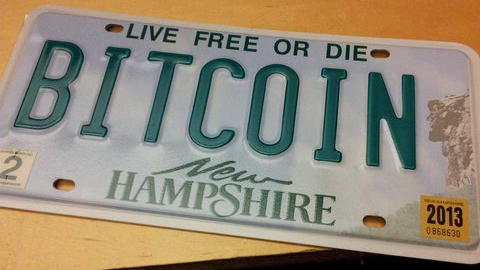

During the first week of the new year, two U.S. representatives from New Hampshire, Dennis Acton and Michael Yakubovich, proposed a bill that would allow the state’s residents to pay taxes with cryptocurrencies. Now after some deliberation, New Hampshire’s House Subcommittee unanimously approved the state’s bitcoin for taxes bill.

Also read: US State of Ohio Accepts Bitcoin for 23 Types of Taxes

New Hampshire Bitcoin for Taxes Bill Passes Unanimously

Residents from the state of New Hampshire, otherwise known as the “free state,” may soon be able to pay their taxes using cryptocurrencies like bitcoin. Over the last few weeks, the state’s legislators have been discussing the recently submitted bill, HB 470, which would allow residents to pay specific New Hampshire taxes with bitcoin. HB 470 will address any accounting, valuation and management issues related to accepting cryptocurrencies, the bill states. Further, the plan will need to find a third party payment processor that will process digital asset transactions at no cost to the state.

“Implementation Plan for the State to Accept Cryptocurrencies as Payment for Taxes and Fees,” explains HB 470. “The state treasurer, in consultation with the commissioner of the department of revenue administration and the commissioner of the department of administrative services, shall develop an implementation plan for the state to accept cryptocurrencies as payment for taxes and fees beginning July 1, 2020.”

If the bill passes, then on or before November 1, 2019, the state treasurer must submit the roadmap to the Governor, the Speaker of the House of Representatives, the Senate President, the House Clerk, the Senate Clerk, and the offices of the State Library. On Jan. 29, 2019 at 9 a.m., the New Hampshire House Subcommittee unanimously approved the bitcoin for taxes legislation and the bill’s amendments. HB 470 will now go back to the executive branches like the state’s Administration Committee for further voting.

New Hampshire Joins Ohio and Possibly Indiana

New Hampshire is currently on the move to join Ohio, the first state in the U.S. to accept payments in bitcoin cash (BCH) and bitcoin core (BTC) for 23 types of business taxes. “Ohio has become the first state in the United States, and one of the first governments in the world, to accept cryptocurrency,” detailed Josh Mandel from the Ohio Treasurer’s Office at the time. Then there’s the state of Indiana which plans to amend the tax code and accept cryptocurrencies for tax payments as well, according to House bill number 1683 filed on Jan. 24, 2019. Indiana’s Treasurer will be in charge of handling similar parts of the system, like finding a payment processor, but if enacted, Indiana’s amended tax code would go into effect on July 1, 2019.

With the New Hampshire Subcommittee unanimously pushing through the bitcoin for taxes bill, it seems like the state may approve the legislation in the near future, although residents will still have to wait until 2020 in order to pay taxes with cryptocurrencies. HB 470 also emphasizes that New Hampshire will not accept the responsibility of bitcoin’s price fluctuations and all taxes collected will be converted to U.S. dollars immediately. Furthermore, the state’s Treasury is unable to predict whether a third-party payment processor would process cryptocurrency services at no cost to the state, the proposed bill concedes.

What do you think about the New Hampshire Subcommittee pushing the state’s bitcoin for taxes bill forward? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Pixabay, and video courtesy of Freekeene.com.

Need to calculate your bitcoin holdings? Check our tools section.