The Ethereum has been correcting for two days already, but for now, this has little significance: the market remains unmistakably positive. On Thursday, February 11th, the ETH is trading at $1,726 USD.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Tech analysis of ETH/USD.

- The ETH renewed its all-time highs alongside the BTC.

- The CME started trading ETH futures.

On D1, the pair renewed its highs again. The MACD histogram remains above zero, giving another signal for growth. Meanwhile, the signal lines of the indicator keep growing, confirming further growth again. Judging by previous occasions, it is possible that before breaking through 0.00% Fibo, the quotations might correct to $1,600 USD. The next aim of the uptrend is $1,860 USD.

Photo: RoboForex / TradingView

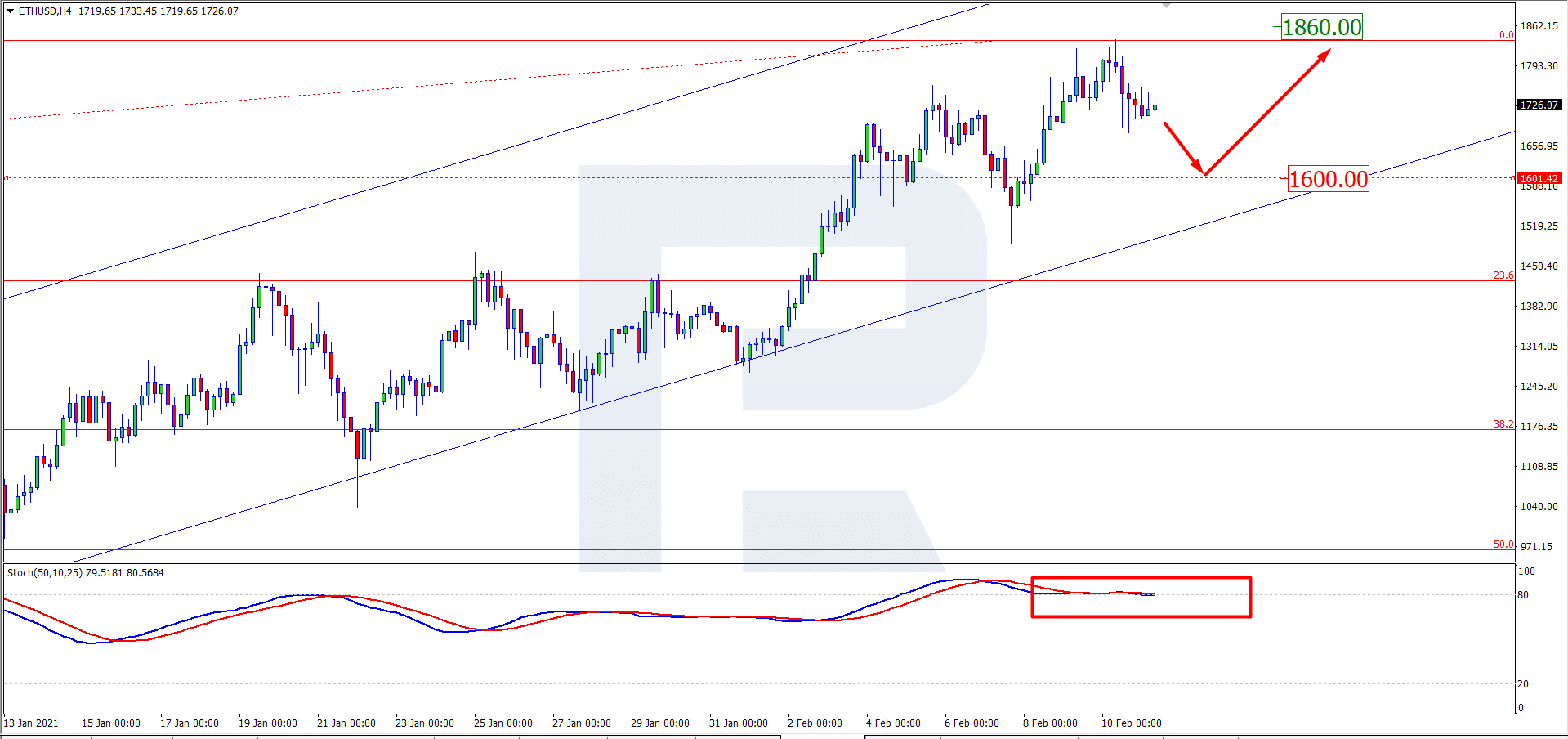

On H4, the picture is similar: the quotations are correcting inside an ascending channel. Upon forming another pullback, the coin has all the chances for further development of the uptrend. The Stochastic is in the overbought area, where it has formed a Black Cross, additionally supporting the correction. The aim of further growth is the same as on the larger timeframe – $1,860 USD.

Photo: RoboForex / TradingView

This week, the ETH feels so good, following the trend set by the BTC. Monday through Wednesday, it grew by 24%, which does not look like its limit. The market capitalization of Ethereum has reached 208 billion USD, while trade volumes have risen to 43 billion USD. The rally in the crypto sector started when Tesla reported buying a large amount of the BTC. This news pushed the whole sector of cryptocurrencies forward.

Meanwhile, some traders kept losing money while cryptocurrencies kept growing. The reason was that a huge number of marginal positions (some 130 thousand in volume, for about 1.5 billion USD total) were exterminated. Not everyone got in time to act, and the volatile market did its job. The maximum loss per trade was witnessed in the BitMEX exchange, where an investor lost 10 million USD. Note that the largest losses happened in trades with cross-rates of the ETH and USD.

This week, the CME started trading ETH futures. The market had been anticipating this, but the ETH rate hardly reacted to this – there was a wave of growth in the market, supported by other catalysts. At least, we did not see the negative scenario as with BTC futures in 2017 when the cryptocurrency was growing well but reversed after the contracts started trading.

For this article, we’ve used ETHUSD charts by TradingView.

Disclaimer: Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.