Bitcoin (BTC) recovered from a dip below $50,000 on Dec. 8 as Wall St. trading opened on a fresh bullish note.

Bitcoin market ditches “extreme fear”

Data from Cointelegraph Markets Pro and TradingView captured a classic rally for BTC/USD on hourly timeframes, gaining $2,000 in a single one-hour candle.

The pair had hit daily lows of $48,656 on Bitstamp before a dramatic trend change brought back the psychologically significant $50,000 level.

Buckle up

— Zhu Su (@zhusu) December 8, 2021

#Bitcoin held crucial level and continues probably to a new test at $51.6K and $53.6K.

Nice!

— Michaël van de Poppe (@CryptoMichNL) December 8, 2021

As positive signals began to emerge from well-known names on social media, sentiment likewise felt the benefit, exiting “extreme fear” for the first time since Friday’s crash below $42,000.

Popular trader Rekt Capital, who earlier eyed healthy behavior on the weekly chart, meanwhile added that BTC price action could be mimicking its recovery seen during September’s major dip. This involved acting between two exponential moving average (EMA) lines.

“Bitcoin may be repeating a consolidation period it also experienced following its May 2021 crash,” he tweeted.

“This consolidation takes place between the blue 50-week EMA support and green 21-week EMA resistance.”

Exchange Bitcoin holdings drain faster since sell-off

On-chain metrics continued to please on Wednesday, against a backdrop of network fundamentals shaking off spot price action by nearing new record highs.

Related: Third-biggest Bitcoin whale’s holdings total $6B after ‘whopping’ 2.7K BTC buy-in

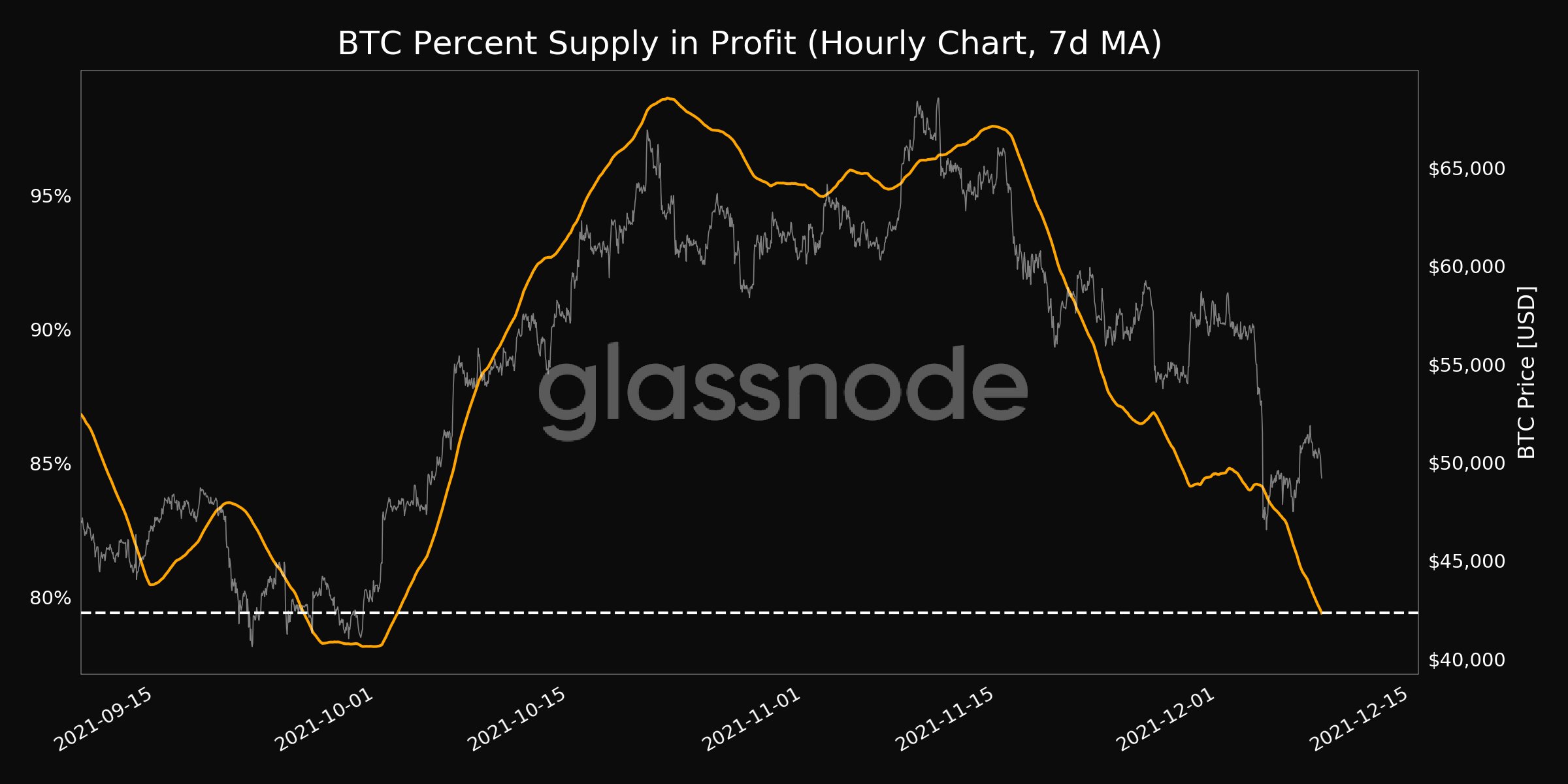

Almost 80% of the BTC supply was still in profit at lower levels, according to data from on-chain analytics firm Glassnode, this nonetheless constituting a one-month low.

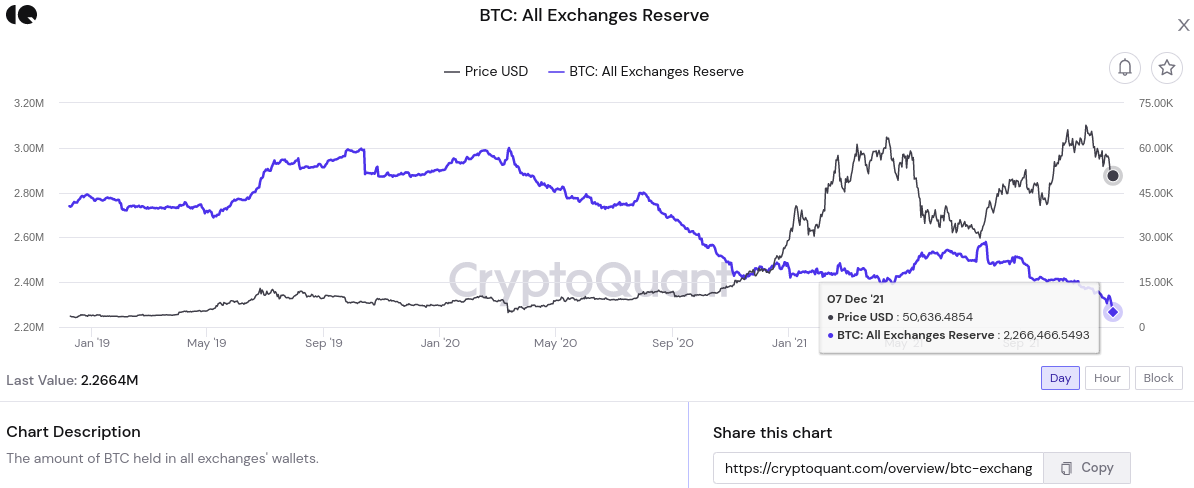

A look at the BTC balance on exchanges added to the positivity, reserves at their lowest in multiple years and far below when Bitcoin traded at four figures.

Last week’s dip failed to upend the trend, which in fact accelerated over the weekend, data from on-chain analytics platform CryptoQuant confirms.