Bitcoin has remained relatively stable in the $3,800 to $3,900 range over the past week while crypto assets like Enjin Coin (ENJ), Litecoin (LTC), ICON (ICX), and Kyber Network (KNC) surged by 30 percent to 100 percent.

Off of the reported partnership between Enjin and Samsung, the price of Kyber Network spiked by 60 percent overnight.

In late January, the Enjin team revealed that it integrated Kyber, Changelly, and Bancor to convert 200 tokens from thousands of trading pairs natively on the wallet.

What to expect for $KNC here? My guestimate is based on the performance $enj showed after the news came out. With Enjin being used by Samsung and Kyber being used by Enjin, the impact should be comparable for KNC. Expect to see a further move up once the public finds out. pic.twitter.com/4OTIARZg77

— ₿urger (@BurgerCryptoAM) March 9, 2019

Analysts have said that the utilization of the Kyber Network by Enjin Wallet led KNC to spike by a large margin in a short time frame, which also explains the 28 percent rise in the price of Bancor (BNT).

Can Bitcoin Ride the Momentum of Crypto Assets and Tokens?

Previously, in an interview with CCN, a technical analyst known as “Satoshi, MBA” said that the strong momentum of alternative cryptocurrencies has prevented Bitcoin from retesting its key support levels at $3,700 and below.

While Bitcoin has avoided a near-term drop to the low $3,000 region, it also has been unable to cleanly break out of the $4,000 resistance level.

This is the first time $BTC has two higher lows since … January 2018 🔥

— Alex Krüger (@krugermacro) March 8, 2019

The extended period of stability demonstrated by Bitcoin has concerned investors since early March as BTC has tended to record large sell-offs following weeks or months of low volatility.

The projections of the Bitcoin price by traders and technical analysts in the cryptocurrency market have been contrasting in recent weeks.

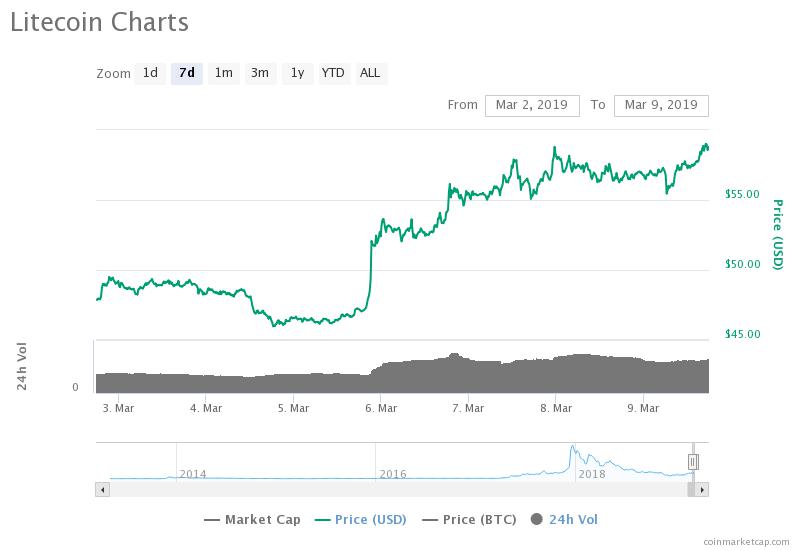

One trader with an online alias “The Crypto Dog” said that Litecoin, the fourth most valuable cryptocurrency in the global market, could push Bitcoin and Ethereum upwards.

In the past week, Litecoin has recorded a 28 percent increase in price from $46 to $59.

“LTC is leading the charge. Already completely re-traced the dump and reaching for new highs. At this point I’m expecting ETH and BTC to follow,” the trader said.

But, according to Mayne, despite the strong upside price movements of alternative cryptocurrencies, Bitcoin remains vulnerable to retesting low support levels.

Until Bitcoin moves out of the mid-$4,000 region, Mayne explained that the dominant cryptocurrency could still test support levels at $3,693 and $3,358.

“I’m still short biased. $4,100 is a key level for me from the weekly. If I’m stopped out of my current short I would look to re-short on a move above the local high and as high as they grey zone. I have some alternative cryptocurrency exposure, leveraged ETH long, XRP, ZRX, ADA,” he said.

The analysis of Mayne resonates the statement of former International Monetary Fund (IMF) economist Mark Dow, who said that if Bitcoin remains in the $5,000 to $6,000 range in the months to come, it will become risky for investors.

Based on the performance of alternative cryptocurrencies, Bitcoin could ride off of the general momentum of the cryptocurrency market and possibly move into the $4,000 region.

But, traders are being cautious on declaring the start of a short-term rally as technical indicators show BTC still has work to do in the weeks to come to reverse its trend.

Tokens are Flying

After a strong several days of upside movement, tokens have started to record large gains against both Bitcoin and the U.S. dollar.

Tokens such as Enjin Coin, ICON, and Binance Coin already demonstrated gains in the range of 30 to 100 percent earlier this week and some of the tokens have exceeded their quarterly highs.

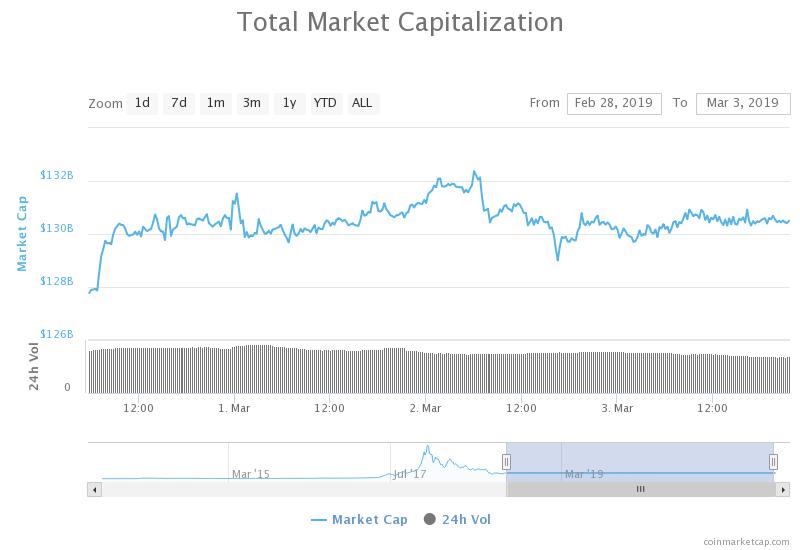

Since March 4, the valuation of the crypto market has increased from $125 billion to $134 billion, by $9 billion.