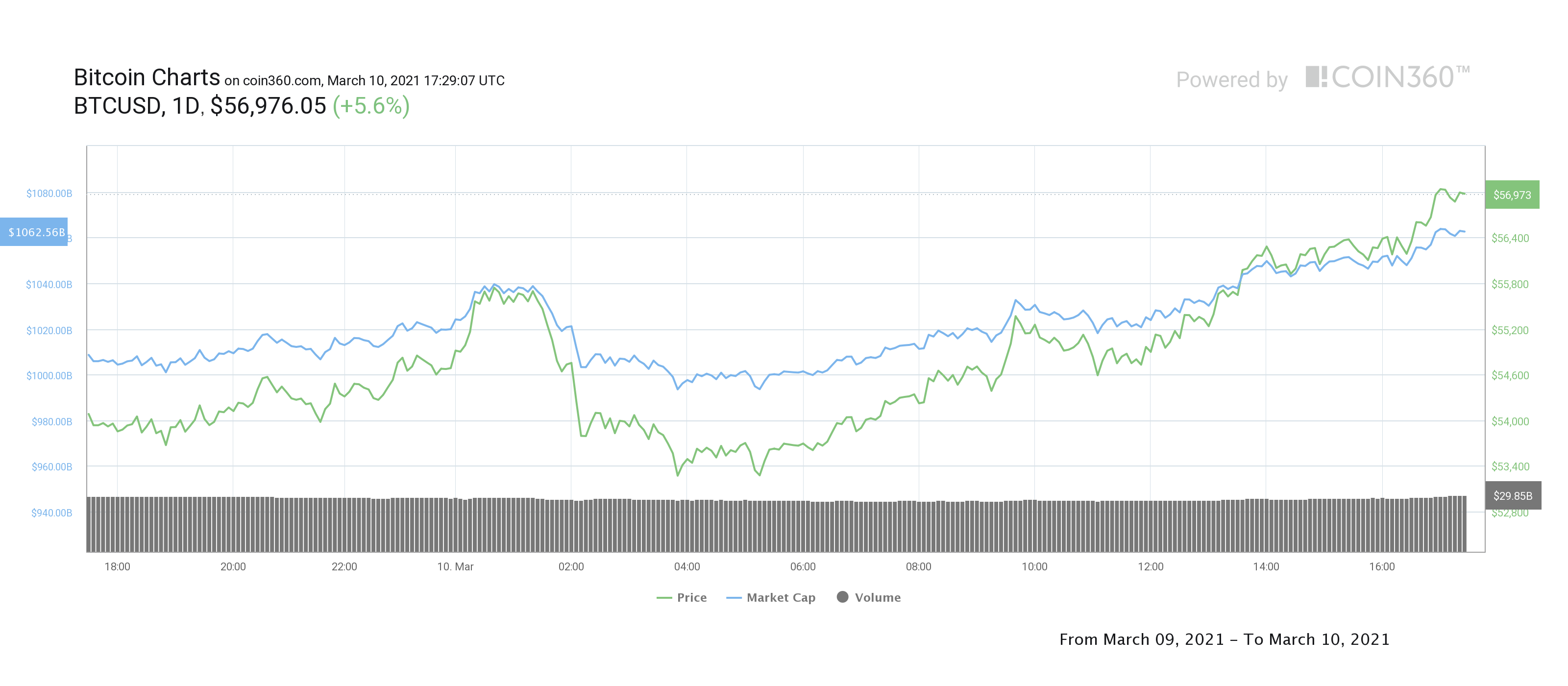

Within the last hour, Bitcoin (BTC) price surged to $57,100, a level not seen since Feb. 20 when BTC price made a new all-time high at $58,352. The bullish breakout signals that investor sentiment has shifted back in favor of bulls and it increases the likelihood that BTC will attempt a run at the $60,000 level.

Data from Cointelegraph Markets and TradingView shows that Bitcoin bounced off a low of $52,998 in the early morning hours and proceeded to rally 6.5% above the $57,000 level.

Today’s upside move was preceded by news that Digital Currency Group intends to buy up to $250 million shares of the Grayscale Bitcoin Trust (GBTC). The purchase comes at an interesting time, considering that on March 8 GBTC shares traded at a 15% discount to Bitcoin’s spot price on major exchanges.

While institutional investors may be able to take credit for the current move, overall interest in Bitcoin is also continuing to grow. Recent data shows that 10,000 Bitcoin ATMs have been installed in the U.S. since March 1, 2020, marking a 57.5% in the number of BTC-equipped ATMs over the past year.

Bitcoin ignores the economic concerns weighing on stocks

In the past two weeks, equities markets have been weighed down by a downturn in technology stocks and concerns over the rising Treasury yield. Many analysts predicted that a strengthening dollar and rising Treasury yield would negatively impact Bitcoin price.

According to Chad Steinglass, Head of Trading at CrossTower, the “underlying current in BTC is still incredibly good,” as it seems like there are major traditional finance players getting involved with BTC on a daily basis.

Steinglass said that the recent addition of Ether (ETH) to the balance sheet of the Chinese software firm Meitu is another positive development as it demonstrates the growing prominence of cryptocurrencies in traditional finance.

Steinglass further explained that the BTC correction of the past two weeks was the result of a “massive sell-off in tech equities” which hit GBTC hard as the “discount to NAV that GBTC traded got as high as 15%” on March 5 as European traders “ran in fear” at the close of the Europe equity markets.

Steinglass said:

I believe that this caused a drag on BTC prices, as adventurous traders stepped in to slowly buy GBTC while selling spot or futures. The fact that spot BTC prices were able to tread water during this route was something I found quite bullish.

Altcoins follow Bitcoin’s breakout

As Bitcoin takes aim at the $60,000 level, several altcoins also chased after new all-time highs.

Theta (THETA), a blockchain-based video streaming platform, rallied 18% over the past 24-hours to reach a new all-time high of $5.92.

Meanwhile, Polygon (MATIC) received a 33% boost on March 9 when Coinbase announced that the token would be added to Coinbase Pro.

The overall cryptocurrency market cap now stands at $1.74 trillion and Bitcoin’s dominance rate is 61.1%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.