Without a doubt, 2021 has been a momentous year for nonfungible tokens (NFT). The nascent market has seen unprecedented growth as sales volume from January to date nears $10 billion — a 14,500% surge from 2020. The NFT marketplace OpenSea is responsible for processing a great chunk of that.

OpenSea controls a majority of NFT sales and has processed more than $10 billion worth of transactions since launching in December 2017. Its 2021 volume alone even topped the revenue earned by Etsy and is comparable to the revenue generated by eBay. But despite this, it appears as though OpenSea and the entire NFT space are just getting started.

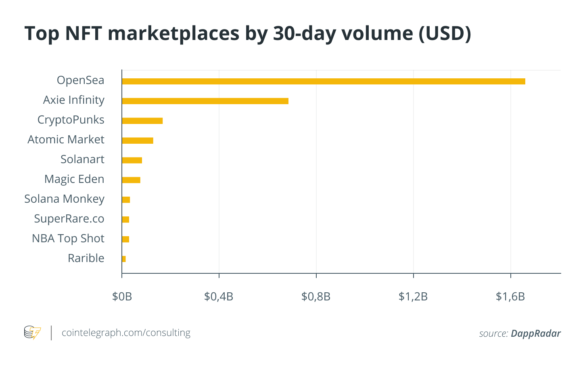

In the past 30 days, OpenSea processed more than $1.6 billion in transactions, leading all other marketplaces by a wide margin. NFT game Axie Infinity comes in at a distant second, with $675 million, and CryptoPunks, whose average price per sale is 447 times higher than OpenSea, comes in at third with $165 million. Surprisingly, Rarible, which in 2020 rivaled OpenSea in sales and even headlined a funding round of its own this year, pales in comparison to the transaction volume OpenSea has been posting recently.

OpeanSea’s growth

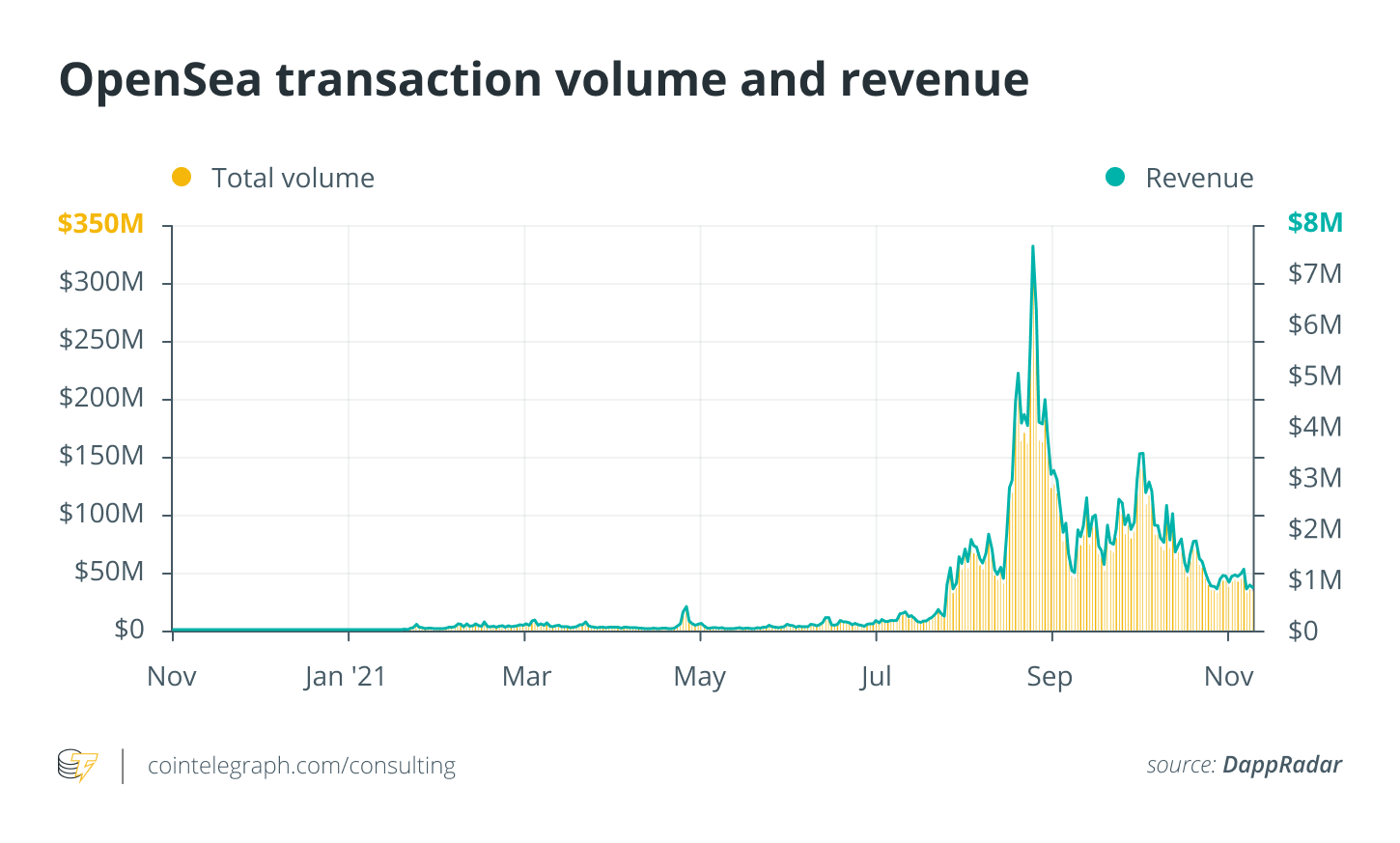

OpenSea didn’t start the year registering billions of dollars in sales. From January to July, the marketplace processed an average of about $106 million worth of transactions, per DappRadar. It was not until August when the billion-dollar mark was reached, which came amid a resurgence of NFT sales following a cooldown period from a prior peak in activity in May. Sales topped at $3.4 billion that month, marking a 1,025% increase from July.

Demand continuously increased despite rising gas fees that have frustrated a growing number of users. OpenSea has addressed this issue with its integration with layer-two Ethereum side chain Polygon and has provided cheaper and faster transactions since July.

While most of the transactions still take place on the Ethereum blockchain, Polygon-based volumes on OpenSea exhibit decent numbers. Data from Dune Analytics reveal that about $111.5 million worth of transactions has been processed since September — still a cut above the volume generated by other marketplaces in the past month. Active users are also well beyond 200,000.

Moreover, OpenSea has benefited immensely from being a first mover in the space and has continually refined how users navigate its platform and how NFTs are curated. Quite ostensibly, the success of OpenSea wouldn’t be without the concept of NFTs hitting off. Digital certificates of ownership for physical and digital goods alike simply provided a new avenue for collectors, creators and even traders. For instance, NFTs have become a way for artists to ascribe an element of scarcity to a digital artwork on which value can be appraised.

How does OpenSea make money?

OpenSea takes a 2.5% cut per sale. This small commission for each transaction allowed OpenSea to realize roughly $79 million in revenue at its peak in August, followed by $68 million in September and $57 million in October. In 2021, it’s estimated that OpenSea has already totaled at least $235 million in revenue, with $204 million coming from the three months starting August.

Valuing OpenSea

With all the apparent revenue that OpenSea generated, it is interesting to see how it stacks up against comparable protocols and companies. When OpenSea started in 2017, it received $2 million in startup funding. But its most recent valuation has elevated it to unicorn status after a funding round led by Andreessen Horowitz, placing a $1.5-billion price tag on OpenSea.

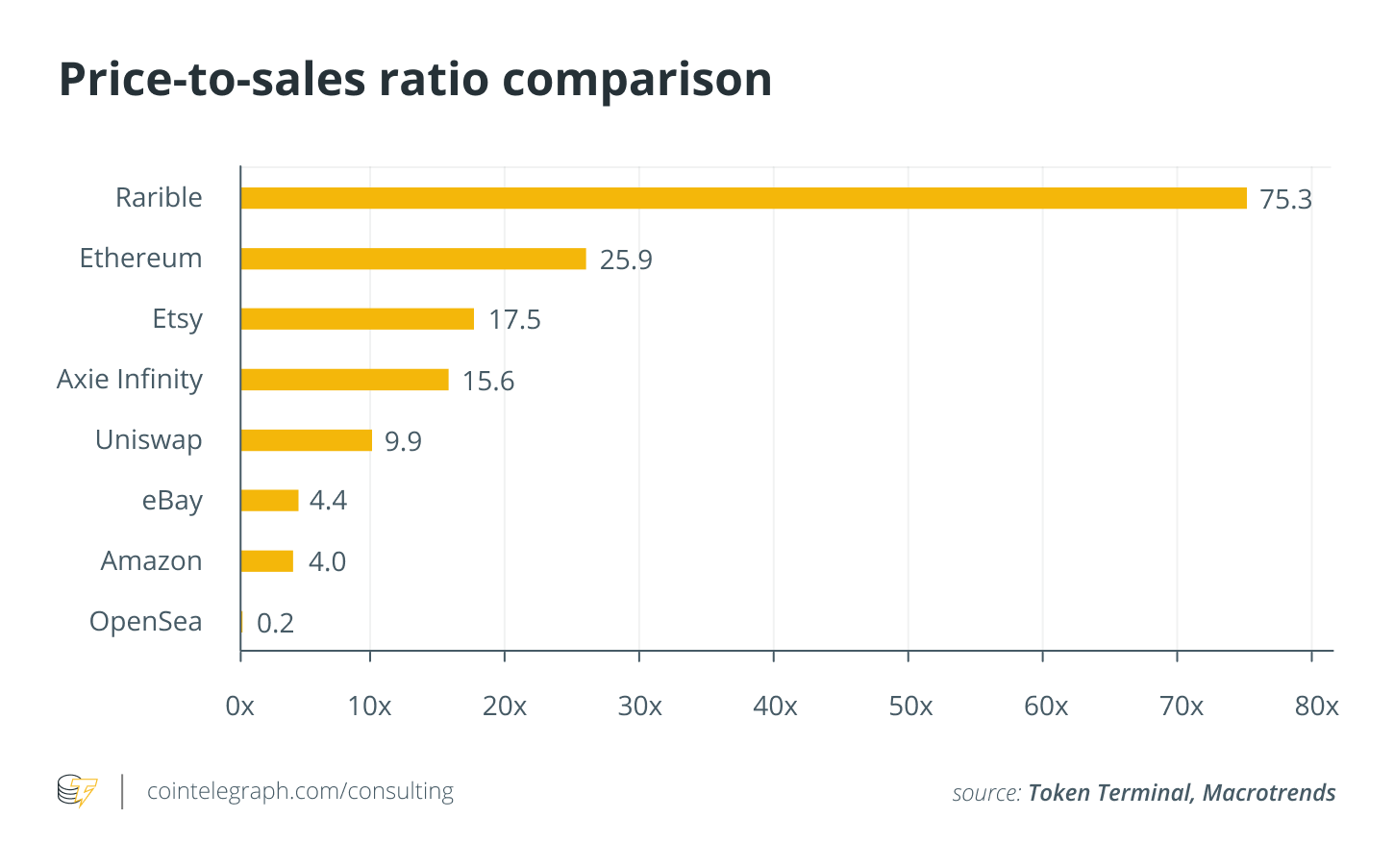

However, valuations should be taken with a grain of salt. For one, it can be challenging to value a startup chiefly due to a lack of historical data. One fairly simple measure is to use a multiples approach. The available sales data and market value of similar protocols and companies can be a helpful basis for comparison — i.e., how much it’s worth relative to how much it earns. And since OpenSea’s market capitalization can’t be measured because it doesn’t offer a token, its latest funding round valuation will be used as a proxy.

So, for example, Rarible charges two times more than OpenSea and yet pales in comparison to OpenSea with the revenue it earns. Therefore, Rarible’s price-to-sales ratio makes it appear significantly overvalued compared to OpenSea. Companies that may share some similarity with OpenSea, such as Amazon, Etsy and eBay, look substantially more expensive as well. Even Ethereum, with the high gas fees it generates from transactions, appears pricier than OpenSea with this valuation metric.

However, tweaking the figure to account for only the protocol revenue OpenSea earned in the last 12 months would result in a 6.4 multiple, making it just a bit more expensive than Amazon and eBay. Still, it is worth repeating that OpenSea earned the bulk of its revenue in the last three to four months. If a revenue run rate is used with the sales data of the last three months to forecast sales for a whole year, it will translate to more than $800 million in revenue. This would again make it undervalued with a 1.8 multiple in contrast to the price-to-sales ratio of these other protocols and companies.

Of course, a large part of this projection is based on the assumption that OpenSea remains the top choice for NFT transactions. NFTs are proving to be more than the hype they were initially thought of as Google searches for NFTs have even spiked to a record high in November. And with more interest coming to the space, it equates to more companies vying for a piece of the pie, which, in turn, will diversify where NFT sales take place.

Download the 35th issue of Cointelegraph Consulting Bi-weekly Newsletter in full, complete with charts, market signals, as well as news and overviews of fundraising events.

Solanart, Solana Monkey Business, and Magic Eden are just some examples of non-Ethereum NFT marketplaces that have claimed the top spots in terms of 30-day transaction volume. Coinbase exchange is set to unleash NFT capabilities on its platform, potentially leaving a mark on the NFT space. More than 1 million users have signed up for Coinbase’s upcoming NFT offering, far exceeding the 230,000 users who interacted with OpenSea in the past 30 days.

With all of that in mind, can OpenSea still maintain its commanding spot when the NFT sector matures, or is another platform taking over just plain inevitable?

Cointelegraph’s Market Insights Newsletter shares our knowledge on the fundamentals that move the digital asset market. The newsletter dives into the latest data on social media sentiment, on-chain metrics and derivatives.

We also review the industry’s most important news, including mergers and acquisitions, changes in the regulatory landscape, and enterprise blockchain integrations. Sign up now to be the first to receive these insights. All past editions of Market Insights are also available on Cointelegraph.com.