Lennard Neo, head of research at Stack Funds, attributed the cryptocurrency’s recent drop to the market uncertainty leading investors to take risk off the table. Bitcoin is seen by some investors as a risk-on asset, which generally refers to assets that have a significant degree of price volatility such as industrial metals, equities and commodities; all things being equal, tighter monetary policy would theoretically make these risk-on assets less attractive.

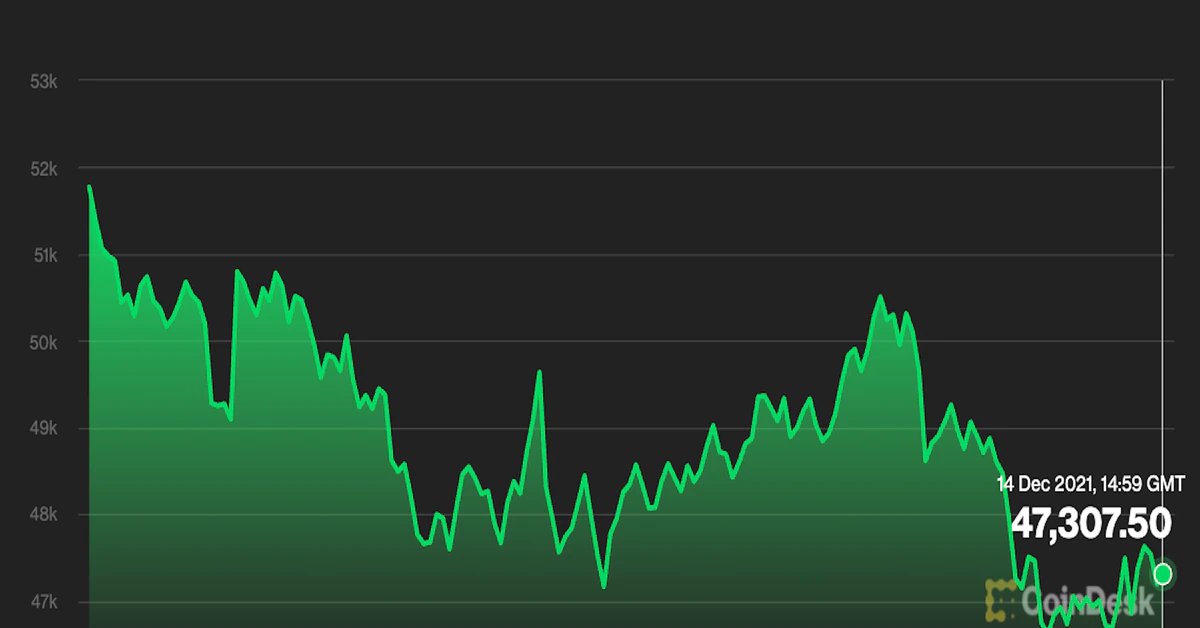

Bitcoin Struggles to Break $47K as Fed Meeting Looms