Bitcoin (BTC) lost almost 8% on Feb. 10 as the first significant correction after Monday’s price pump set in.

BTC price wobbles at $48,000

Data from Cointelegraph Markets and TradingView tracked BTC/USD as it fell from local highs of $47,360 to briefly touch $43,750 during trading on Wednesday.

The pair had been on course to hit $50,000 after clocking new all-time highs earlier in the week thanks to news that Tesla had converted $1.5 billion of its balance sheet to Bitcoin.

Corrections had already been expected, a necessary part of Bitcoin’s steady upwards grind, which Cointelegraph Markets analyst filbfilb, believes will see $63,000 hit in the short term. $52,000, he said earlier on Wednesday, may also produce temporary consolidation.

On the topic of current market behavior, fellow analyst Michaël van de Poppe likewise advised Twitter followers to adapt to what has been a protracted period of upside.

“‘Why are you scaling out?’ Well, markets are going up heavily, but we’ll be seeing some downwards momentum as well. Nothing goes up in a straight line,” he wrote.

“Realizing partial profits is fine. I’m still keeping big bunches in play, but I can accumulate some more. Easy game.”

Bitcoin doesn’t heed all celebrity endorsements

The downturn nonetheless amused some, coming just minutes after actress Lindsay Lohan tweeted a surprise Bitcoin endorsement.

“Bitcoin to the moon,” she suddenly proclaimed.

bitcoin to the moon

— Lindsay Lohan (@lindsaylohan) February 10, 2021

Among longtime market participants, celebrities and other non-industry figures suddenly engaging with Bitcoin is a “classic” signal that the cryptocurrency has gone mainstream too quickly and that a correction is imminent.

“Tops in, time to sell,” Cointelegraph’s Keith Wareing responded just before the 7.6% dip, which buyers quickly halted.

As Cointelegraph reported, Bitcoin’s overall strength is apparent, which on the back of Tesla’s buy-in and interest in MicroStrategy’s dedicated summit last week seems destined to see higher highs thanks to a domino effect of corporate exposure.

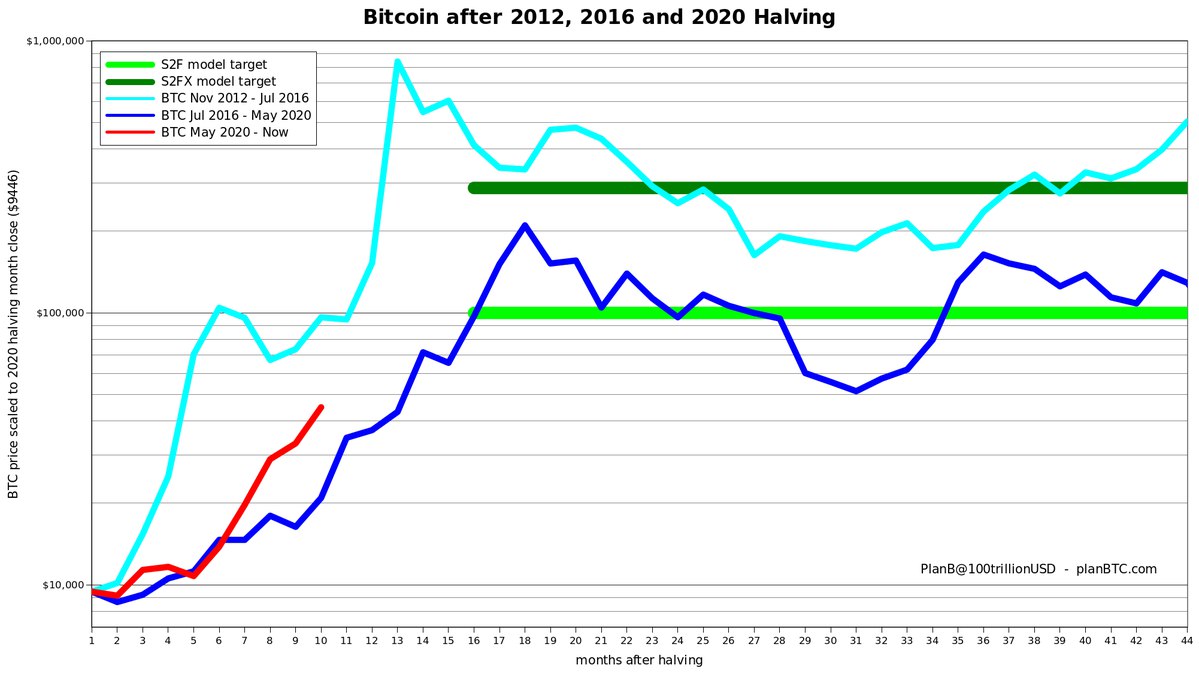

In a fresh update on the day, quant analyst PlanB reiterated that Bitcoin was still on track to hit $100,000 by September. Progress a year after the most recent block subsidy halving, he said, was in between what happened after the 2012 and 2016 halving events.