Other traders remain active, seeking opportunities for investments that will outperform BTC by using options and futures strategies. “Over time, a lot of folks that deployed in crypto went for vanilla (passive) strategies, but saw that they could get more alpha and mitigate risk with active strategies,” crypto hedge fund BKCoin Capital said in an interview with CoinDesk.

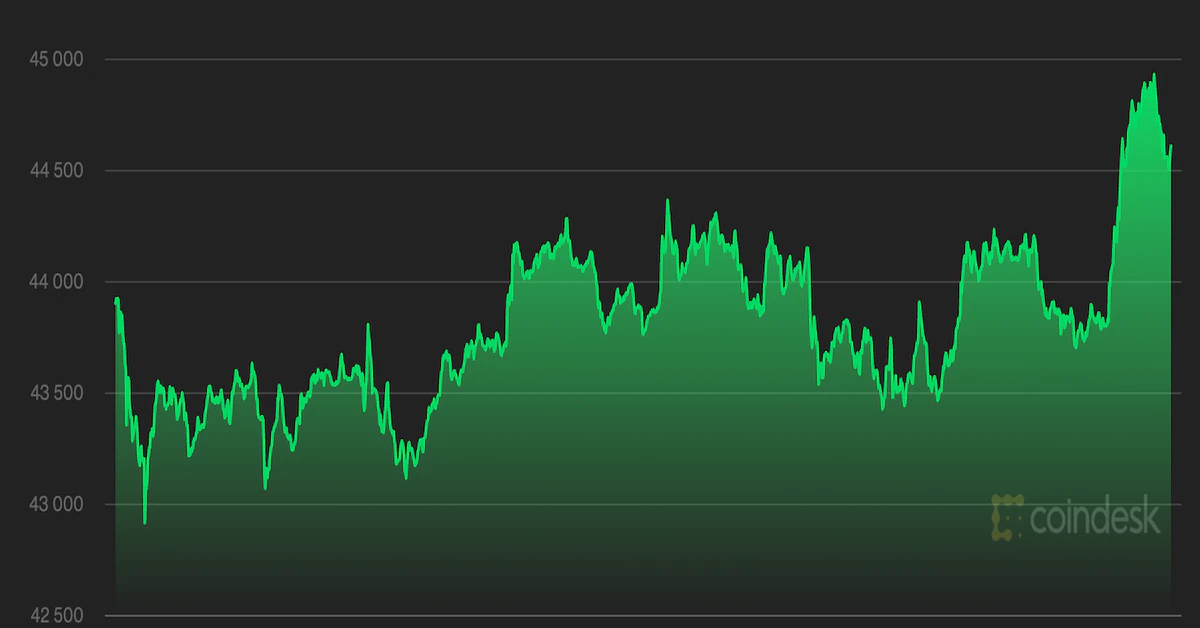

Bitcoin Rises Even as Indicator Shows Extreme Bearish Sentiment — CoinDesk