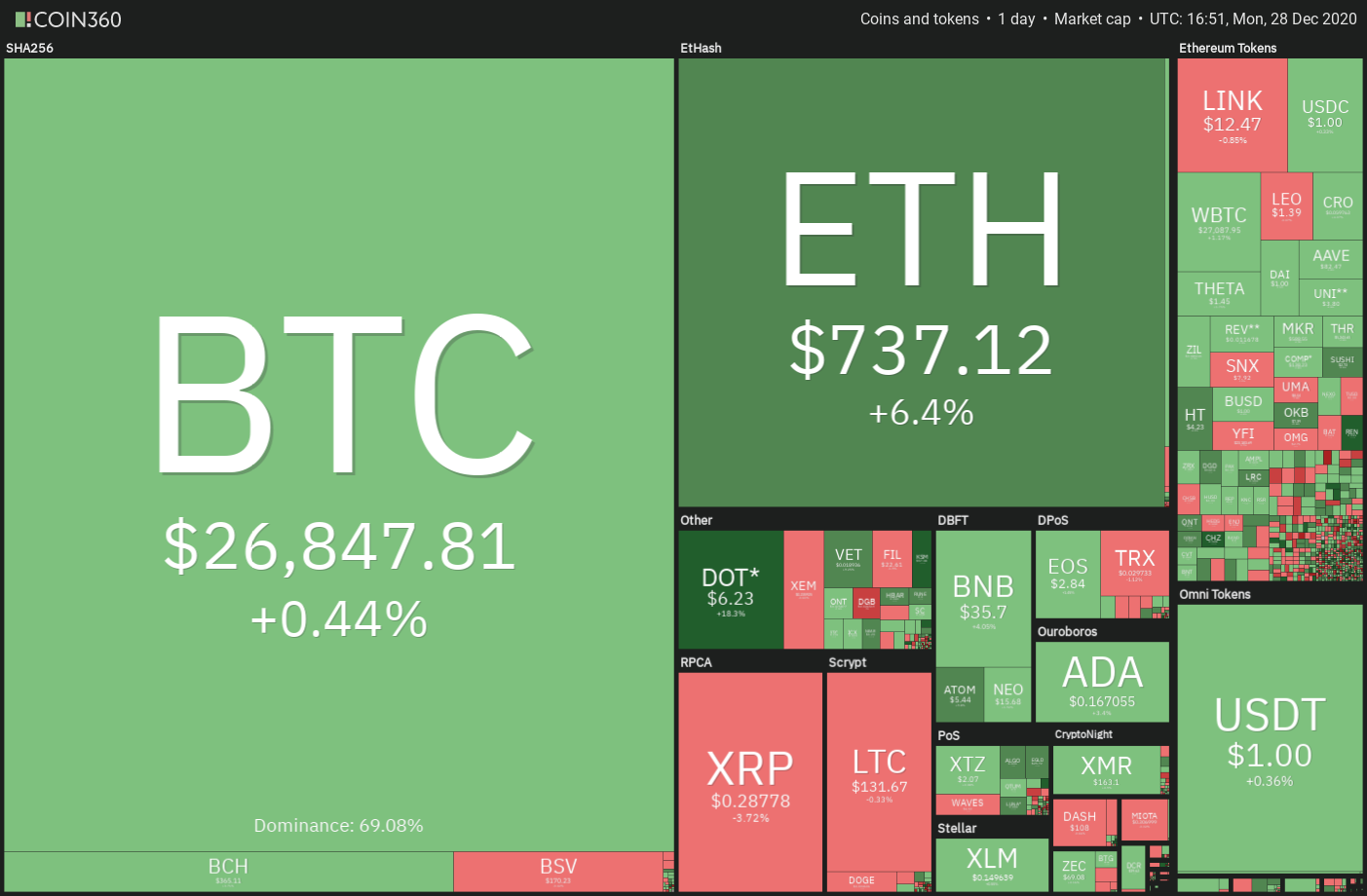

Bitcoin is taking a breather after the recent rally while altcoins are attempting to play catch up.

Several central banks have resorted to unprecedented monetary expansion and aggressive rate cuts to support their respective economies badgered by the coronavirus pandemic. Record liquidity has resulted in sharp rallies in the S&P 500, gold, and Bitcoin (BTC), which suggests that investors are plowing money into assets of their choice.

While gold is way below its all-time high set in August, both the S&P 500 and Bitcoin are near their all-time high.

The last five trading days of the year and the first two of the next year have historically been bullish for the S&P 500, dubbed as the “Santa Rally.” It will be interesting to see whether Bitcoin continues its Santa rally into 2021 with the arrival of institutional investors.

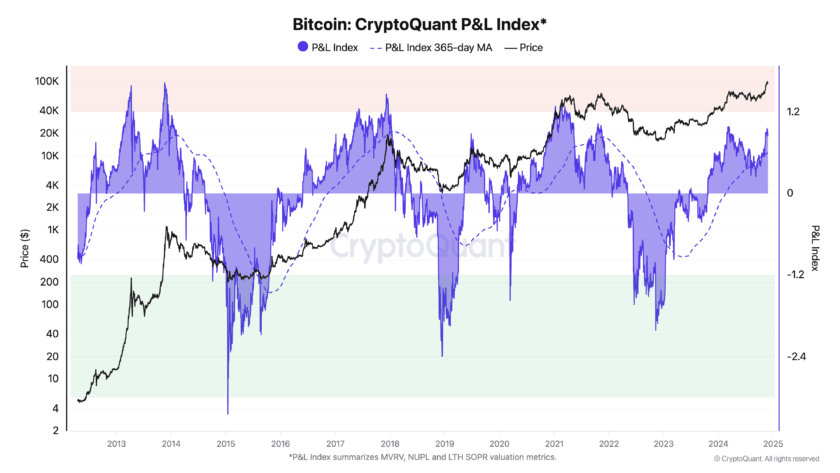

Another interesting thing to note is that Bitcoin has rallied from a low at $10,377.10 in October to a high at $28,419.94 in December, a 173.87% rally in three months. Although the sentiment is bullish and the institutional inflows are accelerating, every bull market witnesses strong corrections and Bitcoin is unlikely to be an exception.

Traders should protect their paper profits and not get carried away with greed because corrections after vertical rallies can be ruthless. Let’s study the charts of the top-10 cryptocurrencies to determine the overhead levels that may act as a strong resistance that can trigger a correction.

BTC/USD

Bitcoin formed a Doji candlestick pattern on Dec. 27 with a long wick, which suggests profit booking above the $27,000 level. The bulls are again struggling to sustain the price above $27,000 today.

If the bears sink the price below $25,819.69, the BTC/USD pair could drop to the immediate support at $24,302.50 and then to the 20-day exponential moving average at $22,951.

A strong bounce off this support will suggest that the uptrend remains intact and the bulls are buying on dips. If that happens, the bulls will attempt to resume the uptrend.

However, if the bears sink the price below the 20-day EMA, it will suggest the formation of a short-term top. The correction could then deepen to the 50-day simple moving average at $19,577.

Contrary to this assumption, if the bulls push and sustain the price above $28,419.94, the pair could rally to $30,000, which is likely to act as a stiff resistance.

ETH/USD

Ether (ETH) rebounded off the 50-day SMA ($566) on Dec. 23, which suggests that the bulls are accumulating on dips. The buyers again pushed the price back above $622.807 on Dec. 25, indicating that the correction could be over.

The ETH/USD pair picked up momentum on Dec. 27 and cleared the $676.325 overhead resistance. This suggests that the uptrend has resumed. The next target objective on the upside is $800.

The upsloping moving averages and the relative strength index (RSI) close to the overbought territory suggest that bulls are in command. This positive view will invalidate if the pair turns down and plummets below the $622.807 support.

XRP/USD

XRP is in a downtrend. The altcoin broke below the critical support at $0.435 on Dec. 23 and this intensified the selling, resulting in a sharp fall to $0.2132.

The downsloping 20-day EMA ($0.426) and the RSI in the negative territory suggest that bears have the upper hand.

When the sentiment is bearish, minor rallies are sold into and that is what happened on Dec. 25. The XRP/USD pair turned down from $0.384998, just above the 38.2% Fibonacci retracement level of the most recent leg of the decline.

However, the bulls are currently trying to keep the pair above the $0.25 support. If they succeed, the pair may remain range-bound between $0.25 and $0.38 for a few more days. The first sign of strength will be a break above the 20-day EMA.

LTC/USD

Litecoin (LTC) broke above a flag pattern and the overhead resistance at $124.1278 on Dec. 25, which indicated the resumption of the uptrend. The breakout of this setup has a target objective of $160.

However, the bears are not willing to throw in the towel as they are currently attempting to stall the up-move at the $140 overhead resistance. If they can sink and sustain the price below 124.1278, a drop to the 20-day EMA ($107) may be on the cards.

On the other hand, if the bulls can defend the $124.1278 level, it will suggest that this level has flipped to support. That could enhance the prospects of a break above the $140 to $145 overhead resistance zone.

The rising moving averages and the RSI near the overbought territory suggest that the path of least resistance is to the upside.

BCH/USD

The bulls are currently trying to propel Bitcoin Cash (BCH) above the $370 overhead resistance. If they succeed, it will be a huge positive because during the previous two attempts, the price had quickly reversed direction from this level.

The upsloping moving averages and the RSI above 64 suggest that bulls are in command. If they can drive the price above $$370 and sustain the breakout, the BCH/USD pair could rise to $409 and then to $430.

On the contrary, if the bears again defend the $370 resistance and the price turns down sharply, it could keep the pair range-bound between $370 and $255 for a few more days.

DOT/USD

Polkadot (DOT) had been trading in a range between $3.53 and $5.60 for the past few weeks. The bulls have pushed the price above the $5.60 to $6.0857 overhead resistance zone today.

If the bulls can sustain the price above $6.0857, it will suggest the start of a new uptrend that could retest $6.8619 and then rally to $7.67. The gradually upsloping moving averages and the RSI above 68 suggest bulls have the upper hand.

The bears are likely to defend the $6.8619 level aggressively but if the bulls do not allow the price to dip below $6, it will suggest that the uptrend remains intact. This bullish view will be invalidated if the DOT/USD pair re-enters $5.60.

ADA/USD

Cardano (ADA) rebounded off the $0.13 support on Dec. 24 and the bulls have been sustaining the price above the 20-day EMA ($0.154) since then. This is a positive sign as it prepares a launchpad to thrust the price above the $0.175 to $0.1826315 overhead resistance zone.

The RSI has risen into positive territory and the 20-day EMA has started to turn up gradually. This suggests that bulls are attempting to gain the upper hand.

If the bulls can push the price above the overhead resistance zone, the ADA/USD pair could resume the uptrend and rally to $0.22 and then to $0.235.

Contrary to this assumption, if the pair again turns down from $0.175, it could extend its stay inside the range for a few more days.

BNB/USD

The bulls are currently attempting to propel Binance Coin (BNB) above the $35.69 overhead resistance. If they succeed, the altcoin could resume the uptrend and rally to the all-time high at $39.5941.

The bears are likely to mount a stiff resistance at the all-time high but the upsloping moving averages and the RSI in the positive territory suggest that bulls have the upper hand.

If the bulls can push the price above $39.5941, the BNB/USD pair could pick up momentum and start its journey towards $50.

This bullish view will be invalidated if the price turns down from the current levels and plummets below the 50-day SMA ($30). Such a move will suggest profit-booking at higher levels.

LINK/USD

Chainlink (LINK) plummeted to $8.05 on Dec. 23 but rebounded strongly from the lower levels as seen from the long tail on the day’s candlestick. The bulls again bought the dips on Dec. 24, indicating strong demand at lower levels.

The failure of the bears to sustain the LINK/USD pair below $11.29 attracted buying from the bulls who pushed the price to $13.2448 on Dec. 27. However, the bears are in no mood to relent as they sold close to $13.28 as seen from the long wick on the candlestick.

Both moving averages have flattened out and the RSI is just below the midpoint, which suggests a balance between supply and demand.

The bulls may gain an upper hand if they push and sustain the price above the downtrend line. Conversely, a break below $10 will suggest advantage to the bears.

XLM/USD

The bulls are currently attempting to sustain Stellar Lumens (XLM) above the $0.14 support. However, any rise from the current levels could face selling at the downsloping 20-day EMA ($0.159) and then at $0.17.

If the price turns down from the overhead resistance, it increases the likelihood of a break below $0.14. The next support on the downside is at $0.11 and then $0.08.

Conversely, if the bulls can push the price above $0.17, the XLM/USD pair may move up to the downtrend line. The sentiment is likely to remain negative as long as the price remains inside the descending triangle pattern.

A break above the downtrend line of the triangle will invalidate the bearish setup and that could result in a rally to $0.231655.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.