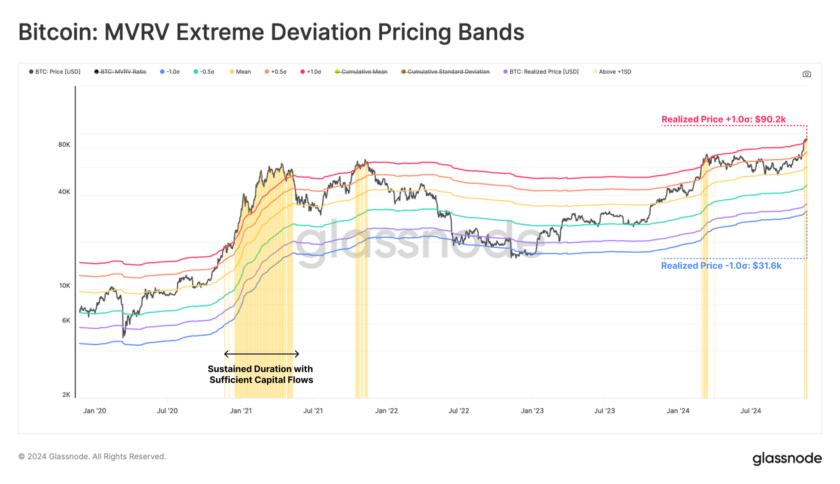

As shown in the chart above, “when implied volatility (options market expectations of future volatility) is substantially higher than realized volatility (the actual price fluctuation during past trading ranges), an increase in the latter is usually around the corner and long volatility options positions pay exponential returns,” Two Prime wrote.

Higher Volatility Expected in Bitcoin and Ether