its Grayscale Ethereum Trust (ETHE) will split 9-for-1, a move that will increase liquidity and perceived affordability of the shares. TAKEAWAY: While cryptocurrencies can be fractionalized (it still surprises me that some people think you have to buy a whole bitcoin), trust shares cannot. So, just like with equity shares, it can be convenient to lower the unit price, to make the shares more accessible to retail investors. ETHE is still only available to accredited investors on issuance, but holders can sell to the general public after the initial six-month lockup. This move should make that easier, and could boost the ETHE premium (the difference between the trust share price and the underlying value, currently at 124% according o Ycharts) to even higher levels. This in turn will make it more appealing to accredited investors, boosting new inflows.

Struggling to get your head around whether ether (ETH) might be a better investment than bitcoin (BTC), and if not, why not? This explainer might help.

S&P Dow Jones Indices plans to launch a customizable cryptocurrency indexing service in partnership with crypto data provider Lukka in 2021. TAKEAWAY: This could signal more crypto-related products to come from financial firms in the short term.

New York Digital Investments Group (NYDIG) raised $150 million for two new funds to invest in cryptocurrencies. TAKEAWAY: This does more than confirm the growing institutional interest in crypto markets. It also reveals the size of some of the commitments: NYDIG’s Digital Assets Fund I, which invests solely in bitcoin, received $50 million from two unnamed investors, while the NYDIG Digital Assets Fund II raised $100 million from just one investor.

Private German bank Hauck & Aufhauser is launching a cryptocurrency fund in January 2021. The fund will be called the HAIC Digital Asset Fund, will hold a range of cryptocurrencies, and is aimed at institutional investors. TAKEAWAY: Here we have a bank offering a crypto fund. One of the first, by no means the last.

My colleague Michael Casey aptly points out that bitcoin beats gold on most of the established advantages, except perhaps for allure and beauty – and they are cultural constructs. TAKEAWAY: Yes, this does imply that Bitcoin’s allure is also perhaps a cultural construct, and perhaps also will not be permanent. That’s not a bad thing – that implies progress. And the arc of history is long. (See THE BRIEFING above.)

Nearly 20% of PayPal users have already traded bitcoin using the PayPal app, according to a report published this week by Mizuho Securities. TAKEAWAY: This figure is from a sample survey, so cannot be taken at face value. But even if it is remotely correct, and even if the amounts are small, this result implies that approximately 25 million new users have bought BTC.