Quick take:

- 78,156 traders have been liquidated in the last 24 hours as Bitcoin zoomed past $20k

- Total liquidations in the same time period have hit $1.1 Billion

- $956.13 Million are Bitcoin liquidations

- 90%+ of the liquidations were short positions

Bitcoin’s $20k price ceiling has broken hard with the King of Crypto continuously setting all-time high values in the last 24 hours. At the time of writing, Bitcoin’s most recent all-time high value is $22,900 – Binance rate – and after slicing through $21k and $22k like a warm knife on butter.

$1.1 B in Liquidations, 78,156 Traders Liquidated

According to data from Bybt.com, the push above $20k by Bitcoin has resulted in $1.1 Billion in liquidations across the various digital asset futures contracts on the major exchanges. Of this amount, $956 million was in Bitcoin liquidations.

Furthermore, the largest single liquidation was on Bitmex with a total value of $10 million. The screenshot below, courtesy of Bybt.com, further demonstrates this fact.

90%+ Liquidations were Short Positions

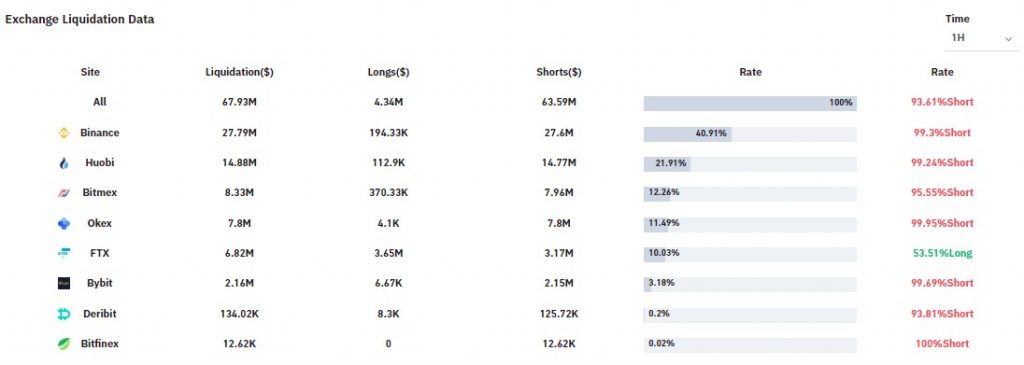

Data from Bybt.com also indicates that over 90% of these liquidations were short positions. The screenshot below further highlights the shorts liquidated across all major exchanges.

Bitcoin Could Very Well Break $23k

Bitcoin breaking $20k has resulted in a scenario where there is no reference data for traders to go by as this is literally uncharted territory. The path up provides the least resistance for Bitcoin as FOMO kicks into high gear as seen with the current Fear/Greed index of 92. Therefore, Bitcoin could very well keep pushing past $23k based on continual interest by institutional and retail investors.

Also worth mentioning is that today is December 17th and exactly three years since Bitcoin set its most famous all-time high value of $20k. Bitcoin facing a similar situation today might be a case of sheer coincidence or it could be the first indicator of a possible top for Bitcoin.

As with all analyses of Bitcoin, traders and investors are advised to set adequate stop losses during times like these when BTC goes parabolic.