The Dow barreled toward a 140 point gain on Monday after US President Donald Trump announced a delay to the US-China trade deadline. Cryptocurrency investors, meanwhile, were left searching for answers after the bitcoin price crashed below $3,715 just hours after pushing toward $4,200.

Dow Sees Triple-Digit Climb, S&P 500 Looks to Jump Past 2,800

As of 8:41 am ET, Dow Jones Industrial Average futures had soared 157 points or 0.6 percent, implying a gain of 140.19 points at the open. Nasdaq futures outperformed with a 0.69 percent surge, while the S&P 500 targeted a push past 2,800 on the back of this morning’s 0.48 percent pre-market rally.

Stock market futures tracking the Dow (blue), S&P 500 (red), and Nasdaq (orange) all shot higher on Monday.

On Friday, the Dow raced past 26,000 en route to a 181.18 point or 0.7 percent gain, carrying the US stock market bellwether to its highest level since November. The S&P 500 rose 0.64 percent but failed to unseat resistance at 2,800. The Nasdaq outperformed with a 0.91 percent rally that pushed it past 7,500 to 7,527.54.

Trump Tweet Sends Dow Higher

This morning, all three of Wall Street’s major indices are riding high on the news, delivered via Twitter, that the Trump administration would not hike tariffs on more than $200 billion worth of Chinese goods following the president’s self-imposed March 1 trade deal deadline.

Trump did not set a new deadline, instead confirming that he would likely meet with Chinese President Xi Jinping at his Mar-a-Lago resort in Palm Beach to “conclude an agreement.” Presumably, the delay is both a carrot and a stick to entice Xi to strike a firm deal at the summit, which reports have said could come in late March.

I am pleased to report that the U.S. has made substantial progress in our trade talks with China on important structural issues including intellectual property protection, technology transfer, agriculture, services, currency, and many other issues. As a result of these very……

— Donald J. Trump (@realDonaldTrump) February 24, 2019

….productive talks, I will be delaying the U.S. increase in tariffs now scheduled for March 1. Assuming both sides make additional progress, we will be planning a Summit for President Xi and myself, at Mar-a-Lago, to conclude an agreement. A very good weekend for U.S. & China!

— Donald J. Trump (@realDonaldTrump) February 24, 2019

An increasing number of stock market analysts believe a firm trade deal will spark another equities rally, enabling the Dow and its sister indices to rocket back toward their 2018 all-time highs.

Analyst: Trump’s Trade Deal Won’t Solve US-China Tension

However, others warn that a trade deal will not be enough to defuse tensions between the US and China.

Hua Changchun of Guotai Junan Securities said that the US and China will strike a trade deal in late March but that the two superpowers would continue to wage economic warfare on other fronts:

“The two nations will likely reach a deal on all aspects in late March and the tariffs will not rise from the current levels, but that doesn’t mean the conflict between them will be over.”

“Tariff wars will be suspended and we’ll enter the ‘post-trade-war’ era, where the two nations will shift to championing companies, promoting advanced technologies and trying to increase control over global economic rules.”

Even so, there remains a general belief that a trade deal – whatever it ends up looking like – will provide stock markets worldwide with a degree of stability they have sorely lacked since the trade war began.

Bitcoin Blackout Sends Crypto Market $15 Billion into the Red

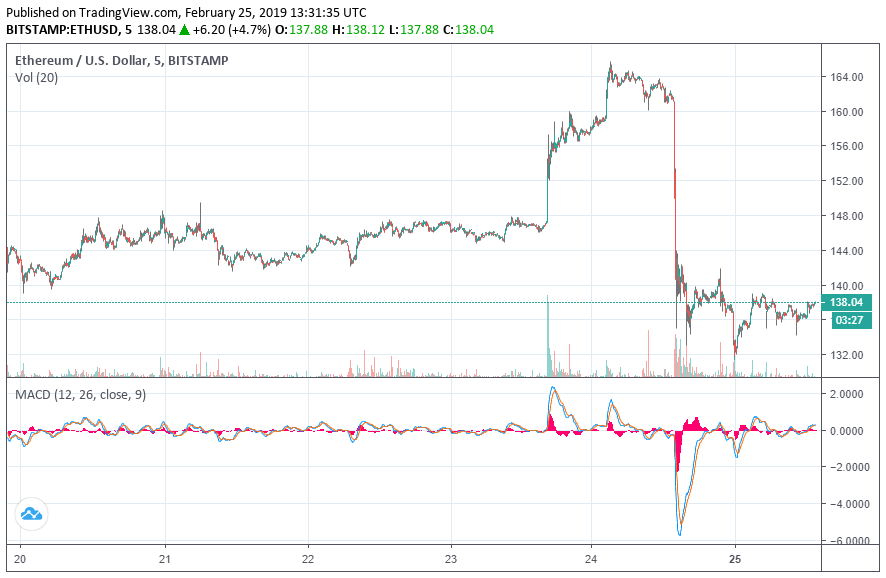

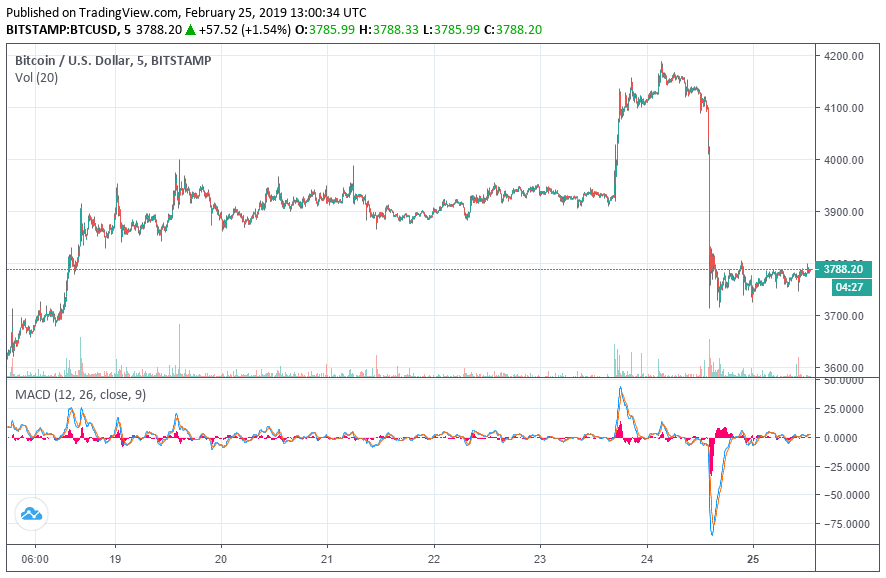

Cryptocurrency investors had much less to cheer about heading into the US trading session, as traders continued to grapple with the impact of Sunday’s severe sell-off, which in a matter of minutes erased a full week of progress.

Over the course of February, the bitcoin price had steadily climbed from the low $3,200s to $4,190, representing an intramonth gain of nearly 30 percent. However, the flagship cryptocurrency failed to smash through technical resistance at $4,190, triggering a rapid sell-off that carried bitcoin as low as $3,714 on Bitstamp – a decline of $476 or 11 percent.

That’s what you call a full Bart – not something any crypto investor wants to see.

Other cryptocurrencies were rocked even harder, with ethereum, EOS, litecoin, and bitcoin cash all flashing 24-hour declines of at least 13 percent.

What had so recently looked like the makings of a bull market once again feels precarious, and bears are already patting themselves on the back for not joining last week’s feeding frenzy.

Mati Greenspan, Senior Market Analyst at eToro, said that the Sunday crash was a “stark reminder” about the high-risk nature of cryptocurrencies. However, he declined to join the doom-and-gloom parade, stating that bitcoin now has an excellent opportunity to build support at $3,800 before making another upside breakout attempt.

“This latest crypto sell off is a stark reminder that cryptoassets remain a volatile, developing asset-class, and investors should act accordingly. Bulls will be watching to see if prices can hold at $3,800, as this would be a nice place to build support.”

Greenspan further noted that the sell-off was led by the ethereum price, which he says also helped catalyze the recent crypto rally. He argued that this indicates that ethereum is re-establishing itself as an asset that has the gravitas to move the wider markets.

“Curiously, this slide was led by Ethereum, which dropped about 5 minutes ahead of the rest of the market. As such, Ethereum has now become a [bellwether] asset for the market. Last week’s miniature bull run was led by Ethereum, and this latest slide means the asset cements its place as a key signal for investors watching the market.”

For now, bitcoin is trading below $3,800 at $3,788 with nearly $11 billion in 24-hour trading volume. The cryptocurrency market cap stands at $129 billion, a drop of $15 billion from its weekend peak.

Featured Image from Shutterstock. Price Charts from TradingView.