The price of bitcoin is still hovering below the $3,500 mark and volatility seems to be dying fast. Is it strange, then, that SFOX‘ report (a cryptocurrency prime dealer for large-scale investors) places the Crypto market at ‘mildly bullish’ entering February?

This is a couple of notches up from its ‘mildly bearish’ tag last month.

Why?

SFOX Crypto Volatility Report January 2019

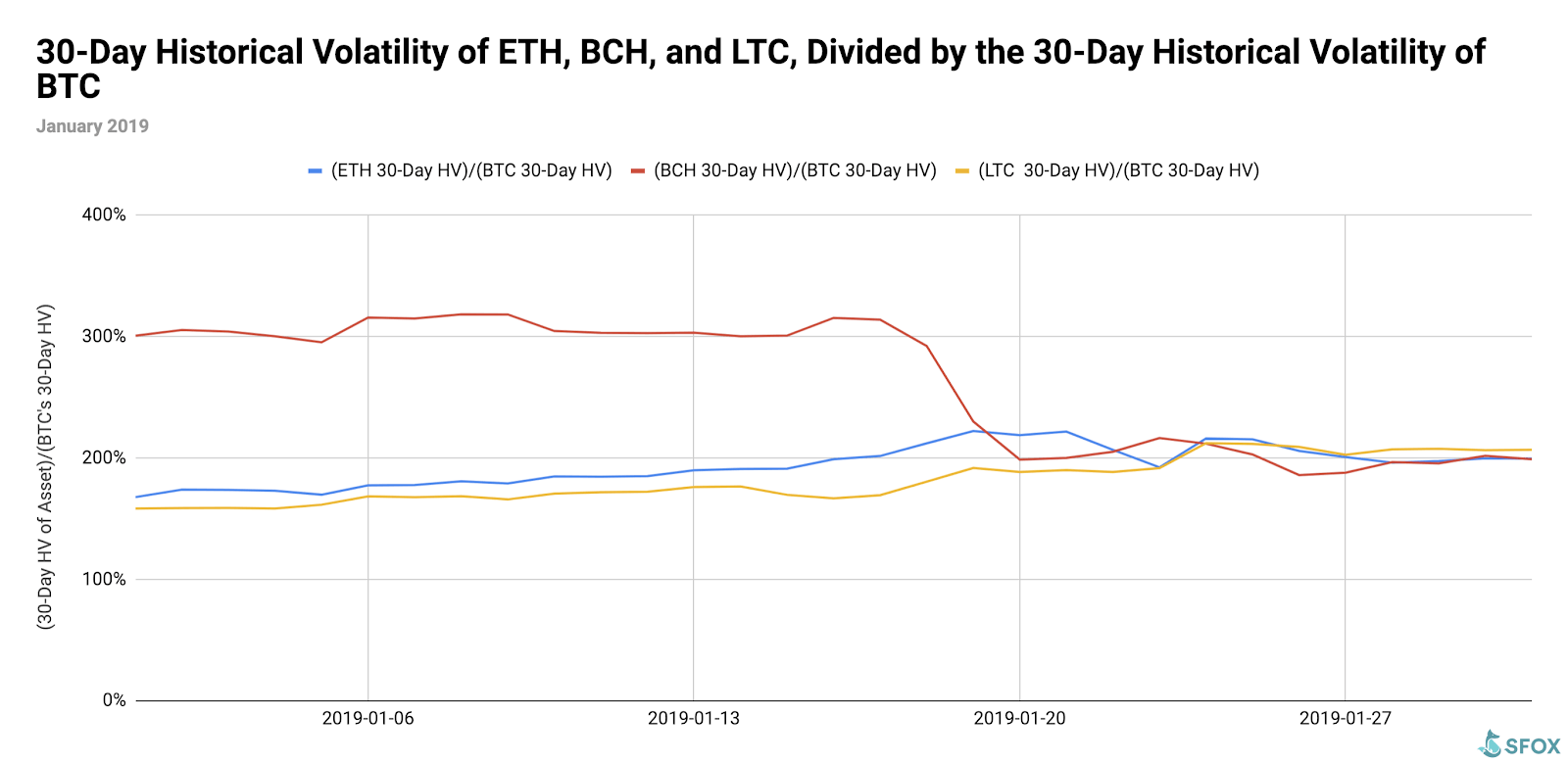

The institutional broker-dealer SFOX report collects key metrics, including volume, price, and volatility data from eight major exchanges on four leading crypto assets–Bitcoin, Litecoin, Ethereum, and Bitcoin Cash. It then analyzes their global performance. According to the report:

Two things stand out in this month’s data on crypto volatility: (1) the sharp decrease in BCH’s volatility and (2) the general marketwide decrease in crypto volatility.

Volatility Almost Flatlined in Late Jan

All assets saw a major decline in their 30-day historical volatility in January.

SFOX Crypto Volatility Report January 2019

The four crypto assets remain strongly correlated. Yet, despite the decline in volatility, remained more volatile than gold in January.

The Market Is Moving to a ‘Building’ Phase

The improving stability of the Bitcoin Cash/Bitcoin Satoshi Vision relationship is an indicator that the market is focusing on building, rather than hype.

There may be less consumer interest in cryptocurrencies right now, but institutional interest is sustained. There’s also an increase in blockchain usage and blockchain projects coming to life.

Abra just announced that you can now invest in stocks, ETFs, and other cryptocurrencies all on top of the Bitcoin network.

Every stock, bond, currency, and commodity will be tokenized.

No longer a question of “if,” but rather “when” 🚀

— Pomp 🌪 (@APompliano) February 6, 2019

Moreover, three major events on the near horizon could spark volatility throughout the remainder of this month. All these factors combine to lead the SFOX report to its optimistic conclusion.

Why the Market Is Moving to Mildly Bullish

February 2019 could be a month to remember for the Crypto markets. There are at least three major events coming up that are sure to drive volatility. These are:

- Bitcoin futures expirations

- Ethereum Constantinople hard fork

- SEC reviewing the VanEck and SolidX Bitcoin ETF proposals

The CBOE BTC futures expire on February 13, while the CME Bitcoin futures have their last-trade date for February 22. Why does this matter? Because crypto volatility tends to pick up when futures contracts expire.

Ethereum’s delayed Constantinople hard fork is finally happening on February 27. While the upgrade isn’t anticipated to cause a split in the blockchain, as the SFOX report points out:

Forking networks breeds uncertainty, and volatility often follows (see the Bitcoin Cash hard fork last November).

Finally, the Crypto community will be holding its breath as the SEC is set to review the VanEck and SolidX Bitcoin ETF proposals on February 27 as well. Not many events or entities have the power to unsettle the markets like the SEC.

VanEck SolidX Bitcoin ETF was just refiled https://t.co/FAHsgcdLCU

— Barry Silbert (@barrysilbert) January 31, 2019

If you’re wondering whether Bitcoin volatility is dying and will ever come back, you should have your answer by the end of this month.

Featured Image from Shutterstock.