Risk coverage is one of the most identifiable use cases that decentralized finance enables, paving the way for a multi-billion dollar industry based on the widespread hacking and fraud that takes place within the blockchain market. Insured Finance introduces a platform to mitigate these losses once and for all, enabling anyone to take out or fund a decentralized insurance policy as protection against rug pulls, stablecoin devaluation, cryptocurrency exchange hacks, and smart contract manipulation. This first-of-its-kind platform will innovate across the entire industry, allowing anyone to interact with new or potentially compromisable projects without having to worry about a potential loss of funds.

Gearing Up for Launch

Since the announcement of this highly ambitious project, Insured Finance has had its nose to the grindstone, working on bringing decentralized risk coverage to all. Following a highly oversubscribed IDO, the development team has made huge strides since its inception, and is now preparing for the launch of the platform’s testnet. With this release, platform users will be able to begin experimenting directly with on network, testing its capabilities to make sure it can smoothly provide its promised services when Insured Finance launches its mainnet.

On this highly usable blockchain-agnostic network, Insured Finance provides an intuitive and easily navigable dashboard for its users to begin their insurance journey. Since these offerings will most likely be very highly sought after, Insured Finance has made its dashboard as user-friendly as possible, eliminating technical barriers that could scare away non-technical users. The dashboard will initially offer two opportunities for users to capitalize on, taking out coverage and providing liquidity, with more features planned down the pipeline.

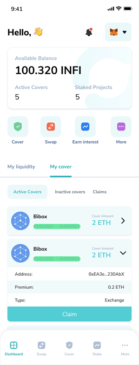

Since Insured Finance will mirror the traditional insurance industry’s capabilities, it will provide its users the option to facilitate both ends of the insurance transaction. The first sector, called ‘My cover”, enables any user to take out insurance coverage against an exchange hack, rug pull, stablecoin decoupling, or smart contract vulnerability, with the dashboard presenting the type of asset the user took coverage out on and the total value of the coverage in case the event occurs.

An excerpt from a test version of the application showing a screen from “My Cover”

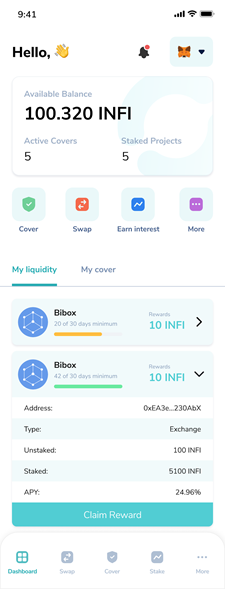

The second section is labeled “My liquidity’ and allows users to provide risk coverage to others. This segment shows the user the amount of the value they have staked on the platform to actively provide coverage and the percentage yield they receive by providing this risk coverage liquidity. In the case of a triggered risk coverage event, the platform can instantaneously pay out insurance claims once validated since the coverage liquidity is always staked on the network.

An excerpt from a test version of the application showing a screen from “My Liquidity”

Providing Value Via a New Industry Sector

The launch of the Insured Finance platform will be one of the first of its kind, allowing anyone to easily and safely navigate the speculative and novel aspects of the cryptocurrency market without fear of losing their hard-earned value. There are so many new and interesting projects in the distributed ledger market, but since it is still highly unregulated, there is a propensity for fraud. Insured Finance ushers in a new era where users can interact with any application without the threat of substantiated loss. This powerful new tool is sure to change users’ outlooks and interactions within the space, providing a safety net for anyone who requires one.