Bitcoin (BTC) will never be the same and it’s too late to use Tether (USDT) as an excuse to be bearish, Cointelegraph Markets analyst filbfilb says.

In a series of tweets on Feb. 10, the popular analyst and co-founder of trading suite Decentrader said that the cat was out of the bag for Bitcoin going mainstream.

“The game has changed” for Bitcoin

Bitcoin’s mainstream presence has exploded since Tesla purchased $1.5 billion of BTC, but not everyone is convinced. Within crypto circles, some still point to stablecoin Tether’s emission and backing as reasons to be bearish.

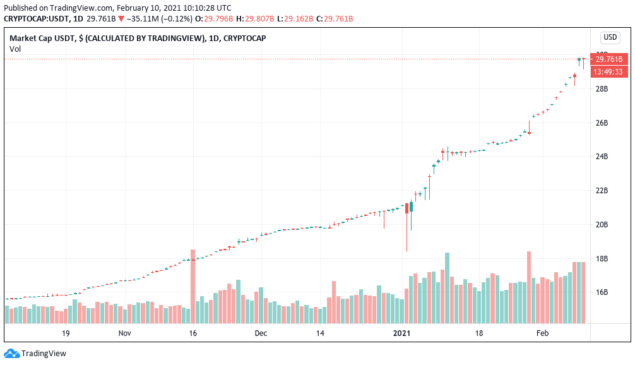

As Cointelegraph reported, rumors continue to circulate about the financial buoyancy of Tether’s issuer, despite multiple backlashes and USDT supply increasing at unprecedented rates.

“The game has changed”, filbfilb summarized, noting that daily printing alone had reached $1 billion.

As such, short-term price targets are not only $50,000, but as high as $63,000 including some consolidatory moves along the way.

“IMO the target from the consolidation is c. 52k where I’m expecting a bit of a correction but the measured move overall should take us towards. 63ish,” he added in a post to subscribers of his Telegram trading channel.

“Aggressive” sellers have already been outmaneuvered by demand, he noted.

Never mind the bears

On the topic of corporate adoption, he added that there are implications that few have considered, further making the bearish take on Bitcoin redundant. Consumers are already indirectly in on Bitcoin, and the performance of stocks from firms which have already made allocations will fuel the fire.

“I really dont think people understand that S&P500 companies owning Bitcoin means that by default people’s pensions are exposed to Bitcoin. The % of people invested in Bitcoin has already reached the masses, they just dont even know it,” he wrote.

“The premium in terms of stock appreciation alone seen on MSTR along with the current economic environment means shareholders will demand Bitcoin exposure. And yet a lot of CT is bearish. Never change.”

The view directly rebuffs cautious words from JPMorgan analysts this week, who claimed that few companies will follow Tesla and MicroStrategy on Bitcoin due to its volatility.

Speaking to CNN, however, MicroStrategy CEO Michael Saylor himself took volatility bears to task.

“If you’re looking out for the long-term interest of your shareholders, I think they’d prefer if you double their money every six months than lose 75% of their money with a guarantee over the next eight years,” he told the network.