Photo: QuoteInspector

Key Highlights:

- Consolidation is ongoing in the Bitcoin market;

- Bitcoin price will target $3,903 in case $4,050 level does not hold;

- the coin may find its resistance at $4,144 price level.

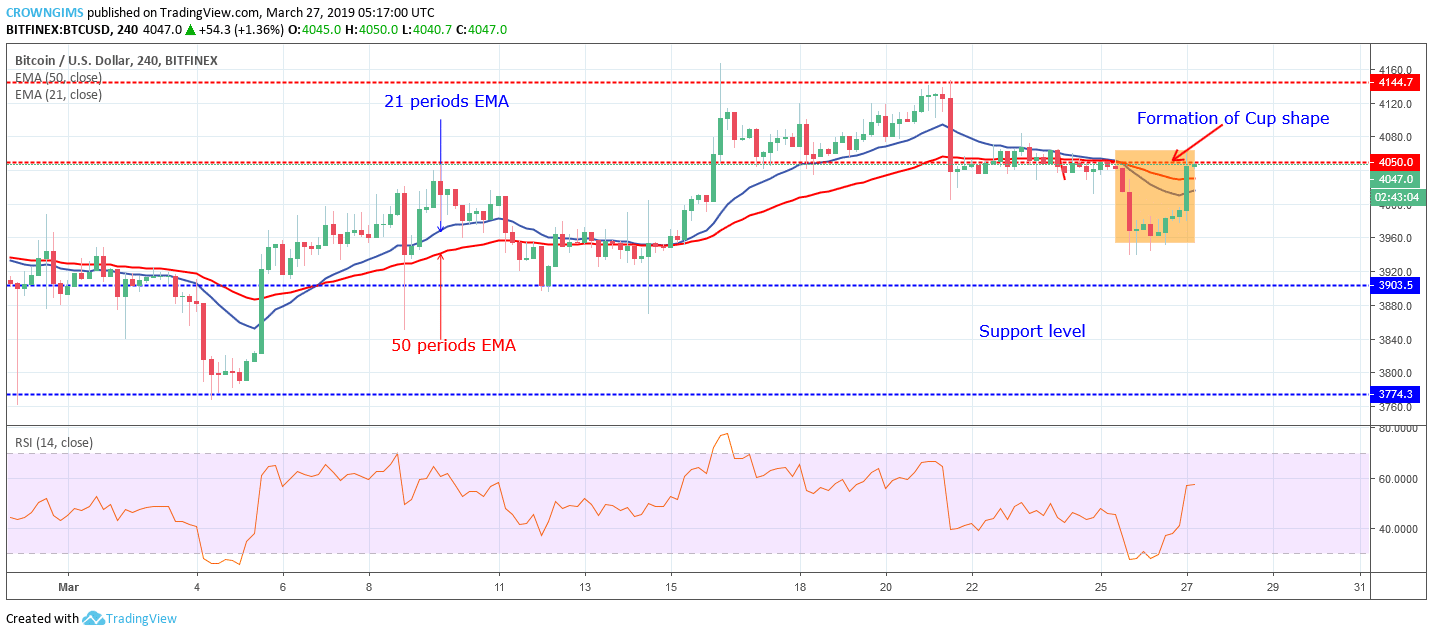

BTC/USD Medium-term Trend: Bearish

Resistance levels: $4,050, $4,144, $4,254

Support levels: $3,903, $3,774, $3,637

On the Medium-term outlook, BTC/USD is Bearish. BTCUSD consolidated for four days (March 21 – March 25). The Bears eventually gained momentum over the Bulls and there was a breakout towards the south with the formation of bearish candles that broke down the former demand level of $4,050 and Bitcoin price declined towards the demand level of $3,903.

The BTC price was supported at the zone of $3,903 and the doji candle formed followed by a bullish candle pushed up the price to the supply level of $4,050 to form a cup shape pattern.

The Bulls has pushed up Bitcoin price across the 21 periods EMA and 50 periods EMA with the two EMAs bending upside to indicate bullish pressure in the BTC market.

The Relative Strength Index is at 60 levels with the signal line pointing up to indicate buy signal. In case the Bulls were able to penetrate the supply level of $4,050 upside and the bullish candle close above the level, $4,144 supply level may be its target. In case the $4,050 level holds, the bearish movement may continue.

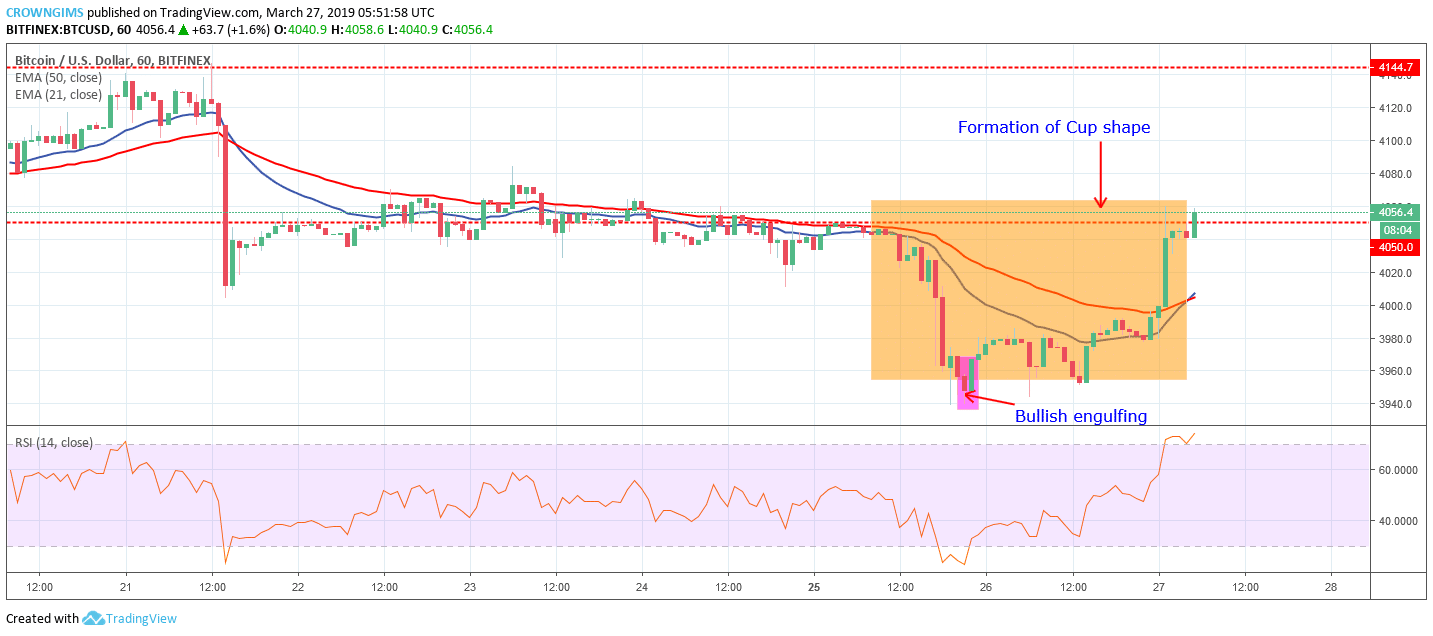

BTC/USD Short-term Trend: Bullish

On the short-term outlook, BTC/USD is bullish. The consolidation scenario came to an end on March 25 by the Bears as the strong bearish candle broke down the $4,050 level and Bitcoin price rolled down towards $3,903 price level. The bullish engulfing candle emerged that signified the Bulls’ increased pressure and this returned the BTC price to the supply level of $4,050 to form cup shape pattern.

The BTC is trading above the 21 periods EMA and 50 periods EMA with the former trying to cross the later upside to confirm the bullish trend. Meanwhile, the RSI is at 70 levels with a signal line pointing up to indicate further increase in Bitcoin price.