You could argue that the crypto industry should be crowdsourcing Blockstack’s legal expenses.

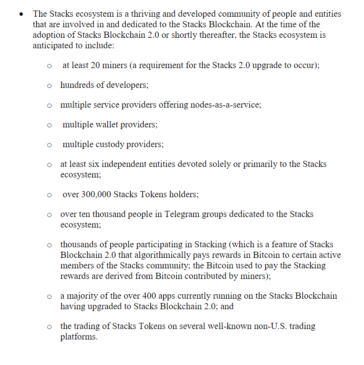

Blockstack’s trailblazing work with the Securities and Exchange Commission on the initial coin offering (ICO) for its native Stacks (STX) tokens made headlines in mid-2019. On Monday, Cointelegraph reported on Blockstack’s legal analysis that said that upon the launch of its 2.0 network next month, Stacks will be sufficiently decentralized to leave the status of a security. Blockstack itself will be rebranding to Hiro Systems to further encourage the independence of Stacks tokens.

To explain a complicated topic quickly, the concept of a “security” in investment is that the value of an asset depends on the work of another party, like stocks, which fluctuate based on a company’s success. Securities are subject to greater scrutiny than, say, commodities like oil or currency trading because that dependence on a third party renders an investor especially vulnerable to fraud or even just lack of information. Consequently, the SEC’s primary demands of firms issuing securities is that they provide regular, accurate information to the public. This is what public reporting means.

Though Blockstack hasn’t yet sent in the exit report that the SEC would need to ok before the firm can stop reporting for Stacks tokens, the recent legal memo is huge news. As Blockstack CEO Muneeb Ali told Cointelegraph of transitioning STX to non-security status, “I think there’s no precedent.”

Before its 2019 offering, Blockstack registered STX as a security under Reg. A+, exempting the firm from full registration and reporting requirements.

Reg. A+ is a product of the Obama-era JOBS Act. Unlike Reg. D, which restricts an offering to “accredited investors” i.e. the very wealthy or demonstrably savvy, anyone can invest in a Reg. A+ offering. The total is, however, capped at $50 million. Though it’s an exemption, the issuing firm still needs to write reports accounting for their security, even if those reports are less comprehensive than a fully publicly traded firm would have to put out.

For STX, specifically, registration as a security means that the token cannot trade on retail crypto exchanges in the U.S., as crypto exchanges do not have the necessary controls on who can and cannot use their platforms, among other limitations. Security tokens do trade in the U.S., but only on STO platforms that are mostly off-limits to the public OR are plagued by low volumes. Ali said:

“A bunch of other exchanges are already trading it internationally, but U.S. people were not able to participate. Now what’s going on is over the last year, given the mission on the project, we’ve also been working on this path of increased decentralization, meaning that there are several other independent entities in the ecosystem.”

Since Blockstack’s offering, the industry has seen what many consider the end of the SAFT framework that hoped to accomplish the same transformation by turning an offering of investment contracts under Reg. D into non-security token distribution — although Filecoin’s recent network launch may disprove this pessimism.

This year has also seen a stalled proposal from SEC Commissioner Hester Peirce for a safe harbor for blockchain networks looking to make such a transformation. Meanwhile, ICOs have ground to a halt.

The situation has been a barrier to Blockstack beyond just getting listed in the U.S. Ali said:

“I know that some people would stay away from the project thinking that there’s uncertainty here. We don’t know if Blockstack will get stuck in securities-land forever right now.”

Referring to Peirce’s proposal, Ali noted that there still needs to be a proper framework for evaluating whether the final token is decentralized:

“Even with some of the safe harbor proposals, like Hester Peirce’s, yes, they’re talking about a safe harbor. But the question still remains that at the end of the safe harbor period, how do you evaluate that this thing is no longer a security?”

This is what is so interesting about what Blockstack is up to. The firm is setting up a framework that, if successful, could function as a viable means of demonstrating decentralization for other projects.

The recent legal memo is using the independence of the new network and its current diverse array of stakeholders to prove that buying STX is no longer an investment in Blockstack. The SAFT framework tried to do something similar by splitting the initial investment from the token that you’d get at the end of the product’s development. Blockstack’s idea here is that you can take the same token and prove that you no longer have a stake in it.

Blockstack’s strategy includes rescinding the firm’s role in mining and, consequently, its ability to make future decisions for the network, in which miners are the ones who vote on protocol changes. It promises: ”PBC will not be a miner, will not provide mining services, and will have no ability to approve or prevent changes to the Stacks Blockchain.”

In response to a question as to trading by Blockstack parties, Ali said: “We can’t trade. We don’t trade. None of our employees trade. We just have our internal trading policy. We don’t do that.” The role of token trading has been extremely controversial in the case of, for example, Ripple’s massive escrow holdings of XRP, a relationship that is also under SEC investigation.

To prove that the network can survive without the firm, the legal memo catalogues the breadth of the ecosystem surrounding Blockstack:

No matter what happens, it’s an interesting sort of analysis to be running. The SEC has made public statements to the effect that a network can theoretically transform from centralized to decentralized. Ethereum is a classic example. The SEC acknowledges that Ether is a commodity, though it’s highly doubtful that the commission would allow the token’s 2014 pre-sale to happen today.

But despite that theoretical authorization, the SEC has been hesitant to sign off on many projects in ways that could be taken as guidelines for other protocols. So what happens after Blockstack submits its exit letter, referring to the recent legal analysis, is entirely the SEC’s decision:

“As of today, we are treating Stacks as a security. So [the memo] is a little bit of a heads-up that these conditions are met. We think that this should not be considered a security anymore. Here’s our legal analysis and we will go ahead and file the exit report. The SEC could theoretically complain when we file the exit report and say, ‘no, you still have reporting requirements’ and we’ll be like, ‘fine.’ We can keep reporting.”

With leadership at the SEC changing in anticipation of the incoming Biden administration, there’s no telling when the SEC will put out a solid response. Ali is hopeful that Blockstack’s work will help give some kind of roadmap to projects that have stalled out, unable to access capital.