The total cryptocurrency market capitalization – a major bellwether for the overall health of the digital asset class – broke $1 trillion for the first time ever at 19:00 ET on Tuesday January 6th.

Measured by market cap, the crypto asset class has virtually doubled over the past month as Bitcoin (BTC) broke out to new all-time highs and Ether (ETH) cleared $1,100 for the first time in three years. Combined, both assets account for roughly two-thirds of the overall market.

BTC and Ether’s gravitational pull on the market has seen dozens, if not hundreds, of cryptocurrencies, report double-digit percentage returns this past week.

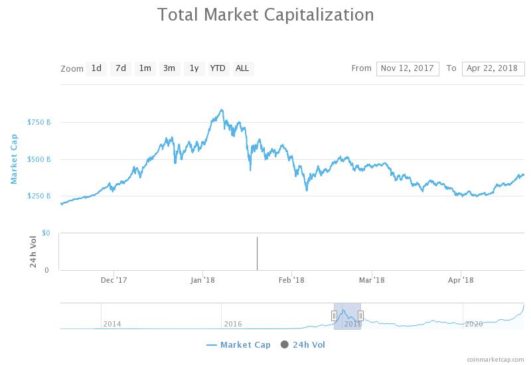

The trillion-dollar capitalization was reached mere days after the market exceeded the highs from the 2017-18 bull market. During the last cycle top in early 2018, the combined market cap hit roughly $830 billion, according to CoinMarketCap.

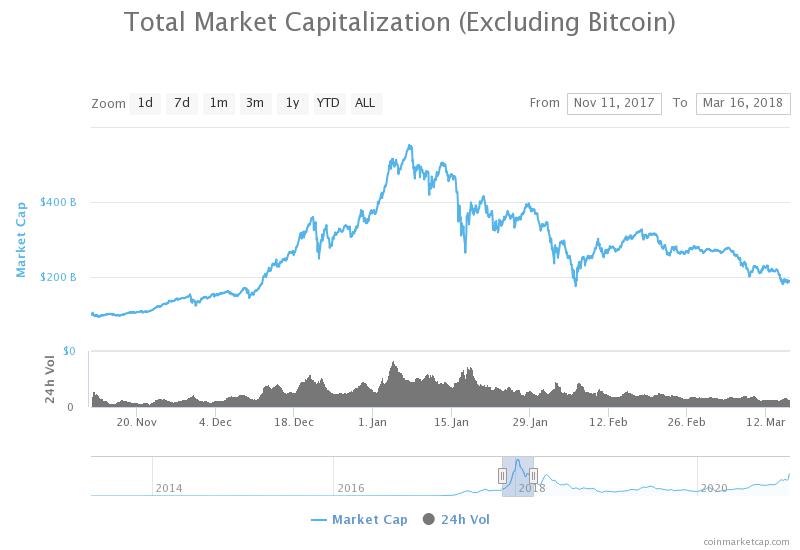

At the time, altcoins peaked near $547 billion after Bitcoin retreated from its Dec 2017 high. The altcoin market is currently worth less than half of that total, underscoring Bitcoin’s sheer dominance so far in the current cycle.

Typically, Bitcoin’s bull cycles pave the way for a subsequent altcoin rally, which is often larger than the initial BTC mark-up. Dubbed ‘altseason’ by the crypto community, the parabolic rise in altcoins can happen quickly, leaving investors with little time to prepare.

Many crypto observers are forecasting a bullish 2021 for Bitcoin and altcoins. They cite growing institutional demand for BTC, the ubiquity of crypto on-ramps and the natural ebb and flow of four-year market cycles for their optimism.