In the legacy financial world, yield has dried up. Yields on U.S. Treasury bonds have never been lower. The 10-year Treasury bond now offers you a less than 0.9% return. At around 2.1%-2.3%, AAA corporate bonds aren’t doing a whole lot better.

Knowing this, while also hearing about the Federal Reserve’s strong intentions to get inflation above 2%, it’s no wonder investors are ditching low-yielding assets and getting into more speculative investments. People are allocating capital in increasingly distorted ways. How else are they going to get a return?

David Hoffman is the co-founder of Bankless, a content studio with a newsletter, podcast and YouTube channel focused on how to live a life without banks.

On Ethereum it’s difficult to avoid yield. Yield is the default incentive for successful decentralized finance (DeFi) applications to attract capital.

At the most basic level, borrowing and lending applications like Compound and Aave are offering 4.6% and 6.2% interest, respectively, on deposited USDC. More sophisticated yield aggregators like Yearn are generating 7.8% in their basic yield strategies, and up to 16% in more aggressive strategies.

Uniswap, averaging over $1 billion in trading volume per week, is putting its 0.3% trading fees into the hands of those that have supplied liquidity to the protocol. Those that have supplied ETH and USDC to Uniswap have received a staggering 35% APY on a hybrid 50-50 USD/ETH position in the last 30 days.

No negative rates

The DeFi economy is constructed fundamentally differently than its legacy counterpart. In order for DeFi to work, it requires over-collateralization. No one can borrow more than they have deposited, and so far this simple safety net has been the foundation on which DeFi has been able to stand.

It is also the reason why Ethereum and DeFi will become synonymous with “yield” in 2021. In DeFi, rates can’t go negative. There is no room for fractional-reserve lending in DeFi, because it would break the trust model that makes these applications function. In order to remove trust (and therefore centralization), you must over-collateralize.

The elimination of fractional reserve lending in the DeFi economy is why yield will always be able to be found in DeFi. Negative yield is not possible in Compound or Aave; the math doesn’t allow for it. Because these protocols are solvent-by-design, in a scenario in which demand to borrow is at absolute zero, then the yield is also at zero, but not negative.

ETH: The internet bond

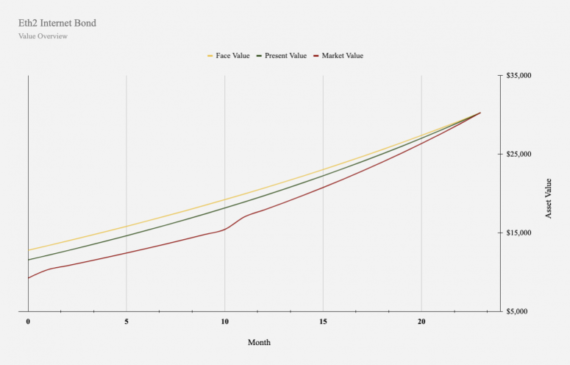

The launch of the Ethereum 2.0 Beacon Chain kicked off the long-awaited ability to stake ETH and receive ETH-denominated returns.

In addition to its native store-of-value qualities, the launch of ETH staking turns ETH into a capital asset that produces cash-flow for its owner. We have seen other protocols offer proof-of-stake style returns on alternative assets, but ETH is uniquely compelling because it is also backed by the native economy of Ethereum.

When the size of the Ethereum economy increases, staking yields are designed to reflect this growth. The relationship between the Ethereum economy and ETH should be familiar to the typical bond investor: Healthy economies are highly valued, therefore the native bond typically has a premium associated with it.

Ethereum cannot default on its ETH payments to ETH bond-holders. ETH is dependably issued to ETH bond-holders for compensation for providing security to Ethereum. Ethereum doesn’t need to collect taxes or generate revenue to compensate those who are looking for ETH-denominated yield. Removing this requirement is a boon to the valuation of ETH bonds because there is no risk of default. Ethereum has no debts to pay, it is solvent by design.

Bitcoin’s recent penetration into the minds of the legacy investor class shows people are interested in a protocol-constrained monetary asset. Additionally, DeFi’s explosion onto the scene, underpinned by offering extremely high yields not found anywhere else in the financial universe, shows how thirsty investors are for dependable yield.

The combination of ETH dividends to bond holders with constrained max issuance creates ETH’s uniquely compelling position as a macro asset in 2021 and beyond.

Last bastion for yield

In 2021, Ethereum is positioned to become the Schelling Point for yield. As bitcoin blasts the doors open on the investability of digital assets, it exposes a yield-rich world behind it in Ethereum.

The diversity of asset types and differing yield-generation strategies is likely to attract the attention of yield seekers of all types. Whether investors are looking for stable, low-risk U.S. dollar-denominated returns, or aggressive high-yield speculative instruments, Ethereum offers investors an array of financial products for them to choose from.

In addition to dollar-denominated returns, ETH as an internet bond is positioned as an instrument that offers upside exposure to the growth of the Ethereum economy, while simultaneously generating ETH-denominated yield for those ready to accept its volatility.