The price of bitcoin and a number of digital assets saw significant gains on Monday, as the entire market capitalization of the crypto economy has gained 2.4% in the last 24 hours. Bitcoin’s value passed the psychological $50k zone after hitting a low of $43,021 the day prior on Sunday.

- Bitcoin (BTC) touched a high on Monday, March 1, at $50,244 per unit at around 7:26 p.m. (ET). At the time of publication, BTC’s overall market valuation is around $926 billion and there’s $22.83 billion in global trade volume. The current price is over 15% higher than the low of $43,021 per unit on February 28.

- Out of all the crypto-assets in existence, BTC’s market dominance in terms of market valuation against the $1.44 trillion in value is 61.02% today. Bitcoin is still down 8% for the week but is up 44.92% against the U.S. dollar during the last 30 days.

- The second-largest market capitalization is ethereum (ETH), which is now trading for $1,583 per coin. ETH has jumped over 9% during the last 24 hours, but ether has lost 12% over the course of the seven-day span. 30-day odds against the U.S. dollar shows ETH is up 13.19% today.

- Cardano (ADA) still commands the third-largest market valuation as each ADA is exchanging hands for $1.29 per unit. ADA’s increases on Monday are not spectacular as the crypto asset has only increased 1.8%. However, the token is up 18% during the last week and a whopping 256% over the course of the last month.

- Binance coin (BNB) is up 18% at press time, and is swapping for $262 per token. BNB is down 4.4% against the USD during the last week, but 30-day stats show BNB has gained 470%.

- Tether (USDT) the stablecoin has moved down to the fifth position this week and has seen an increase in volume during the crypto economy’s dip. USDT’s trading volume is currently larger than BTC’s on March 1, 2021.

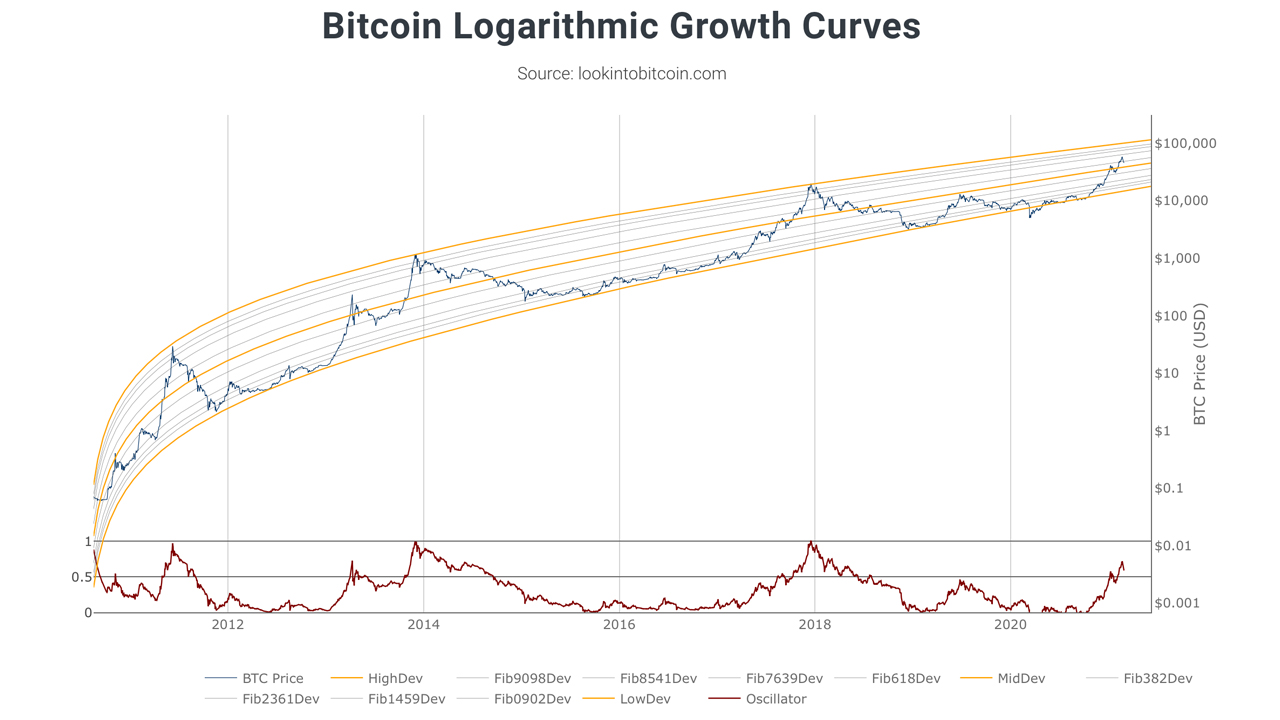

- Crypto prices are looking on the upside right now. After seeing a number of significant bull traps during the last week. Bitcoin prices, in particular, in March, and other crypto-asset markets, in general, have usually done well during this month. This is historically so except for March 12, 2020, otherwise known as ‘Black Thursday.’

#Bitcoin bull market in 2017:

• 6 corrections of 30-40%

• followed by average gain of 153% pic.twitter.com/cx1M10vpKS— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) February 28, 2021

- To many observers, it looks as though we’ve hit two small speed bumps in the 20-25 percentile range. The Twitter account dubbed ‘Bitcoin Archive’ noted that during the bull market in 2017 there were “[six] corrections between 30-40%” and each one was “followed by [an] average gain of 153%.”

- “Bitcoin seems to have bounced back today as cryptocurrency markets start the week in a resurgent mood,” Paolo Ardoino, the CTO of Bitfinex said in an investor’s note on Monday. The backdrop of huge pent-up institutional demand and interest from long-term investors may be here to say, but time will tell,” Ardoino added.

- The Bitfinex CTO further said: “Those drawing parallels to the bursting of the crypto bubble in 2017 may not be accounting for the technology’s advancement since then. We believe the technological infrastructure of the space as a whole is proving itself to be robust.”

Interested in seeing all the crypto asset prices in real-time? Check out markets.Bitcoin.com for the latest price action.

What do you think about the recent price movements within the crypto economy? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Bitcoinwisdom, lookintobitcoin.com/charts, Twitter,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.