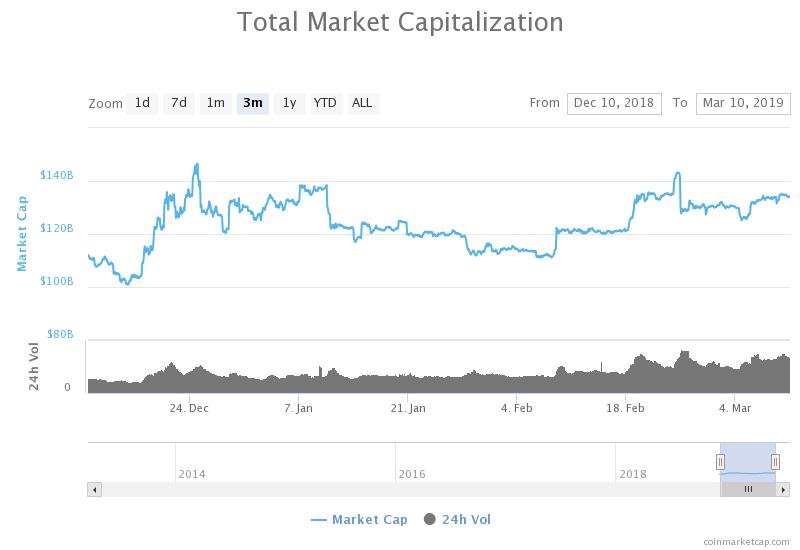

In the past 3 months, the Bitcoin price has been relatively stable, performing strongly against the U.S. dollar with solid volume across major markets in the likes of the U.S. and Japan.

Since December 16, within a 3-month span, the Bitcoin price has increased from its yearly low at $3,122 to $3,943, testing the $4,000 resistance level.

The stability of Bitcoin has led many tokens and alternative cryptocurrencies to record large gains against both BTC and the USD, with assets Litecoin, Enjin Coin, and Kyber Network surging by 50 to 100 percent in short time frames.

However, speaking to CCN in an interview, a cryptocurrency technical analyst known as “Bleeding Crypto” said that a drop to $1,850 still remains a strong possibility for the dominant cryptocurrency.

Why $1,850 For Bitcoin?

Earlier this month, after Bitcoin cleanly broke out of $4,000 but failed to break out of the crucial $4,200 resistance level, the technical analyst said that a drop to $2,400 to $3,100 is likely to be the next near-term move for BTC.

Bitcoin > $4,000

— Barry Silbert (@barrysilbert) February 23, 2019

According to the analyst, in mid-2018, Bitcoin remained in the $2,400 region for several months before dipping to $1,850 and establishing a bottom following the Bitcoin Cash hard fork, which led to a bearish trend in the market.

Bitcoin never re-tested the $2,450 mark once it recovered from $1,800 and due to the steep decline in the price and momentum of the asset in the past year, the analyst said that a potential drop to $2,450 is possible in the months to come.

The technical analyst told CCN:

I believe so because if you look at the chart on May of 2017 we maintained support at $2,450 region for months before we dipped to $1,850 and that marked the end of the BCH fork bearish trend. We shot up from there and we never came back and really re-tested that area $2,450.

So I believe like with most significant area of support, a test back is probably as price action tends to repeat itself. So a test back of $2,450 does not seem irrational.

$BTC Some of you have asked for a chart on why I am calling $2400 – $3100 drop with a possible wick to $1800. Explanation is on the chart. And the way BTC is looking right now, I hope we can even make it to the rejection point! LOL pic.twitter.com/r03HjZaQsh

— Bleeding Crypto (@Bleeding_Crypto) March 8, 2019

He further emphasized that if BTC ends up re-testing $2,450, a similar drop as mid-2018 to $1,850 could be triggered, establishing a proper bottom for the asset.

In recent weeks, several cryptocurrency traders and recognized analysts have suggested that the lack of re-test at previous support levels even at $3,300 are leading traders to be cautious about any short-term upside movement for Bitcoin.

If Bitcoin can break this $3940 area it will be a relatively clear run to $4250 at least.

Though, as long as $3550 and $3350 remain untested I’m cautious about every move up.

— UB (@CryptoUB) March 9, 2019

“Bitcoin is also at one of those funny areas where it can pump with the rest of the market. Or, it can ruin every decent looking altcoin set up and retest ATH salt levels around CT,” a trader said, noting that the upside movements of tokens can be overturned in a short time frame by the price movement of BTC.

As with the price movement of any other asset, there exists many variables for Bitcoin and the rest of the cryptocurrency market.

The strong price movements of alternative cryptocurrencies suggest that the overall confidence of investors in the cryptocurrency market is increasing, as it demonstrates a rise in high-risk, high-return trades.

On the fundamentals side, the adoption of cryptocurrencies by major financial institutions, technology conglomerates, and services firms such as Samsung Electronics, Julius Baer, and Fidelity has noticeably improved.

Unpredictable For Now

While technical indicators remain weak for most crypto assets, the development, adoption, and institutionalization side of the industry have seen significant progress since early 2019.

With that momentum, the valuation of the crypto market has increased by nearly 30 percent since late December and in the upcoming months, at least throughout the second quarter of 2019, analysts say that momentum is key for Bitcoin.