The “Q3 2021 Quarterly Review” by CoinDesk Research looks at driving trends in digital asset markets, focusing on Bitcoin, Ethereum, DeFi and more.

Click to download the report here.

Q3 was characterized by conversations around scalability and broader adoption. With bitcoin officially becoming legal tender in El Salvador the Lightning Network found its way into headlines as Bitcoin sought to transact value cheaply without needing to wait hours to confirm a transaction.

The growth of decentralized finance (DeFi) and non-fungible tokens (NFTs) caused transaction fees on Ethereum to grow so much that new blockchains were able to scoop up some of its market demand. That said, Ethereum still performed well in spite of potential substitutes, given how intimately tied it is to DeFi and NFTs more broadly.

Bitcoin trends

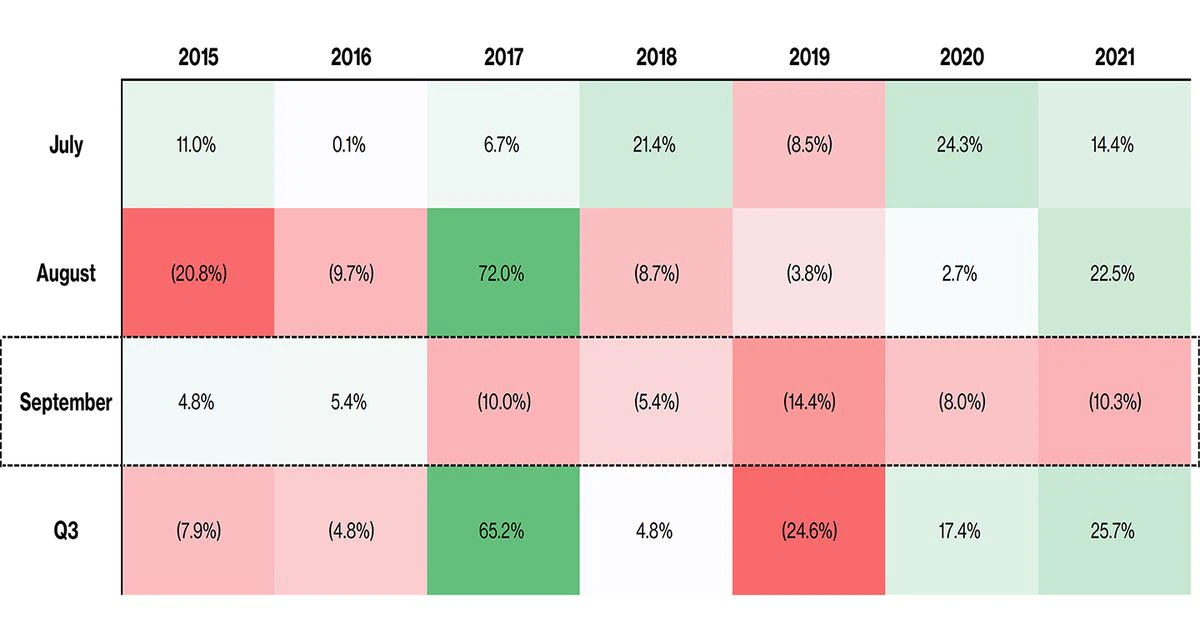

Bitcoin returned to price gains in Q3 on the back of relatively muted volatility. Bitcoin also returned to uncorrelation to the main macroeconomic assets in Q3, allowing it to reclaim its title as a macro asset unlike any other.

Bitcoin’s positive price trend can be at least partially attributed to two key factors: recovering the hashrate that went offline following China’s crackdown on miners in Q2; and explosive growth of the Lightning Network, a popular Bitcoin overlay network that enables cheap and instantaneous bitcoin payments.

That said, Bitcoin transaction fees in Q3 were the lowest we have seen in some time, which could be cause for concern if the lack of transaction fees can be tied to lack of demand for transactions on the blockchain.

More broadly, Bitcoin left exchanges in droves in Q3 and on-chain liquidity continued its downward march as investors continue to “HODL” their coins.

Ethereum trends

Meanwhile, Ethereum can credit its Q3 performance to the EIP 1559 upgrade and the immense growth of DeFi and NFTs.

EIP 1559 introduced a fee burn mechanism which resulted in slashing the yearly inflation rate by 75.5%, which the market viewed favorably.

DeFi Summer trudged on as total value locked in the ecosystem grew, but NFTs did their best to steal the show. The huge demand for NFTs led to huge spikes in gas fees. The spikes gave fuel to the “alternative layer 1″ narrative which led to impressive asset price appreciation of potential substitutes, like Solana, as users looked for cheaper smart contract blockchains to experiment and build with.

Regulation

Lastly, Q3 was characterized by a reintroduction of regulators and institutions to the digital asset space. China doubled down on previous bans; Binance navigated regulations; and the U.S. proposed new crypto tax rules, which were met with heavy criticism from crypto supporters.

On top of that, stablecoin issuer Circle announced plans to go public and in doing so sparked conversations about transparency which led to stablecoin issuers disclosing what exactly was backing their pegged coins. Those disclosures left some skeptics and investors unsatisfied.

This and much more in CoinDesk Research’s Q3 2021 Quarterly Report.