The crypto industry has matured substantially in recent years — so much so that it’s practically unrecognizable when compared to the bull run of 2017. And one of the biggest developments in this dynamic space? Futures.

These derivatives give investors exposure to the price movements of major cryptocurrencies like Bitcoin, without the need to physically own the asset. Although the arrival of futures trading presents opportunities, it isn’t without risks — after all, BTC remains as prone as ever to sudden price movements.

Through the futures market, crypto enthusiasts have an opportunity to generate returns when the markets are in decline, as well as when they’re booming. That’s because of how they can enter into short positions — buying BTC when it’s high, and selling when it’s low.

Hurdles remain for those who are interested in gaining exposure to futures. The 24-hour nature of the crypto markets mean that traders constantly need to remain vigilant for sudden movements that affect the profitability of their positions. Unfortunately, we all need to sleep — and remaining fixated on a computer screen for every minute of our waking hours is ill-advised to say the least.

Then, there’s the challenge of discipline. Over the years, so many traders have lost their cool in the heat of the moment — impulsively abandoning their strategies because they’re driven by greed, or determined to chase after losses.

As futures trading has become more commonplace in the crypto space — just like it did in stocks and commodities beforehand — tools have started to emerge that allow traders to follow the markets 24/7, with safeguards to prevent sudden decisions that work against their interests. What’s the answer? Trading bots.

How trading bots are shaking up the futures markets

Traders tend to enjoy the greatest success with bots when they use this technology as a complement to their existing strategies. Setting up one of these tools and wandering off for a few days isn’t a good idea — they require constant supervision and tweaks in line with the latest fluctuations in crypto prices.

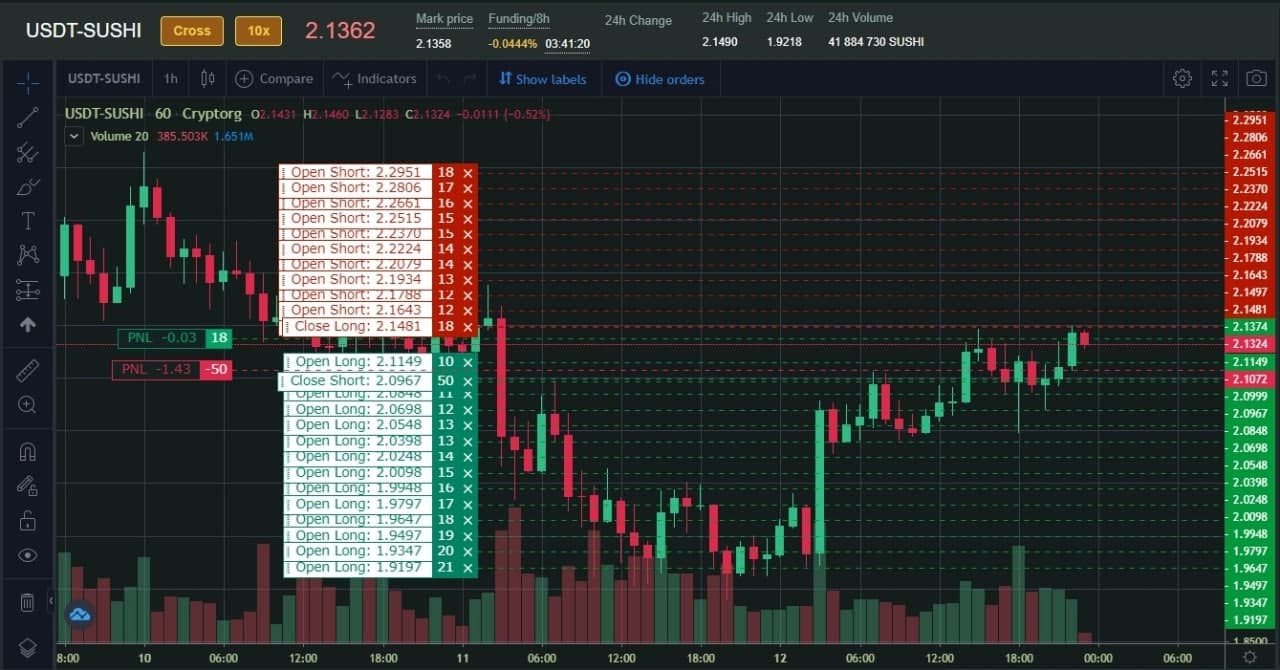

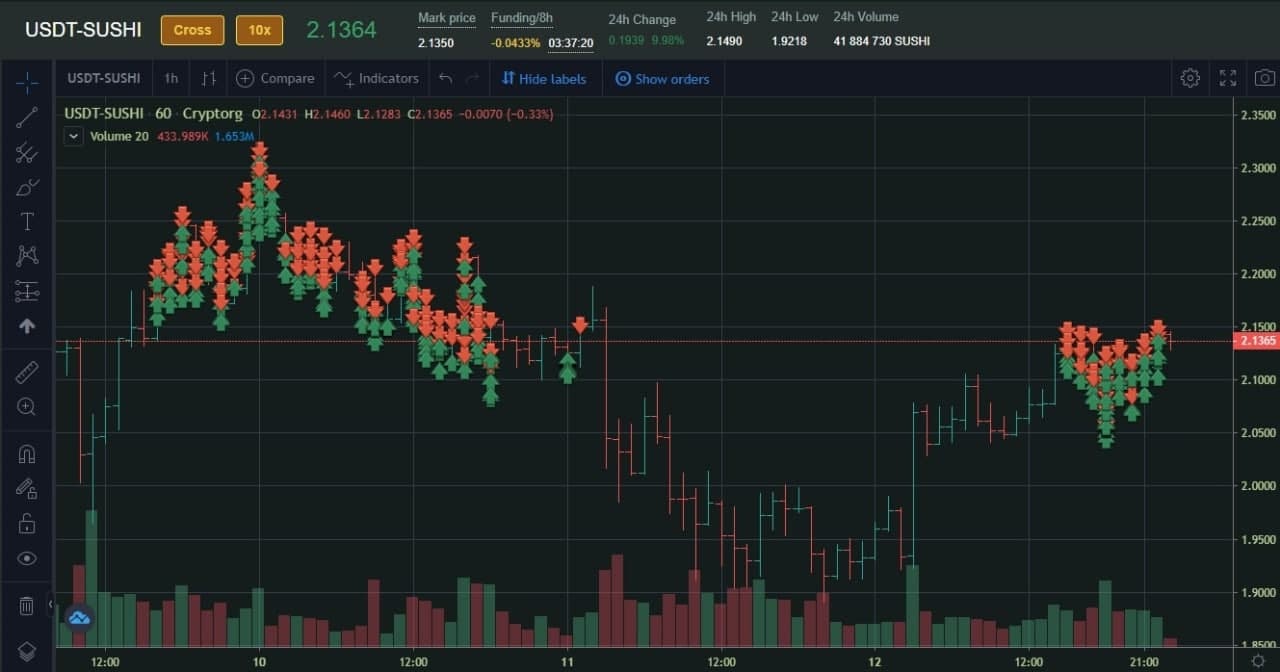

Let’s imagine that a crypto enthusiast spots an opportunity while performing their technical analysis. The user can set up a trading bot to automatically enter into a position when certain conditions are met — irrespective of whether they’re away from their PC. Better still, setting up the trade in advance can also save precious time, as this process can take a couple of minutes when it’s done manually.

These days, sophisticated bots can also work under price restrictions and with a limited number of cycles — delivering notifications via Telegram so traders know what’s going on. It’s even possible to work on a semi-manual basis — users can contribute additional volume into their positions, with the bot subsequently rearranging the take profit based on the change in average transaction prices and volume.

Given how bots connect to futures trading platforms through an API, one common concern can be what happens if there’s an interruption in the connection between the bot and an exchange. Bot providers are addressing this by ensuring that their software can analyze any missed activity and make corrections to the strategy once communications are fixed.

Delivering benefits to experienced traders

One company that provides automated digital currency trading is Cryptorg — and it says its futures tool has the power to deliver better outcomes for experienced traders in a variety of market scenarios.

Long and short positions can be entered into simultaneously

Cryptorg first began offering bots three years ago, and support for futures was unveiled in September 2020 on its own exchange, as well as on Binance Futures and FTX. The company also has the ambition of enabling its bots to be used on the stock market.

Cryptorg says its tools are designed to be flexible around a trader’s exacting requirements — and some users have experienced success by spending just 30 minutes a day on setting up their bots.

One of the platform’s top priorities has been ensuring that its bots are smart, and are built to react to fast-moving events instantaneously. In time, developers hope to enable bots to make one-time trades that capitalize on unusual whale activity detected on exchanges.

Cryptorg says its bots can complete trades far faster than human traders

We’ve seen how drama in the Bitcoin markets can unfold in a matter of minutes. Just last month, cascading liquidations were the driving force of a massive correction that saw BTC fall 16% to lows of $16,334. In a crash that was reminiscent of what happened in March, long positions worth $262 million were liquidated in a single hour on Binance Futures, according to Glassnode data. This happened in the middle of the night in the U.S., meaning many investors would have woken up to painful losses if they hadn’t been using a bot.

Cryptorg says its bots can help traders weather this uncertainty and stay prepared — offering much-needed safeguards against volatility, day or night. The latest figures suggest that there are 5,112 active trading bots on its platform, with over 150,000 deals being completed every week. Three subscription tiers are offered — appealing to newcomers, professionals and businesses who want to make the most of bot-traded futures.

In future, it plans to offer professional monitoring for futures accounts — enabling traders to perform analysis at their convenience using a collection of statistics.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you all important information that we could obtain, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor this article can be considered as an investment advice.