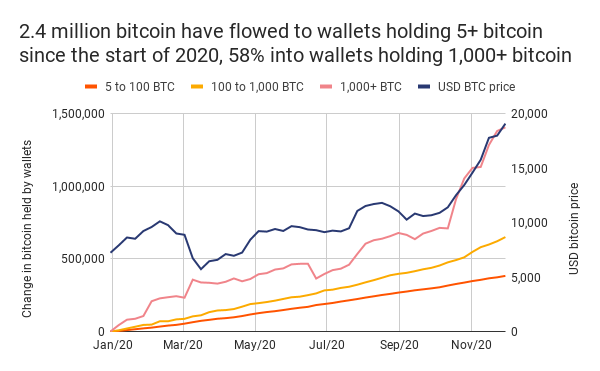

The popular narrative that institutional bitcoin investors have been leading the 2020 price rally looks to be backed up by on-chain data.

In 2020, the number of wallets – defined as a set of blockchain addresses controlled by a single entity – holding at least 1,000 bitcoins has increased by 302 (17%) and is now at a record high of 2,052, according to Philip Gradwell, economist at Chainalysis.

“That’s a big increase in the wealthiest wallets and provides evidence that institutional investors have entered the market,” Chainlysis noted in its weekly market intel newsletter dated Dec. 10.

The so-called rich list, the number of individual addresses holding at least 1,000 coins, is also up over 7% to 2,270. The metric reached a record high of 2,274 on Nov. 24, according to data source Glassnode.

Several prominent publicly listed companies such as MicroStrategy and Square have diversified their cash holdings into bitcoin over the past few months, boosting the cryptocurrency’s appeal as a reserve asset. Even insurers have joined the bitcoin bandwagon with Massachusetts Mutual Life Insurance having now invested $100 million in the cryptocurrency, as reported on Thursday.

Smaller investors have also been increasing their holdings. This year, This year, wallets holding five or more bitcoins have amassed over 2.4 million coins, Gradwell said. The number of wallets holding at least five BTC has increased by 8,842 (4%) to 234,408.

Bitcoin nearly doubled from $10,000 to a new record high of $19,920 in the September to December period. The cryptocurrency was last seen trading near $17,750, representing a 150% year-to-date gain, according to CoinDesk 20 data.

It remains to be seen if the big investors continue to stack more coins during a potential price sell-off.

Bitcoin balances held on exchanges have declined by over 18% this year, taking sell-side liquidity off the market and indicating a strong holding sentiment.

However, the cryptocurrency has pulled back from its peak price in recent days. According to analysts, the decline has been fueled by some investors liquidating their holdings and represents a temporary bull market correction.

As a result, short-term technical indicators are beginning to roll over in favor of the bears.

The widely-tracked 14-day relative strength index has dropped into the bearish territory below 50 for the first time since Oct. 6. Back then, bitcoin was trading near $10,500.

The RSI’s bearish turn comes following the cryptocurrency’s recent downside break of a narrowing price range.

As such, support of the two-month rising trendline, currently at $17,000, stands exposed. Some options investors have positioned for an extended pullback, as discussed earlier this week.