Data shows that Bitcoin trading volume has started dropping off, suggesting that the recent downtrend might be diminishing.

Bitcoin Trading Volume Sharply Drops Off In The Past Week

As per the latest weekly report from Arcane Research, the BTC 7-day average trading volume has significantly reduced recently.

The “trading volume” is an indicator that measures the total amount of Bitcoin transacted on the chain during a particular period.

When the value of this metric goes down, it means the activity on the chain is falling off. This can imply investors are less interested in trading BTC right now as they are making less movements on the chain.

Such a trend may be because investors think the price of the coin will move up soon. And hence they don’t want to move their Bitcoin at the current levels. However, it can also show disinterest in the market.

On the other hand, when the trading volume rises, it means more holders are currently shifting their coins around. This kind of trend is usually the ideal ground for big price swings as you need traders for sustaining such moves.

Related Reading | Bitcoin NUPL Says Market Stands At Key Junction Between Bull And Bear Trends

In the past, there have been instances where the price of Bitcoin seemed to be sharply moving towards a direction, but the chain data didn’t show any corresponding trading activity. Such moves usually died down after some time. For example, when BTC made an all-time high (ATH), the volume still remained low.

Now, here is a chart that highlights the trend in the value of the BTC trading volume over the past year:

Looks like the value of the indicator has recently plunged down | Source: The Arcane Research Weekly Update - Week 49

As the above graph shows, the Bitcoin trading volume saw a massive uptick earlier in the month due to the 4th Dec crash. However, in the past week, the indicator’s value has dropped off by almost 40% as the market calms down.

Related Reading | Crypto Bull Cathie Wood Says Ethereum Is More Undervalued Than Bitcoin

Since August, the trading volume seems to have plateaued around the $5 billion mark, with occasional upticks to about $10 billion during the periods of high volatility.

The trading volume calming down can mean Bitcoin’s recent downtrend might be starting to diminish. This is because, as explained before, high values of the indicator are needed to keep such moves going.

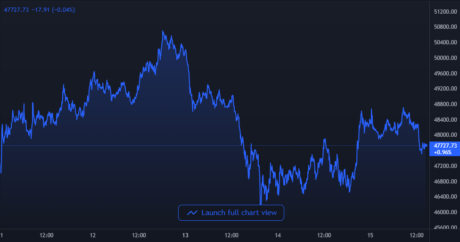

BTC Price

At the time of writing, Bitcoin’s price floats around $47.7k, down 3% in the last seven days. The below chart shows the trend in the price of BTC over the past five days:

BTC's price has continued to drop off in the past few days | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, Arcane Research