The recent boom in non-fungible tokens, or NFTs, has been accompanied with controversy and concern over the technology’s environmental impact due to the computational power required.

Out of all transaction types on a blockchain, NFTs are some of the most intensive of them all as they often involve numerous complicated transactions and executions of smart contracts in the minting, bidding, selling, and transferring process. This is sometimes reflected in transaction costs reaching hundreds of times more than that of a simple transaction.

Almost 5k is the price to accept a bid on @rariblecom now!! Is it because of ETH high gas fees⛽️ or some type of bug ?

Thoughts ? pic.twitter.com/tYoV1ilB85— Olive Allen (@IamOliveAllen) February 3, 2021

In the past, the impact of such concerns was minimal, however, in recent weeks, some artists and platforms are starting to cancel NFT plans as a result. Digital artist Joanie Lemercier canceled his second Nifty Gateway drop after becoming aware of the environmental impact of the platform’s sales:

“It turns out my release of 6 CryptoArt works consumed in 10 seconds more electricity than the entire studio over the past 2 years.”

Art portfolio platform ArtStation canceled its NFT drop of prominent artists hours after announcing it due to excessive backlash on the environmental impact of NFTs.

However concrete figures behind NFTs’ real carbon footprint remain elusive.

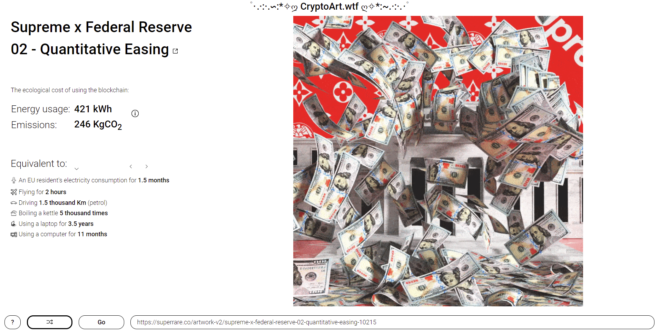

In December, 2020, computational artists and engineer Memo Akten developed the CryptoArt.wft platform which calculates the energy usage and CO2 emissions of any NFT on SuperRare, Nifty Gateway, or any individual transaction on Ethereum.

According to the website, the above NFT on SuperRare has consumed 421 kWh, the equivalent energy to an EU resident’s electricity consumption for 1.5 months. On the site, Akten provided a link to his in-depth analysis behind his calculations, adding that the average NFT has a footprint of approximately 340 kWh.

Offsetra, a project helping to offset cryptocurrencies’ carbon footprints, uses the same methodology as Akten but admitted the calculations have “clear gaps.” These figures, alarming as they are, only apply to Proof-of-Work blockchains (which include Ethereum and Bitcoin) and apply various assumptions..

“For the time being we have included a 20% buffer in our calculations to include both unknown mining pools, and inefficiencies in the network that may lead to energy losses (e.g. such as via waste heat at the point-of-use),” Offsetra added. This 20% buffer was removed on March 8.

However there is light on the horizon with the emergence of Proof-of-Stake blockchains, such as Eth2. These are viable alternatives for NFT minting and use just a fraction of the computational power required to securely transact on them, Akten stated.

“ETH2 aka Serenity [uses] a Proof-of-Stake (PoS) consensus algorithm which is orders of magnitude more computationally efficient.”

Nifty Gateway responded to artist Lemercier’s concerns stating that Layer2 scaling on Ethereum can be deployed in weeks and in doing so, “We can reduce the impact, today, by 99%.”

SuperRare wrote an article responding to some of the environmental issues, stating that calculating transaction costs for NFTs was an incorrect approach as the overall costs of the blockchain remained the same regardless of transaction numbers.

“In other words, if everyone took a break from using Ethereum apps and no transactions were sent for a whole day, the carbon emissions of the network would essentially stay the same,”

SuperRare explained that they, along with many in the Ethereum community, are aware of inefficiencies of PoW blochains and promised to donate money to aid in ETH2 research while exploring alternative scaling options.

But what if crypto was good for the planet?

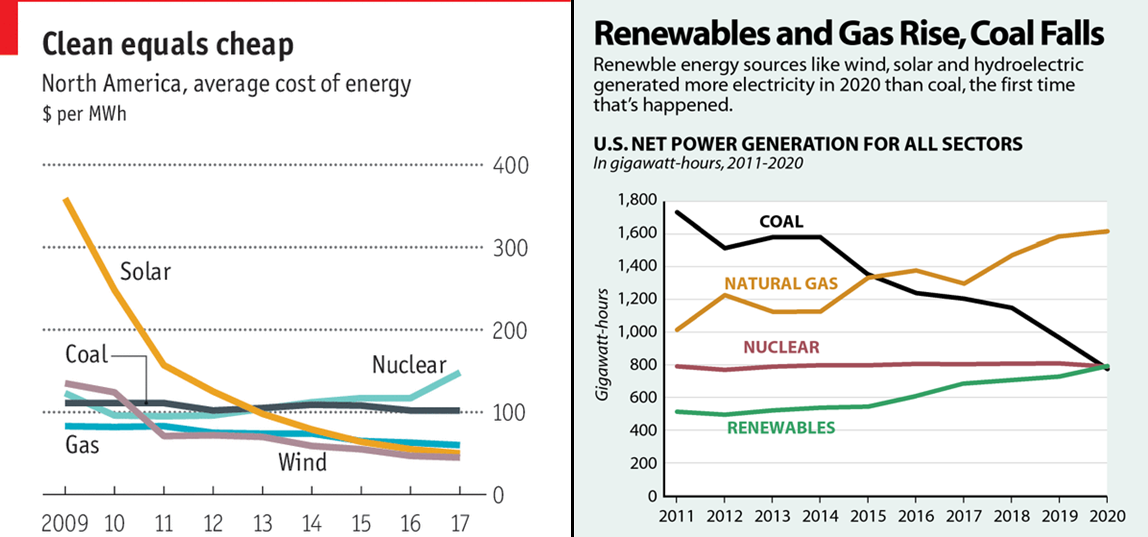

In a counterintuitive approach, Delphi Digital co-founder and head of research Medio Demarco wrote a recent post arguing that cryptocurrency mining could, in fact, help save the planet. He states that the network incentivizes cheap energy which now means clean energy.

Part of his reasoning revolves around miners using otherwise unused clean electricity, allowing clean energy farms to monetize 100% of their production rather than only a fraction of it. This in turn could be enough to fund new clean energy infrastructure. He argued:

“The impact that has on the bottom line can be the difference between funding new solar infrastructure right now or waiting until the economics improve.”