Daniel Cawrey is CEO of Pactum Capital, a cryptocurrency investment firm focused on market making and liquidity. Formerly a CoinDesk Contributing Editor, he is author of the upcoming “Mastering Blockchain” book to be published by O’Reilly Media.

Recently, a report was produced by Bitwise Asset Management showing the existence of faked volumes in the bitcoin market – 95% of total volume according to its research. It’s hard to disagree with many of the facts in the report. Yet there are some items left out in this presentation to the SEC.

It’s hard to justify bitcoin is a mature asset and has a sophisticated market supporting it. And despite the fabricated volumes across crypto exchanges, this presentation makes a compelling argument there is maturity.

However, this market isn’t sophisticated and there are key issues the report simply does not address.

Problematic Exchanges Outside of the 95%

It cannot be disputed there are issues with exchanges reporting fake volumes. It’s hard to argue CoinMarketCap isn’t complicit in reporting false crypto volumes. However, more questions need to be asked about two exchanges listed in the Bitwise report as having “Actual Volume.”

The report to the SEC lists Binance and Bitfinex as two of the 10 exchanges that have actual crypto volume…

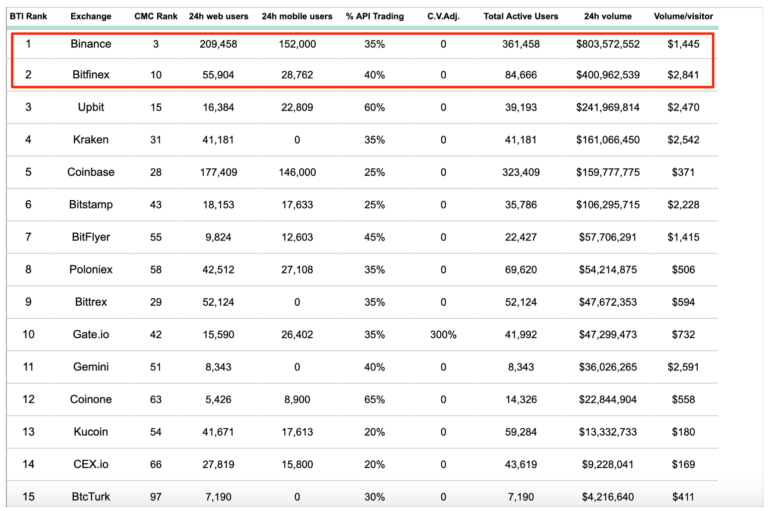

…but leaves out specific information from those two exchanges that have over 50 percent of “real” volume, like on this histogram slide.

The report states that Binance and Bitfinex comprise over 50 percent of the total bitcoin spot volume. Yet neither of these two exchanges have normal banking relationships like others in the report do.

Both exchanges have significant regulatory issues that make their inclusion in this presentation to SEC concerning. Binance, for example, was funded by an ICO, supported by a token that looks a lot like a security and has not been able to obtain standard banking partnerships. Bitfinex has had significant banking issues, losing several relationships – even suing Wells Fargo at one point.

Both of them also use Tether.

The Tether Problem

Tether is a blockchain-based “stablecoin” built on the Omni (formerly Mastercoin) protocol. It is designed, as specified in its white paper, to use something called “Proof of Reserves” backed by the US dollar, to be pegged to USD. This “Proof of Reserves” tenet is supposed to hold and verify the USD peg via regular audits.

Basically, each Tether is supposed to be backed by a dollar in a bank account somewhere. According to the report in the custody part of its presentation, audits in crypto should be easy to accomplish.

Problem is, there’s never been an audit completed for Tether.

Citing “complexity,” an auditing firm hired to verify Tether’s “Proof of Reserves” was terminated – it has never had an external auditor complete this process. And like Bitfinex, Tether has also had its share of banking problems. That shouldn’t be surprising – Bitfinex and Tether seem to be very closely interrelated.

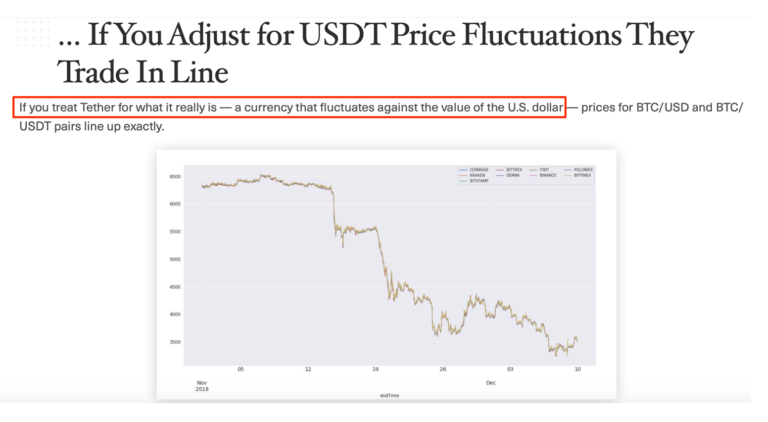

In fact, even the report admits Tether isn’t a stablecoin at all.

That’s not what Tether is supposed to be. It’s supposed to be pegged to USD. And it is used by Bitfinex and Binance to avoid having to satisfy the actual banking and regulatory compliance work that entails.

The Blockchain Transparency Institute

To further support the report’s analysis, there is a reference to a group called the Blockchain Transparency Institute. Claiming “a common institutional understanding of the true nature of the real market,” the report cites the Institute and its research in identifying 56 exchanges with fake volumes.

Interestingly, there’s very little transparency around who runs the Blockchain Transparency Institute. There’s no listing on its website of who is managing this group, who is on its board if it is a non-profit or details on the methodology of its research.

There’s isn’t even an About Us page.

A quick glance at the “Partners” page at the Institute’s website reveals a fascinating detail: Bitwise Investments, author of the SEC report, is listed as an “investor class supporter.”

Source: https://www.blockchaintransparency.org/

Why didn’t Bitwise disclose it has a pre-existing relationship with the Blockchain Transparency Institute in its report?

Other Questions to Ask

It should be applauded Bitwise put together this presentation.

Someone needed to comprehensively detail the amount of wash trading cryptocurrency exchanges are conducting. However, regulators should be asking some key questions:

1. Why is Binance referred to as one of the exchanges that makes up the so-called “real market”?

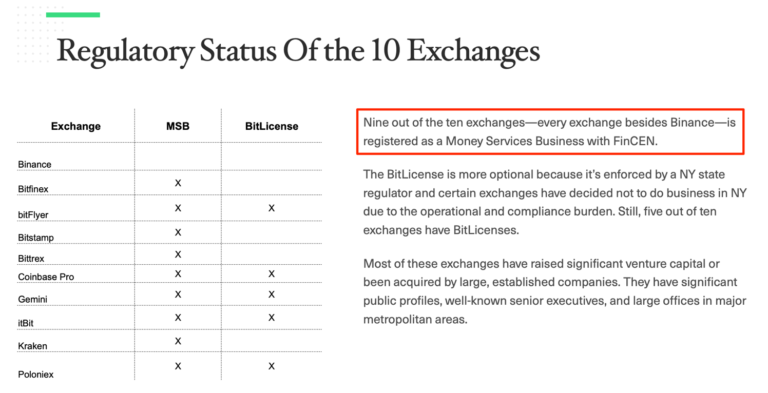

All exchanges in the report are registered Money Services Business with FinCEN, except for Binance, which makes up by far the most – 40.47% of the total “actual” crypto volume traded.

2. Why are the two largest exchanges in the report, Binance and Bitfinex, not more closely examined for their relationship with Tether, an unregulated and unaudited “stablecoin?”

Binance and Bitfinex alone make up 54.41% of “real” volume according to the presentation.

3. Who runs the Blockchain Transparency Institute?

According to the Blockchain Transparency Institute, the exchanges with the least amount of faked volume are Binance and Bitfinex. Yet these exchanges lack normal banking relationships and are supported by an unregulated stablecoin

Credit is due to Bitwise, a company in the crypto space taking the time and effort to do this research to help regulators. However, the picture provided is incomplete.

Bitcoin is not a mature, stable market if two exchanges without banking – and supported by an un-auditable, unregulated stablecoin – comprise half the “real” cryptocurrency trading volume.

Half of the “actual” BTC volume in this report is done on exchanges with no banking relationships and not enough in the way of compliance. This shows there is still a lot of growth left in this market before bitcoin becomes mature. It will happen, and it will be to the benefit of everyone involved.

Yet it’s going to take time, and it’s going to require patience. Surely the regulators realize that by now.

Puzzle piece via Shutterstock