On Thursday, January 14th, the Ethereum altcoin keeps correcting, trading at $1,122 USD.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Tech analysis of ETH/USD.

- The ETH reached its all-time high in January.

- Vitalik Buterin is propelling the idea of social wallets.

On W1, ETHUSD keeps correcting in an uptrend. The aim of the decline can become the next Fibonacci level – 61.8%. The MACD histogram is above zero, which means the upward dynamics will restore soon. The signal lines of the indicator have crossed zero and keep growing, additionally supporting the trend. The Stochastic is in the overbought area, perhaps on the verge of forming a Black Cross, which will predict a correction before further development of the uptrend. Judging by all the above, the quotations are likely to go on correcting in the nearest future and continue the uptrend later. The aim of the growth will be 1,420 USD.

Photo: RoboForex / TradingView

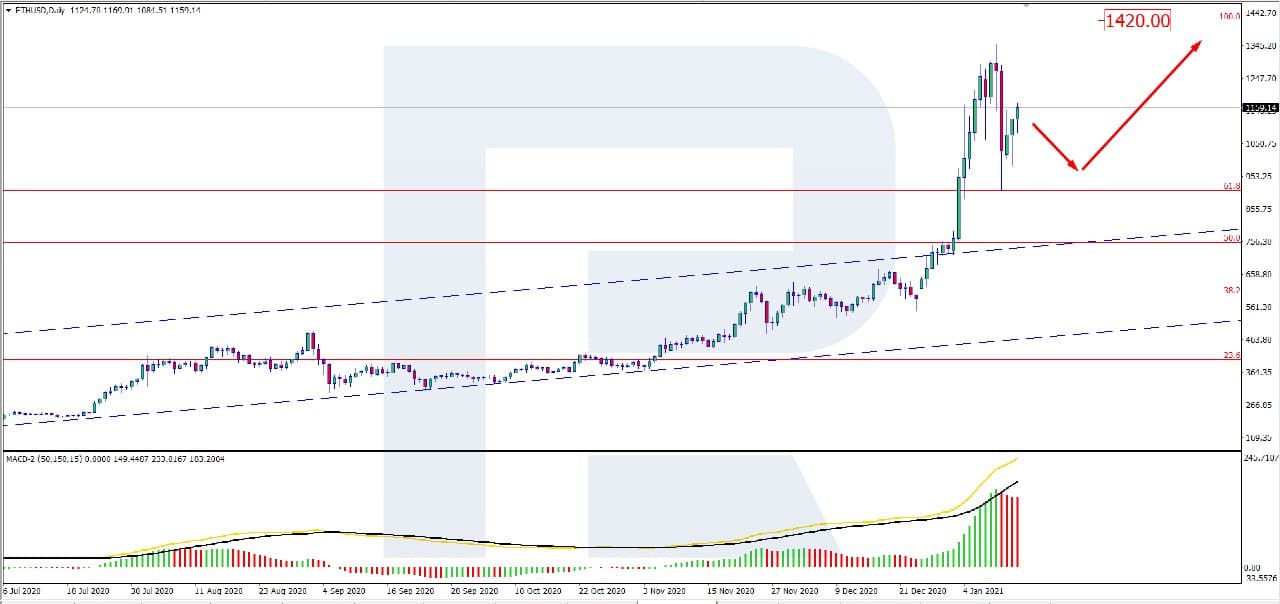

On D1, the situation is similar to that on W1. The aim of the pullback is 920 USD. The MACD histogram keeps declining, enhancing the signal for the correction. The signal lines might form a Black Cross in the nearest future, giving yet another reason for a correction. The aim of the growth after the pullback should be 1,420 USD.

Photo: RoboForex / TradingView

On H4, the picture is almost like on D1: the quotations are correcting from the resistance level in an ascending channel. After the pullback is over, the coin has all the chances for further development of the uptrend. The Stochastic has formed a Black Cross in the overbought area, giving another signal for a correction before the uptrend resumes. The aim for the growth (as on larger timeframes) is 1,420 USD.

Photo: RoboForex / TradingView

In January, the ETH reached a new all-time high – on January 10th, in the Kraken exchange, the quotations rose to 1,285 USD. Now the price is much lower, but most market participants are quite sure that the ETH is on the verge of another stage of growth.

Traders took very seriously the idea that after the ETH crossed 800 USD, the aim for the growth shifted to 5,200 USD. There are more conservative positions as well – with the aim at 1,751 USD. This or that way, the market is not quitting the idea of the altcoin’s flourishing.

The creator of the Ethereum Vitalik Buterin states that we need to focus on designing methods giving users private keys from wallets in case of emergency. Now, this is impossible without the participation of third parties. The idea is to create so-called “social recovery wallets”. They will work as normal wallets except that the chain includes “guardians” – this is a group of persons that will be authorized to make an application on behalf of the wallet’s owner to help them retrieve access to the wallet. Ideally, this group should be anonymous so that the probability of their communication and harming the wallet’s owner was minimal.

For Buterin, who is very keen on social technology, the idea of losing access to the wallet for good is unacceptable. Currently, the use and storage of cryptocurrencies is the responsibility of their owner solely.

For this article, we’ve used ETHUSD charts by TradingView.

Disclaimer: Any predictions contained herein are based on the author’s particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.