Bitcoin today blasted through local resistance and set an all-time high price record. The powerful move came after a short-lived drop downward yesterday, providing enough short-sellers to pose as fuel to push prices higher.

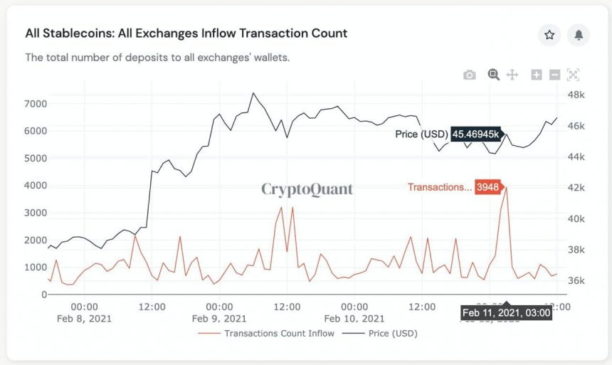

What also contributed to the “rocket fuel” was a sudden increase of stablecoins, which whales are finally taking full advantage of according to a crypto quant analyst. Here’s a look at the correlation between stablecoins, and the top cryptocurrency skyrocketing soon after.

Whales Utilize Stablecoins As Rocket Fuel To Squeeze Short Sellers

After Bitcoin broke the previous high earlier this week on the heels of news that green car maker Tesla had purchased $1.5 billion BTC, the cryptocurrency failed to continue higher the following day. An indecision candle followed by a sharp drop to retest lows, baited bears with the appearance of a evening star pattern.

Related Reading | Bitcoin Overtakes Russian Ruble, Inches Closer To Top Ten Global Currencies

Bulls were able to prevent the pattern from fully forming, stopping the candle short of the 50% engulfing requirement. The pattern and minor pullback was enough to lure bears in a trap, and this morning short sellers were squeeze and Bitcoin blasted through resistance to set yet another new high.

Coinciding with the rise, was a sizable uptick in stablecoin transactions that one cryptocurrency quant analyst says was used as “rocket fuel” by whales to pump BTC prices even higher.

Stablecoin transactions were buzzing ahead of the rally | Source: CryptoQuant

$50,000 Bitcoin Is Next, But Will Tether Eventually Implode?

According to CryptoQaunt CEO Ki Young Ju, Bitcoin is on its way to $50,000 per coin after whales have started revving the engines using stablecoins as “rocket fuel.”

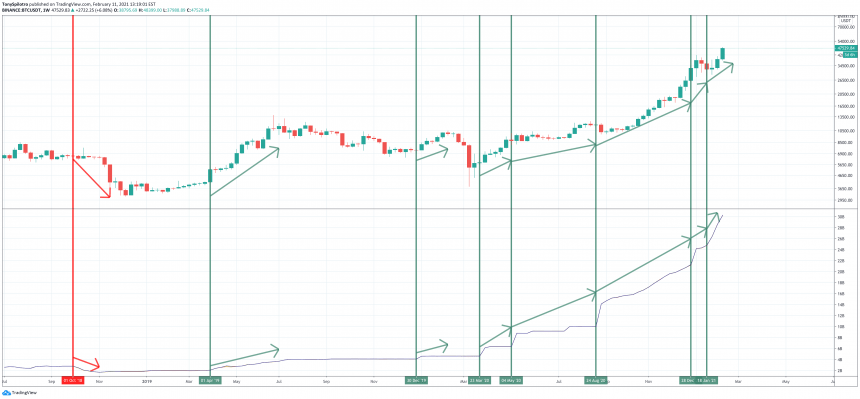

Increases in the supply and activity of stablecoins have long coincided with cryptocurrency market uptrends. The few times Tethers have been pulled from the market, the rug was also pulled on investors.

The only time Tether's were pulled, Bitcoin plummeted | Source: BTCUSD on TradingView.com

But since the bottom put in around 2018, the stablecoin supply has been on a steady rise. Stablecoins represent real capital entering the crypto market.

Related Reading | Running Bitcoin: Passing The Torch From Hal Finney To Jack Dorsey

Despite the name “stablecoin” the leading dollar-backed token, Tether, is still the subject of extreme controversy. There’s still a large camp that believes that most of the USDT in circulation isn’t actually backed, and could be a black swan that could ultimately take down the crypto market.

The claim has never been proven, and thanks to the growth in newer stablecoins like USDC, Tether might not be the leader for long. Could 2021 be the year the Tether saga comes to a conclusion one way or another?

Featured image from Deposit Photos, Charts from TradingView.com