Since its inception in 2009, cryptocurrency has become both a cultural and financial phenomenon. As news headlines tout its ever-increasing exchange values and disruptive potential, investors and banking experts have gone into a frenzy. And yet, while digital money is on a lot of people’s minds, there is still a lack of understanding about what it is and what it can do among mainstream consumers.

This is because cryptocurrency is a discontinuous or disruptive innovation, and its adoption demands significant consumer behavior changes and the infrastructure of supporting businesses. In order to succeed and get closer to the point of mass adoption, cryptocurrency as a product needs to create a bandwagon effect and build momentum so that it becomes a de-facto standard. This process is called a technology adoption lifecycle, and media plays an essential role in it. The crypto industry needs a marketing model that can effectively publicize its continuous changes and innovations.

The chasm

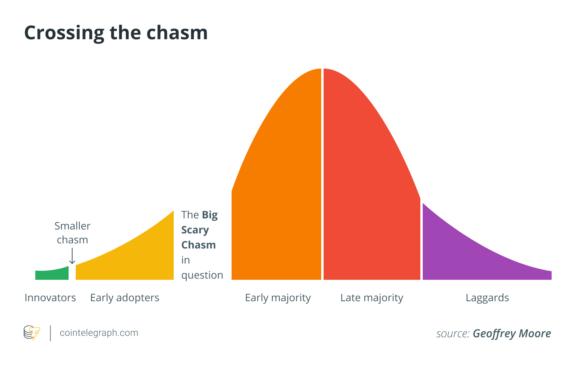

In his 1991 book Crossing the Chasm, Geoffrey Moore explains that every disruptive technology must pass through five stages of adoption: In the first stage, innovators tinker with new technologies; in the second, early adopters discover it; in the third and fourth stages, an “early majority” and a “late majority” — the two biggest groups — hop aboard; and in the final stage, the “laggards” arrive.

Plaguing the adoption process is what Moore calls “the chasm.” The chasm separates the early adopters from the early majority because the demands of these two groups are often vastly different. Unable to gain a foothold in the mainstream, new technologies will fall into the chasm and perish. Anyone who has ever studied the culture of Silicon Valley has probably seen some version of Moore’s schema dozens of times. If it seems more relevant now than before, it’s because it explains the adoption of cryptocurrency so aptly.

The recipe for mass adoption

How do new technologies cross the chasm? According to Moore, they have to connect with the early majority. These first consumers are hungry for information about the new tech: how it works and how it can change people’s lives. Most importantly, they need a story told in their own language to overcome their skepticism.

Without a compelling story, the new technology is unlikely to reach the early majority of adopters. This is where media professionals get into the game. They are the ones who weave that story and educate the public. As Moore sees it, they play a more important role in the industry than many people think.

Crossing the crypto chasm

In the early 2010s, cryptocurrency’s revolutionary potential was understood by a core group of cypherpunks and cryptography enthusiasts. But for the vast majority, it was an enigma — if it was known at all.

That began to change in 2015 as crypto pioneers and technologists developed alternate crypto assets, such as Ether (ETH). Between 2017 and 2020, digital cash was scooped up by early adopters. And in 2020, cryptocurrency had reached a critical juncture: It was on the road to the so-called “Big Scary Chasm.”

The first chasm it crossed was in 2017. Full of promise, it turned early adopters into enthusiasts and enthusiasts into visionaries. The new technology could no longer be dismissed: It seemed to foreshadow a great leap forward, a future whose economy would look radically different. And like a killer app that takes the world by storm, it went public in a big way — with an initial coin offering.

In 2020, large institutions, such as PayPal, Square, MicroStrategy and JPMorgan, spearheaded cryptocurrency’s bull run, while retail investors — who found it easier than ever to buy Bitcoin (BTC) — fueled the momentum. But in order to continue its rise and to shift from the early majority to the late majority, cryptocurrency still needs to demonstrate its viability on a mass scale.

Related: Will PayPal’s crypto integration bring crypto to the masses? Experts answer

According to Moore, for a new technology to break into the mainstream, it needs to find a beachhead. Crypto has certainly found its own: consumers looking to make fast and cheap cross-border transactions without third-party intervention. As it happens, many of these consumers live in countries with economic and political instability, which explains why Bitcoin is booming in places, such as Argentina, Iran, Turkey and Nigeria.

Sounds like crypto is on the right track to adoption? There are still risks, though. Sales-driven companies that pursue the whole crypto market, but lack customer and product focus, can easily fall afoul of the dreaded chasm.

Fighting its way into the mainstream

So, what’s the recipe for mass adoption? New customers need to know why they should buy into the crypto market, and how — this is why at this stage of the market, developing a robust communications strategy in place is crucial.

Vigorous marketing campaigns show us the value and significance of new products. In the case of cryptocurrency, media must take a three-pronged approach: explaining digital cash in terms that everyone can understand, getting influential thought leaders to back it, and acquainting customers with the competition, primarily banks, the Federal Reserve and equities — those intent on squashing cryptocurrency.

Moreover, if crypto as a product wants to acquire pragmatic customers, those who are on the edge of the technology adoption lifecycle, it needs to take into account that these customers want to buy from a market leader with a strong reputation. That is why establishing thought leadership is the key in any communication strategy.

Still not sure whether the crypto industry should focus on communications? Well, the process has already started, and it will likely snowball from here, gaining momentum as more opportunities to invest in cryptocurrency emerge.

In the coming months, we expect to see big developments in the industry, like major banks launching crypto custody services, brokerages opening up access to crypto products, new retailers accepting digital cash, and big institutions launching applications on public blockchains.

But perhaps the most important change will be in how we talk about cryptocurrency, where the conversation will shift from Why should I invest? to Why aren’t we already invested?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Anastasia Golovina is a communications specialist with extensive experience in crypto projects. She has managed communication for various crypto startups in the U.S. and Europe, such as Ledger, Celsius Network, Algorand, MEW, Bitfury, Waves and others. Her specialties include media relations, crisis communications and community management.