Bitcoin price continues to meet resistance at $19,500, a signal that further sideways action in BTC and altcoins is on the cards.

Recent news reports suggest that U.S. lawmakers may announce a new round of economic stimulus worth about $908 billion before the end of today. This second package, if announced, will add to the existing debt pile and may send the U.S. dollar index (DXY) lower. The index is already trading near its lowest level since April 2018.

The slow economic recovery, expansionary monetary policy, overvalued stocks and negative bond yields are some of the reasons that have forced investors to search for alternative assets to safeguard their portfolios.

Gold has been one of the favorite safe-haven assets of investors for many decades. However, in 2020, a few institutional investors diversified into Bitcoin (BTC) because they believed it would outperform gold.

Investors who made this choice have benefitted from the sharp Bitcoin rally of the past few weeks and many are likely to hold their position given that most investors expect BTC price to rise higher.

Bitcoin’s recent stellar performance is no secret and the number of institutional investors attracted to the digital asset is likely to increase because few will want to be left behind in the race to buy the deflationary cryptocurrency.

Henri Arslanian, Global Crypto Leader at PwC, recently told Bloomberg that one day investors will question the wisdom of fund managers who decided not to invest in Bitcoin

While the increased institutional inflow of money looks to be a certainty, the question one needs to ask is to what level will the institutions keep buying. There is not an exact answer to this question but investors should refrain from getting swept up in FOMO and buying Bitcoin just because everyone else is.

Let’s study the charts of the top-10 cryptocurrencies to determine which may offer lucrative opportunities.

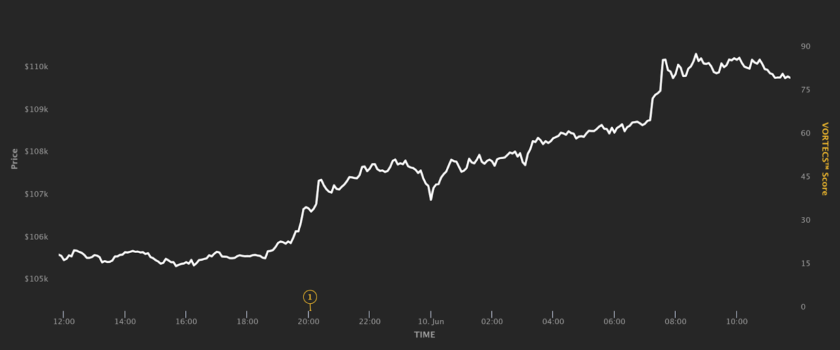

BTC/USD

The bulls are attempting to propel Bitcoin (BTC) above the pennant formation and the $19,500 resistance, but they are facing stiff resistance from the bears. To date, the $19,500 resistance is still acting as a major roadblock.

However, the bears will have to sink the price below the 20-day exponential moving average ($18,305) to dampen the bullish sentiment.

If the price sustains below the 20-day EMA, some short-term momentum traders may dump their long positions and that could drag the price down to the $17,200 support. A break below this support could result in a drop to the 50-day simple moving average ($16,053).

On the other hand, if the bulls do not give up much ground, it could create FOMO among traders and that could boost momentum and drive the price above the overhead resistance zone.

In a strong uptrend, the path of least resistance is to the upside until proven otherwise. Above $20,000 the BTC/USD pair could rally to $21,140 and then to $23,043.

ETH/USD

The bears attempted to sink Ether (ETH) below the 20-day EMA ($559) but failed. The strong rebound on Dec. 5 shows that the sentiment remains bullish as traders are buying on dips to the 20-day EMA.

If bulls can push the price above the $622.807 to $635.456 resistance zone, the ETH/USD pair will complete an ascending triangle pattern that has a target objective of $763.61.

The upsloping moving averages suggest that bulls have the upper hand but the relative strength index (RSI) has formed a negative divergence, which warrants caution. If the RSI rises above the downtrend line, it will indicate that the momentum is favoring the bulls.

This bullish view will be invalidated if the price turns down from the current levels or the overhead resistance and plummets below the 20-day EMA. Such a move will invalidate the bearish setup and may pull the pair down to the $488.134 support.

XRP/USD

XRP bounced off $0.543 and rose above the downtrend line. This is a positive sign as it suggests that the correction could be over. However, this does not mean that a new uptrend will start immediately.

The bears are unlikely to give up easily. They will try to stall the up-move at $0.6794. If they succeed, the XRP/USD pair could remain range-bound between $0.6794 and $0.543 for a few days.

The next directional move could start after the price breaks above or below the range. If the bulls can push the price above $0.6794, a retest of $0.780574 will be on the cards.

Conversely, if the price turns down and breaks below $0.543, selling could intensify and pull the price down to $0.4365.

LTC/USD

Litecoin (LTC) rebounded off the 20-day EMA ($79.79) on Dec. 5 and the price had risen above the overhead resistance at $84.3374. If the bulls can sustain the altcoin above this level, the up-move could reach $93.9282.

The moving averages are sloping up and if the RSI can break above the downtrend line, it will suggest that the bulls have the upper hand.

On the contrary, if the LTC/USD pair turns down from the current levels and breaks below the 20-day EMA, it will suggest that traders are covering their long positions on minor rallies.

The next support on the downside is the 38.2% Fibonacci retracement level at $75.943 and if this level also gives way, the pair could drop to the critical support at $68.9008.

BCH/USD

The bulls are buying the dips to the $280 support but they are struggling to push the price to $300. This suggests that buying dries up at higher levels. The bears will now try to sink Bitcoin Cash (BCH) below $280.

If they succeed, the BCH/USD pair could drop to the 50-day SMA ($270) and then to $246.85. The flattish moving averages and the RSI near the midpoint suggest that the bulls are losing their grip.

This negative view will be invalidated if the pair rises from the current levels or the $280 support and rallies above $300. Such a move will indicate that the bulls are back in action. Above $300, the rally could extend to $320 and then to $338.

LINK/USD

Chainlink (LINK) bounced off the 50-day SMA ($12.60) on Dec. 5, which shows that traders bought this dip. However, the bulls are facing stiff resistance near the downtrend line.

The flat 20-day EMA ($13.40) and the RSI near the midpoint do not indicate an advantage either to the bulls or the bears.

If the price turns down from the current level and breaks below the 50-day SMA, a drop to the uptrend line is possible. If this support also cracks, the LINK/USD pair could start a deeper correction to $10.

This negative view will be invalidated if the bulls can push and sustain the price above the downtrend line. If they can do that, the pair may rise to $14.80.

DOT/USD

The bulls are attempting to keep Polkadot (DOT) above the 20-day EMA ($5.09). However, the lack of a strong rebound suggests a lack of urgency among traders to buy at this level.

If the price does not pick up momentum and rally to $5.5899, the bears will try to sink the price to the 50-day SMA ($4.67). Such a move could keep the DOT/USD pair range-bound for a few more days.

Conversely, if the pair rises from the current levels and breaks above the overhead resistance, it will suggest the possible start of a new uptrend. The levels to watch on the upside are $6.0857 and then $6.8619.

ADA/USD

Cardano (ADA) bounced off the 20-day EMA ($0.147) on Dec. 5 and rose above the $0.155 resistance. However, the bulls are struggling to sustain the price above $0.155, which suggests that bears are selling on minor rallies.

If the bears again sink the price below $0.155, it will increase the possibility of a break below the 20-day EMA. Such a move will suggest that the bulls are no longer buying on dips, which indicates a change in sentiment.

Below the 20-day EMA, the ADA/USD pair could drop to the 50% Fibonacci retracement level at ($0.141) and then to the 61.8% retracement level at $0.1312.

Contrary to this assumption, if the bulls defend the $0.155 support, the pair may rise to the downtrend line. A break above this resistance could suggest that the bulls are back in action.

BNB/USD

Binance Coin (BNB) slipped below the moving averages on Dec. 04. The bulls attempted to push the price back above the moving averages in the past two days but they have not been able to sustain the altcoin above the 20-day EMA (29). This suggests selling by bears on rallies.

If the bears sink the price below $28.6588, the BNB/USD pair could start its journey southward towards the $25.6652 support. The flat moving averages and the RSI close to 50 suggest range-bound action may continue for a few more days.

Trading in a range can be volatile and directionless. Hence, it is better to wait patiently until the price breaks above or below the range and starts a trending move.

XLM/USD

Stellar Lumens (XLM) bounced off the 20-day EMA ($0.159) on Dec. 5, but the rebound has once again fizzled out near the downtrend line. This suggests that the bears are selling on every pullback to the downtrend line.

The 20-day EMA is flattening out and the RSI has dropped below 58, which suggests that bulls are losing their grip.

If the bears sink the price below the 20-day EMA, the decline could extend to the 61.8% Fibonacci retracement level at $0.140209. This is an important support to watch because if it cracks, panic selling may set in.

Contrary to this assumption, if the price once again rebounds off the 20-day EMA and rises above the downtrend line, the XLM/USD pair could rise to $0.20 and consolidate for a few days before starting a trending move.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.