A trader essentially takes a loss on both the collateral and the futures contract. Thus, margin requirements increase at a faster rate with price declines, and longs get liquidated relatively quickly. That, in turn, puts further downward pressure on the market, leading to a deeper slide, also known as leverage washouts, like the one seen in May. Long liquidation refers to forced closure (forced selling) of bullish positions due to margin shortage.

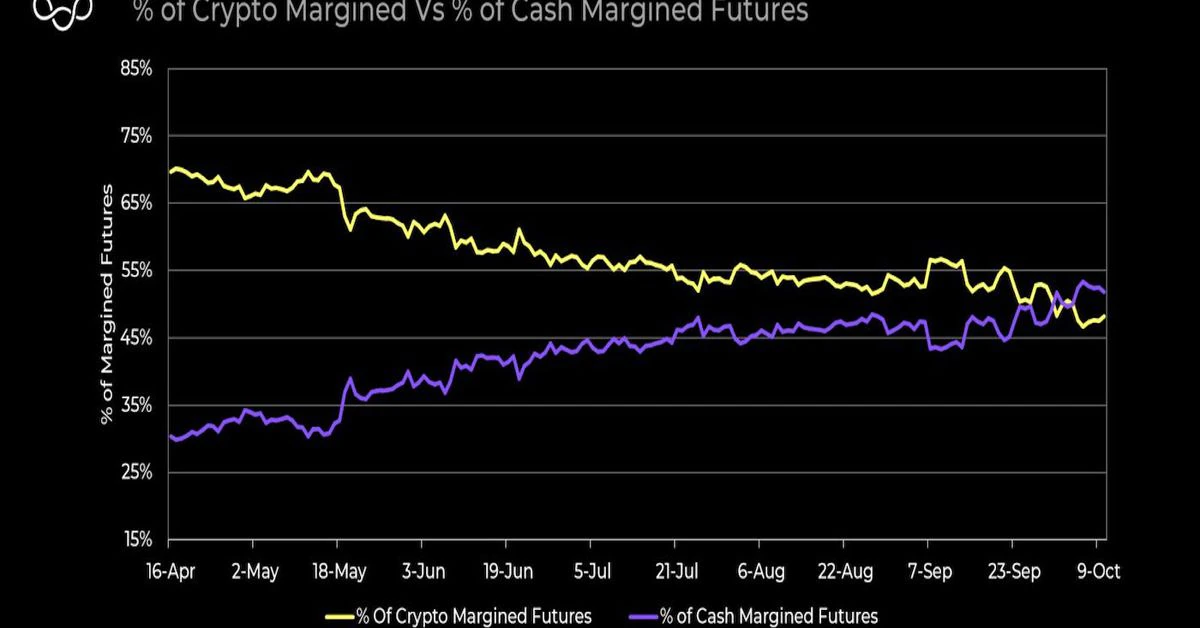

Declining Interest in Bitcoin-Margined Futures Promises Lesser Price Volatility — CoinDesk