Dow futures traded down ahead of the US stock market’s opening bell as three major geopolitical events left Wall Street on edge. The bitcoin price, meanwhile, held steady above $3,800 while the crypto market bid farewell to the once-prominent “Coinbase effect.”

Dow Futures Forecast Drop Below 26,000

As of 9:10 am ET, Dow Jones Industrial Average futures were down 60 points or 0.23 percent, implying an opening bell decline of 73.98 points. That drop would thrust the Dow back below the 26,000 mark.

S&P 500 futures and Nasdaq futures are also in the red, with the former falling 0.22 percent and the latter flashing a 0.31 percent decline.

On Tuesday, the Dow declined by 33.97 points or 0.13 percent, as weak housing data offset optimism over US President Donald Trump’s summit with North Korean leader Kim Jong Un, as well as progress in the US-China trade war.

The Nasdaq declined by 0.07 percent, and the S&P 500 dipped by 0.07 percent to close at 2,793.9 – about 6 points below the 2,800 level that many technical analysts say is crucial for the consumer index.

Wall Street Fixates on Trump-Kim Summit, Cohen Testimony

This morning, traders are eyeing several major geopolitical developments.

On the domestic front, Michael Cohen, Donald Trump’s former personal lawyer-turned-snitch, is scheduled to give bombshell testimony on Capitol Hill. Excerpts of his draft opening statement reveal that Cohen plans to not only label Trump a racist but also accuse him of engaging in criminal activities, even after his inauguration as president.

Trump brushed off the testimony, stating that he “did bad things unrelated to Trump” and is “lying to reduce his prison time.”

Meanwhile, Donald Trump just hours ago shook hands with Kim Jong Un prior to sharing a dinner on the eve of their second summit in Hanoi.

The White House has blamed the media for setting high expectations for the summit, but Trump himself tweeted that it had “AWESOME” potential.

Vietnam is thriving like few places on earth. North Korea would be the same, and very quickly, if it would denuclearize. The potential is AWESOME, a great opportunity, like almost none other in history, for my friend Kim Jong Un. We will know fairly soon – Very Interesting!

— Donald J. Trump (@realDonaldTrump) February 27, 2019

Kim was more measured in his public comments but also struck a positive tone.

“Now that we’re meeting here again like this, I’m confident that there will be an excellent outcome that everyone welcomes, and I’ll do my best to make it happen,” he said.

Finally, traders are watching the situation on the ground in India and Pakistan, where the two countries have engaged in a gradually escalating conflict over the past two weeks. Already, the neighbors have engaged in tit-for-tat airstrikes, leading foreign policy analysts to label it the worst confrontation between the countries in decades.

S&P 500 Makes Fourth Attempt to Survive ‘Place Where Rallies Come to Die’

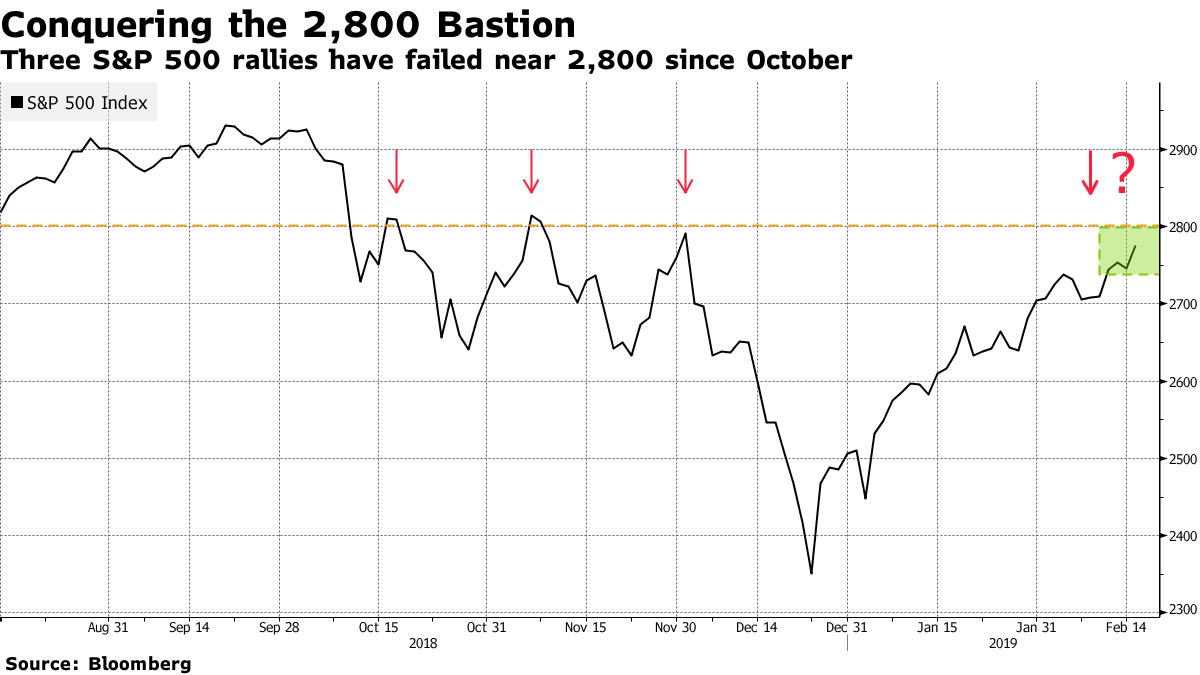

While the Dow and its battle to sustain the 26,000 level dominate the headlines, other US stock market analysts have fixated on the S&P 500 and its quest to reclaim 2,800. The index briefly touched that level on Monday, but failed to close above it – something it has not done since Nov. 8.

The S&P 500 already made three failed attempts to take the 2,800 level during Q4 2018, leading Bloomberg to label the resistance level the “place where S&P 500 rallies…come to die.”

The S&P 500 is now making its fourth attempt to cross 2,800 since Q4 2018. The last three tries failed miserably. | Source: Bloomberg

Each of those failed rallies was followed by a marked correction across all of Wall Street’s major indices, which should concern the bulls.

China’s Stock Market Approaches Major Hurdle

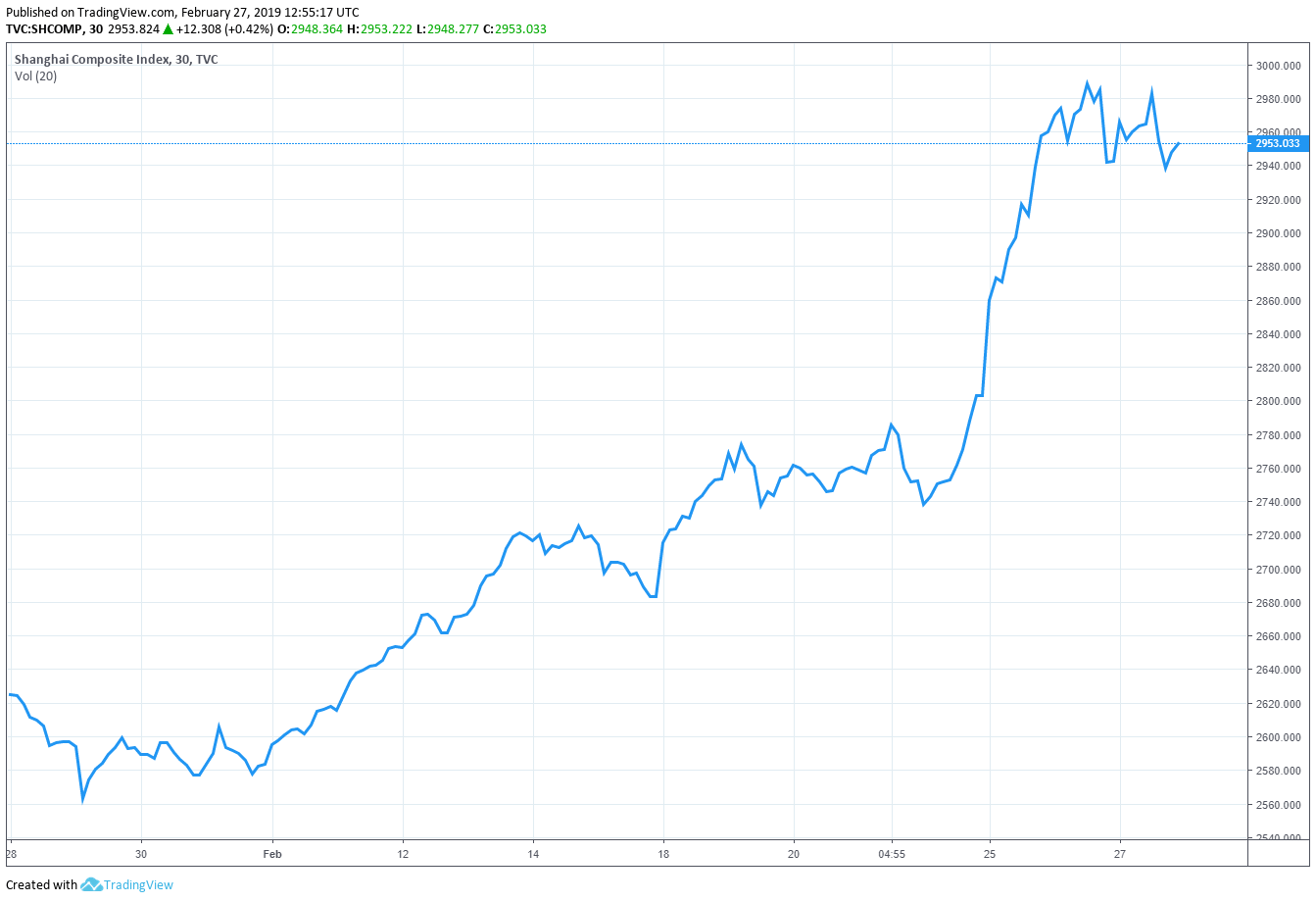

It’s not just the S&P 500 facing strong technical resistance. As ZeroHedge notes, the Shanghai Composite Index (SSE) has struggled to break through 3,000, even after officially crossing into a bull market earlier this week.

The SSE Composite is facing resistance at 3,000. Failure to break through that mark could spark another sell-off and drag on the US market as well.

CCN previously reported that the Dow stands to gain a massive jolt from the SSE’s continued recovery, but some analysts do not believe the index has the momentum to pierce that resistance at 3,000. Consequently, China’s stock market could be on the precipice of another correction.

“It was purely a liquidity-driven rebound without the support of fundamentals, so nobody expected the market to embark on another bull run to hit 5,000 points,” said Yin Ming, vice president of Shanghai-based investment firm Baptized Capital. “When the index nears the technically important 3,000-point level, investors will choose to exit first and wait for bargains after the correction. With gains in recent sessions, shareholders of firms are finally able to close out their share-pledge positions to repay loans.”

That could bode ill for the US stock market, particularly since Trump takes his policy cues from market indicators. If China’s stock market reenters a corrective phase before the two economic superpower strike a new trade deal, it’s conceivable that Trump would feel emboldened to hold out for a more favorable agreement, even if it means allowing new tariffs on Chinese goods to take effect.

On the other hand, Trump is much more fixated on the day-to-day movements of the Dow, and he must be aware that US stocks are practically begging for an end to the trade war.

Bitcoin Price Remains Flat, Ripple Portends the Death of the ‘Coinbase Effect’

A listing on US crypto exchange Coinbase once meant an immediate price pump. However, the “Coinbase effect” appears to be fading out. | Source: Shutterstock

Cryptocurrency prices remain relatively flat heading into the US trading session as the market continues to digest the weekend boom-and-bust that took crypto investors through a roller-coaster of euphoria and despair.

Analysts disagree on the strength of the market’s position. Some have said that bitcoin’s inability to cross resistance at $4,200 is a bearish indicator and could portend that the cryptocurrency has not yet hit its yearly low. Others allege that bitcoin’s uptrend remains intact and that the pullback to ~$3,715 was a natural response to several consecutive mini-rallies.

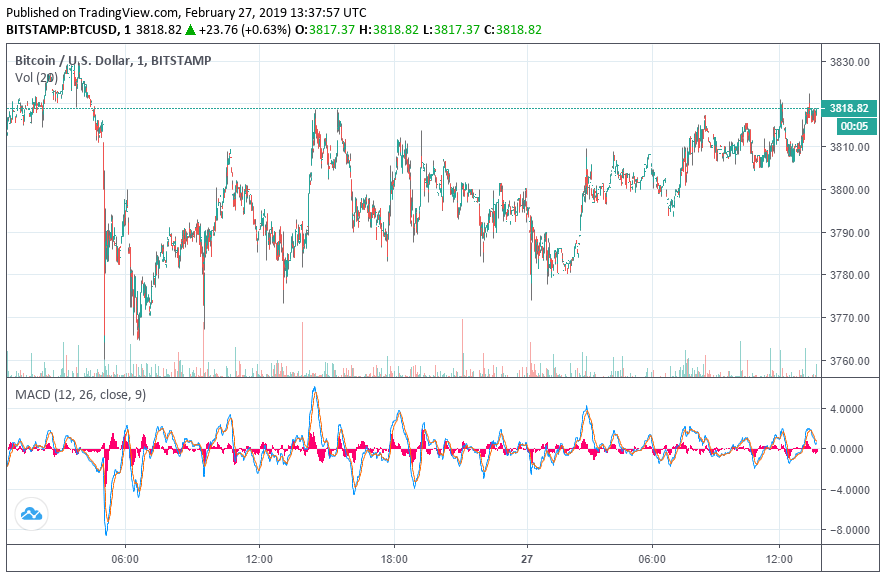

For now, the bitcoin price is trading at $3,818, up from an intraday low of $3,774. The flagship cryptocurrency has a market cap of $68.3 billion and around $7.7 billion in daily trading volume, though researchers increasingly question the reliability of self-reported exchange volumes.

Prices remained comparably stable throughout the wider large-cap index as well.

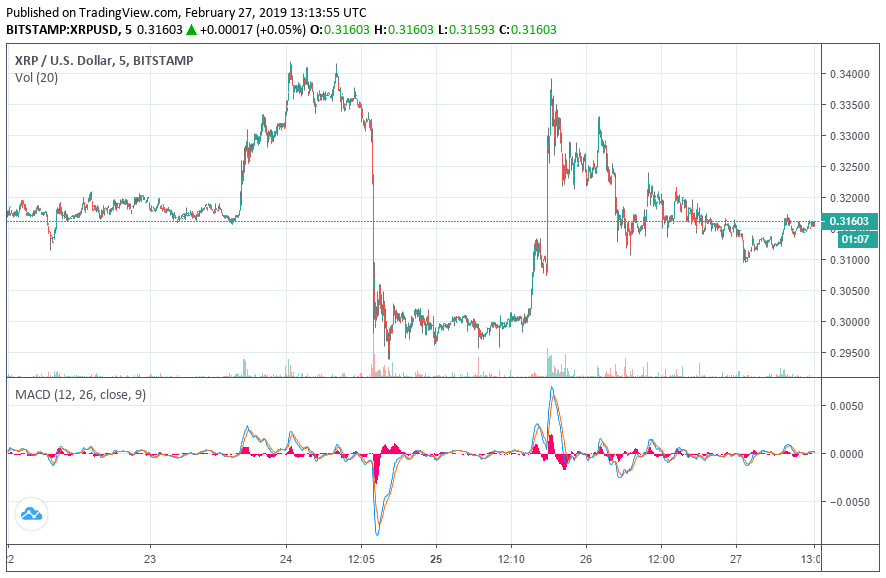

One asset of note is ripple (XRP), which has largely retraced from the double-digit rally it made in the wake of its long-awaited listing on US cryptocurrency exchange giant Coinbase.

There was a time when even the rumor of a Coinbase listing would send ripple into the stratosphere. However, based on the look of XRP’s 5-day chart, it may be time to begin writing a eulogy for the “Coinbase effect.”

That said, high-profile listings can still have a major impact on small-cap assets. Digital Currency Group-backed cryptocurrency Decentraland (MANA) spiked 60 percent in minutes after the project announced a strategic partnership with HTC, the manufacturer of blockchain phone Exodus 1. Earlier, Enjin Coin surged nearly 200 percent after Samsung indicated that it would be supported on the Galaxy S10’s native cryptocurrency wallet.

Michael Cohen Image from REUTERS / Shannon Stapleton / File Photo. Price Charts from TradingView.