ALPHA, the governance token of Alpha Finance Lab, has surged 152% in the past week. It is now the 85th most valuable cryptocurrency in the global market, breaking into the top 100 in a short period.

Behind its meteoric rally are three key factors, namely the rapidly rising total value locked (TVL) of Alpha Homora, the overall positive market sentiment around DeFi, and the imminence of Alpha Homora v2.

What is ALPHA, Alpha Homora and AlphaX?

Alpha Homora is essentially a protocol that enables users to yield farm using leverage.

The term yield farming means the process of providing liquidity to DeFi protocols to earn sustainable yield or APY. By using leverage, Alpha Homora allows users to provide liquidity to pools more efficiently.

Alpha Homora v2 adds various improvements to the first release. It adds more pool support on top of Uniswap, such as Curve, Balancer, and SushiSwap. This allows users to benefit from a more diverse selection of pools to yield farm.

The v2 also lets users hold up to 9x leveraged positions, borrow multiple assets, and lend or borrow other assets apart from Ethereum, as Band Protocol’s Sawit Trisirisatayawong explained.

Ultimately, Alpha Homora should be useful for the average DeFi user with limited capital who wants to maximize their yield.

AlphaX, the decentralized futures exchange, also aims to be beginner-friendly by removing the manual futures funding rate, and baking it into the price. The two key products in the Alpha Finance Lab ecosystem are both designed to serve casual users in DeFi.

At a market cap of $296 million, ALPHA is arguably considered a blue-chip DeFi asset. But, the price of ALPHA has significant momentum and is continuously rallying.

The optimism around ALPHA stems from the rapid increase in Alpha Homora’s TVL and the active developer community of the project.

Alpha Homora’s $618 million alone could justify a high valuation for ALPHA, by calculating the potential fees the protocol could charge in the future and predicting its cash flow.

The existence of other key products like AlphaX that make Alpha a more extensive DeFi ecosystem has likely made ALPHA more appealing as a long-term DeFi bet.

The pace of growth is optimistic

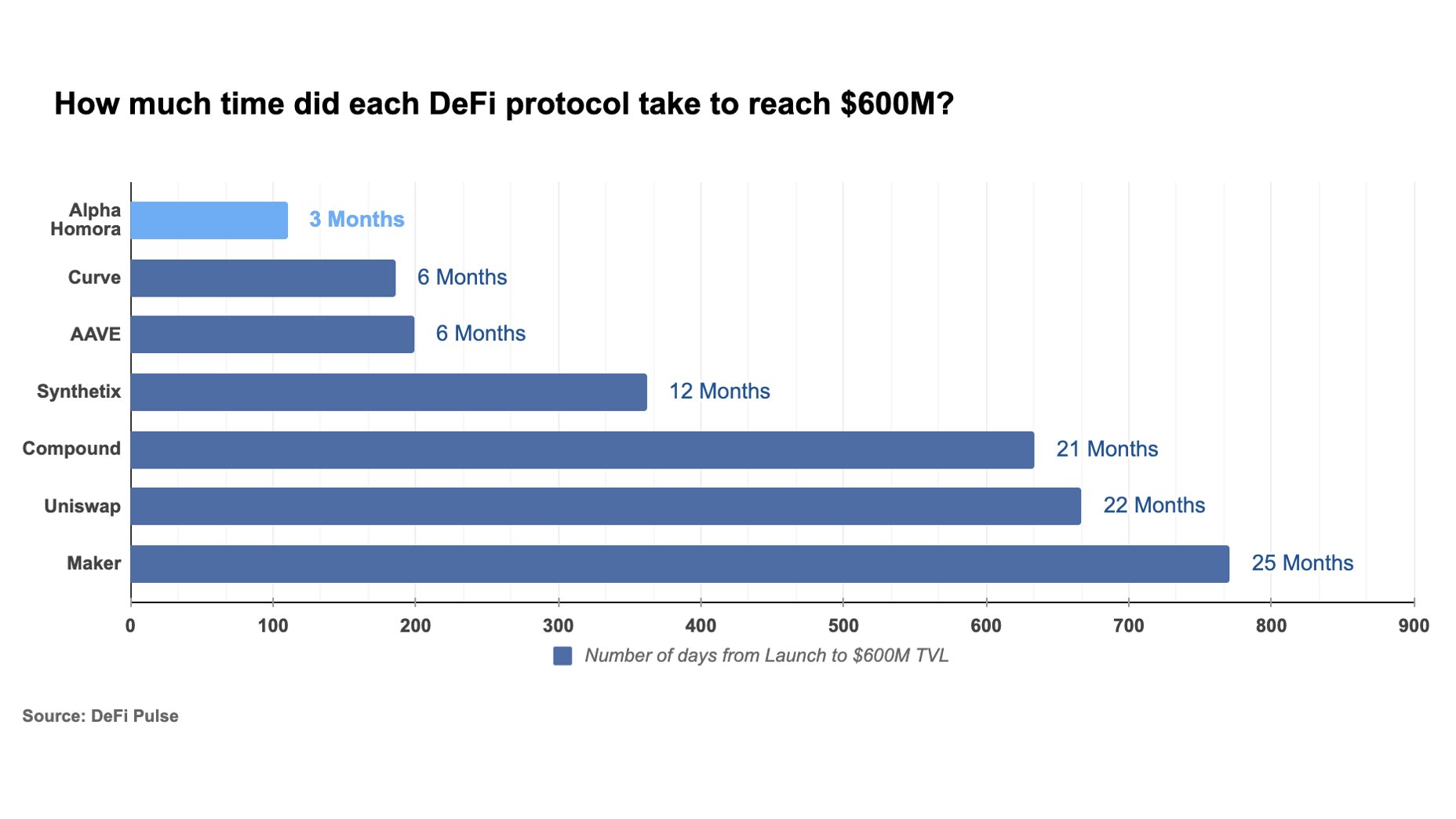

Alpha Homora is the fastest DeFi protocol to reach a $600 million TVL in the history of the DeFi space.

The top DeFi protocols and lending platforms, like Aave and Curve, took around six months to reach the same TVL.

But while Alpha has admittedly launched as the DeFi space was seeing explosive growth, it is still impressive that it was able to outpace the largest DeFi projects in the space.

Over the longer term, there are several potential catalysts for the price of ALPHA.

Most notably, the official document of Alpha Finance Lab shows that the ALPHA token holders might soon be able to receive a portion of protocol fees through either staking or providing liquidity. The document reads:

“Utility token for all Alpha products (e.g. provide liquidity or stake to receive % protocol fees) (not yet implemented).”

More utility for the ALPHA token should act as a strong catalyst in the longer term, and make the token itself more attractive.