Digital currency markets have been on the move northbound on Wednesday as bitcoin and numerous crypto assets have seen decent gains. The entire crypto-economy has once again crossed the $1 trillion mark as a myriad of digital currencies jumped anywhere between 5-20% in value during the last 24 hours.

Crypto Assets See Some Upside Price Action

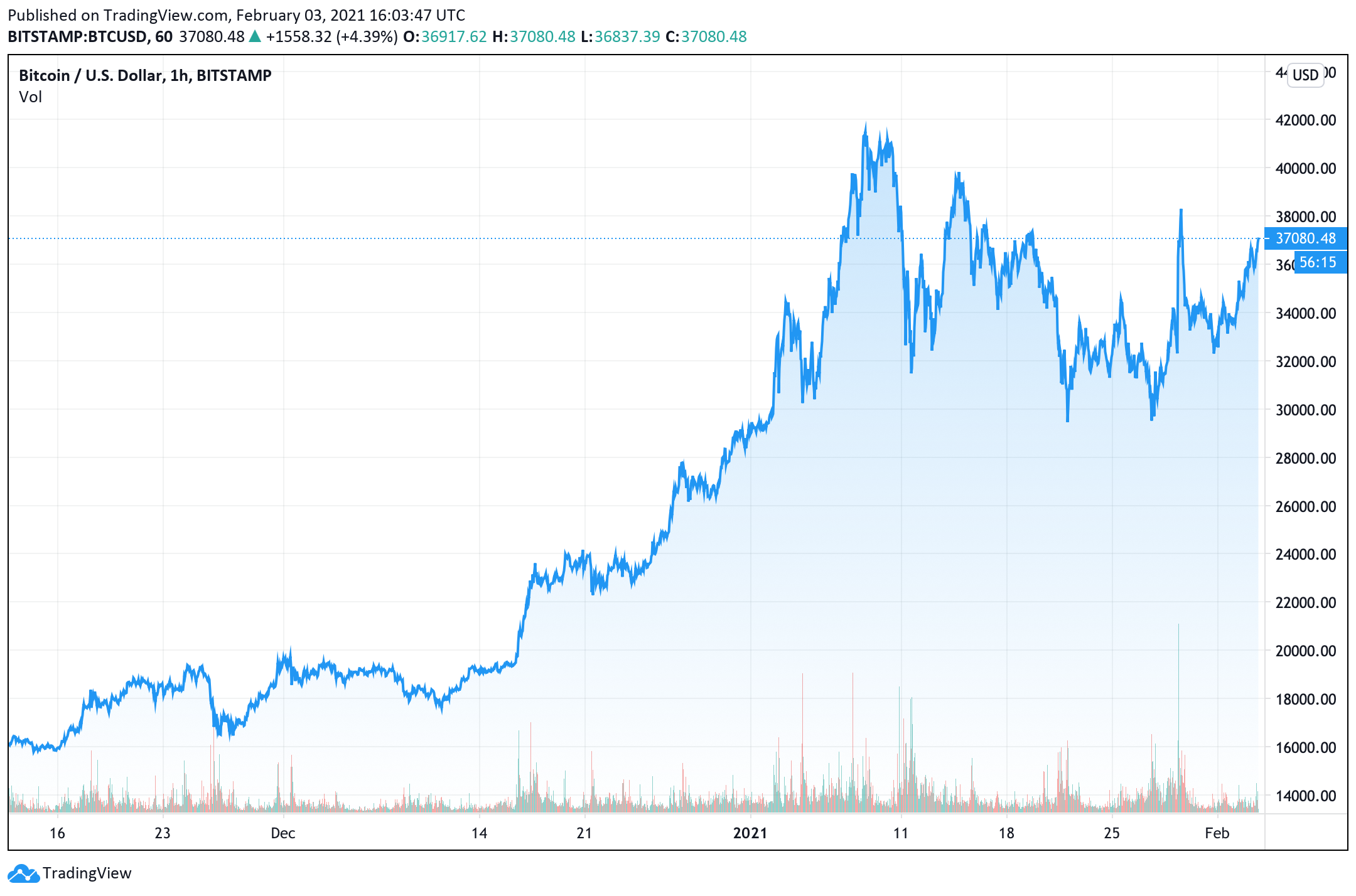

Crypto supporters are pleased on Wednesday as digital currency markets are climbing again and a great number of assets have seen significant gains. The leading cryptocurrency, in terms of market valuation, bitcoin (BTC) is up 5.5% today and is currently trading just below $37k per unit.

On Wednesday morning’s trading sessions, BTC jumped to $37,161 across a number of global exchanges but slid a hair since then. With the entire crypto-economy valued at $1.07 trillion, BTC captures $682 billion (62%) of that aggregate total. Overall, BTC is up 20% for the week, 14% during the last 30 days, 134% for the 90-day span, and 297% for the year.

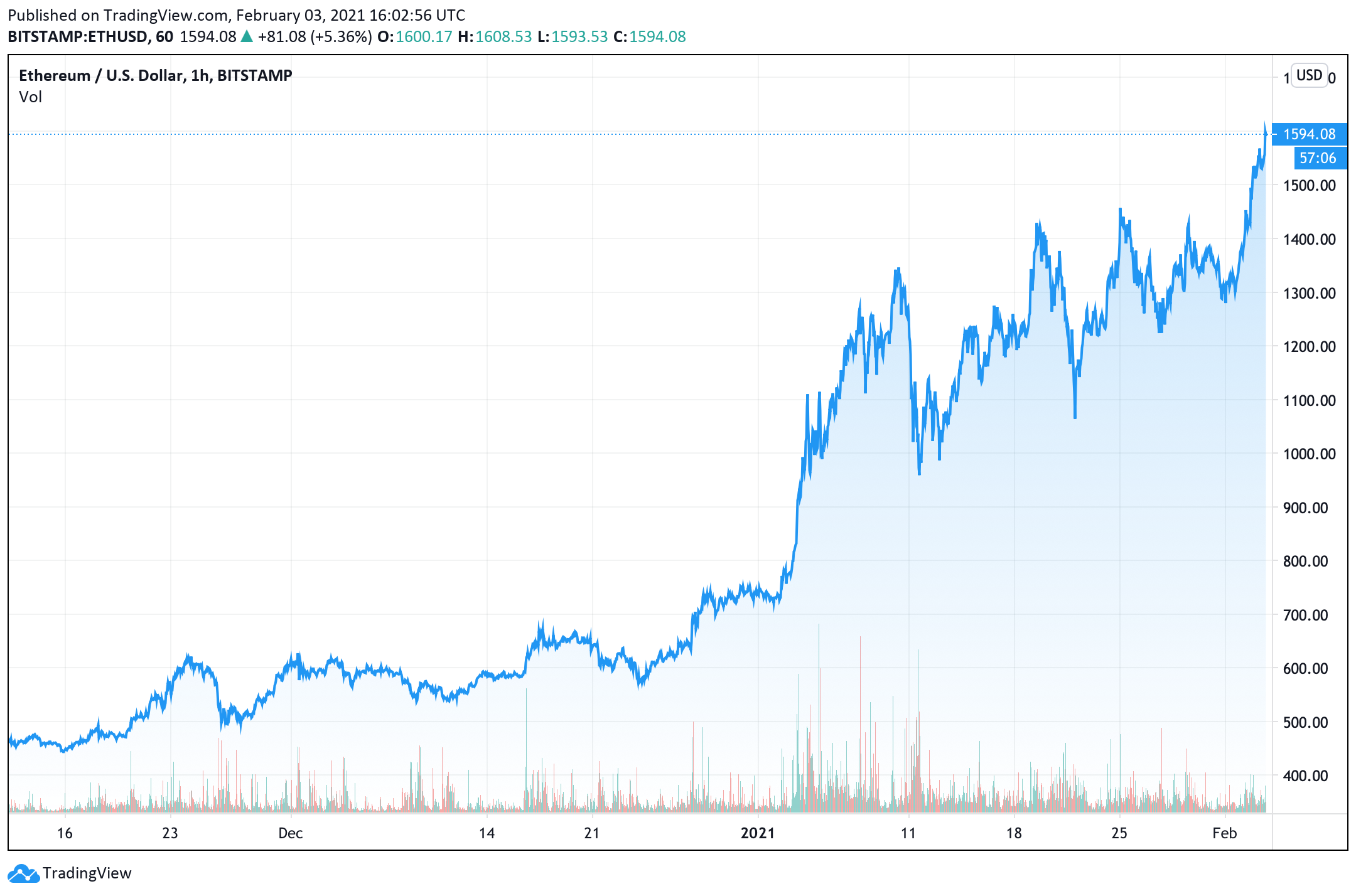

Behind BTC, is ethereum (ETH), which has seen significant gains during the last 48 hours. ETH is exchanging hands for $1,604 per unit and is up over 9% today. ETH stats are better than bitcoin’s climbing 25% for the week, 49% for the month, 273% during the last 90 days, and 724% for the year.

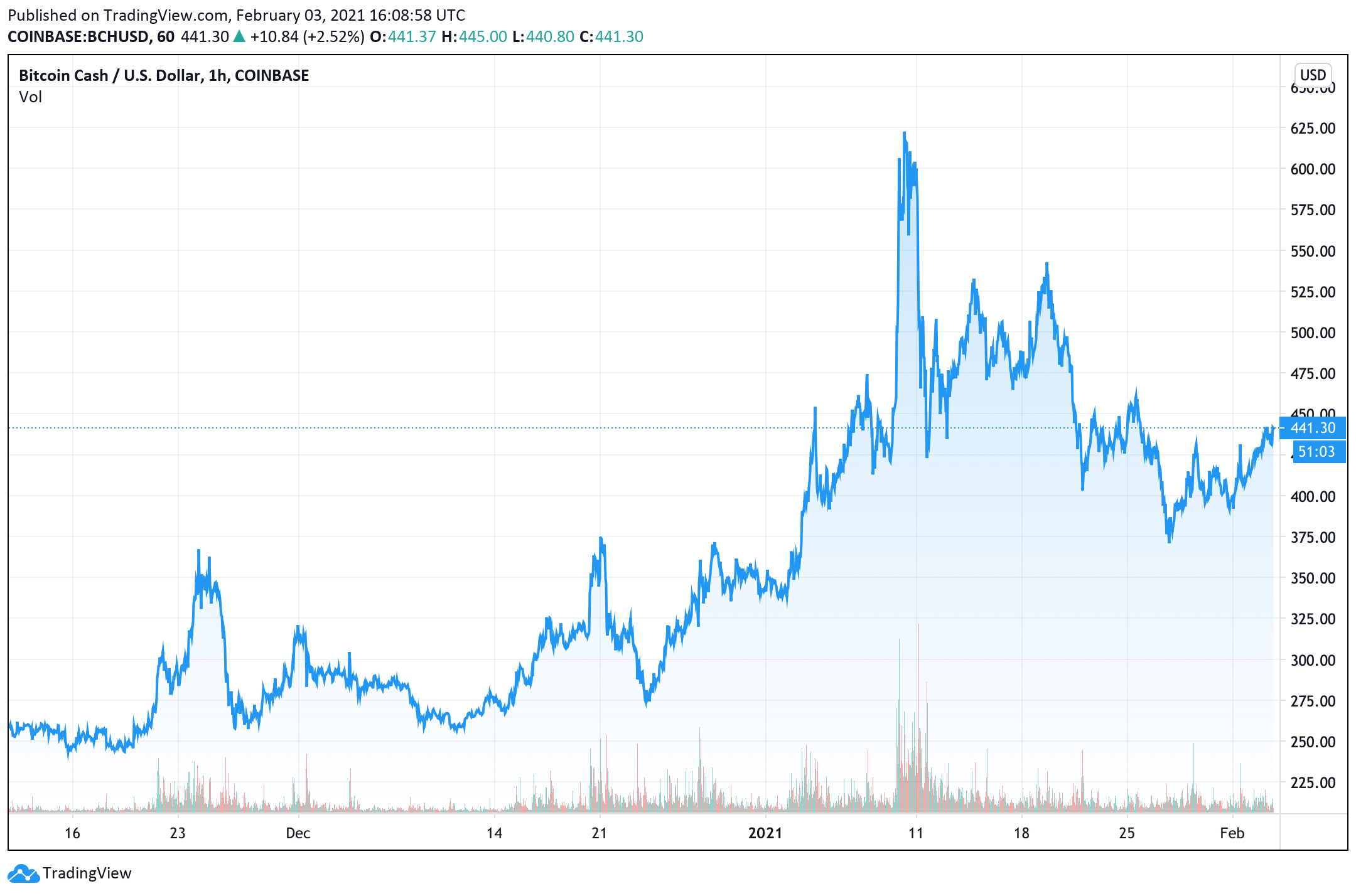

The biggest gainer in today’s top ten positions is polkadot (DOT) which is up 19% at the time of publication. DOT is swapping for over $19 per unit on Wednesday. Bitcoin cash (BCH) has gained over 4.5% and holds the ninth position. At the time of writing, BCH is swapping for $440 per coin and has gained 16.28% during the last seven days.

Today’s top five gainers include stormx (STMX 169%), bao token (BAO 107%), armor (ARMOR 80%), paid (PAID 66%), and telcoin (TEL 55%). The biggest losers today include omnitude (ECOM -62%), gme (GME -53%), saketoken (SAKE -45%), vite (VITE -40%), and polyswarm (NCT -38%).

Analyst: ‘We Continue to See Companies Add Bitcoin to Their Balance Sheets’

During the start of the week, Etoro analyst Simon Peters said he believes it’s time for bitcoin to see some upside. “Bitcoin has consistently remained above $30,000 since breaking above on 2nd January 2021 and with this support level now established, in my opinion, it is now time to see some upside,” Peters wrote in a note sent to investors.

Additionally, the Etoro analyst discussed Marathon’s recent purchase of $150 million worth of bitcoin and said that this trend will continue. “We continue to see companies add bitcoin to their balance sheets, but the trickle has not yet developed into a snowball on a mass institutional scale. The fears of a falling dollar are very real, so what might drive more firms and CEOs to move some cash into bitcoin?” Peters added. Moreover, Microstrategy just announced it added more bitcoin to the company’s balance sheet.

Researchers Claim Ethereum Could Outperform Bitcoin This Year

Meanwhile, as eyes are focused on bitcoin (BTC), many analysts suspect ethereum (ETH) will outperform BTC. Dmitriy and Perdix from the organization Coinsheet give a number of reasons in Coinsheet’s report #263 to “why ETH will outperform BTC this year.”

The Coinsheet researchers mention Ethereum’s fees and cash flow, high turnover, decentralized exchange (dex) volumes, ETH’s hashrate, address activity, number of coins leaving exchanges, the amount of decentralized finance (defi) applications, and defi’s assets under management (AUM) aggregate. Coinsheet also mentions that CME Group is launching ETH-based futures on February 8, 2021.

The Verdict: Low Volatility and Tight Ranges Indicate Big Price Moves Ahead

Further analysts have been discussing the fact that bitcoin (BTC) volatility is dropping and many believe this will lead the way to more bullish prices. Many traders have leveraged BTC’s volatility levels to gauge the recent spikes in late 2020 and into 2021.

Whatever the case may be, traders expect a big price move in the near future which could go either way. BTC and cryptocurrencies, in general, have a reputation for being extremely volatile but in more recent days the leading crypto asset has traded in a tight range for the last 30 days.

What do you think about the recent price movements within the crypto economy? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tradingview, High charts,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.