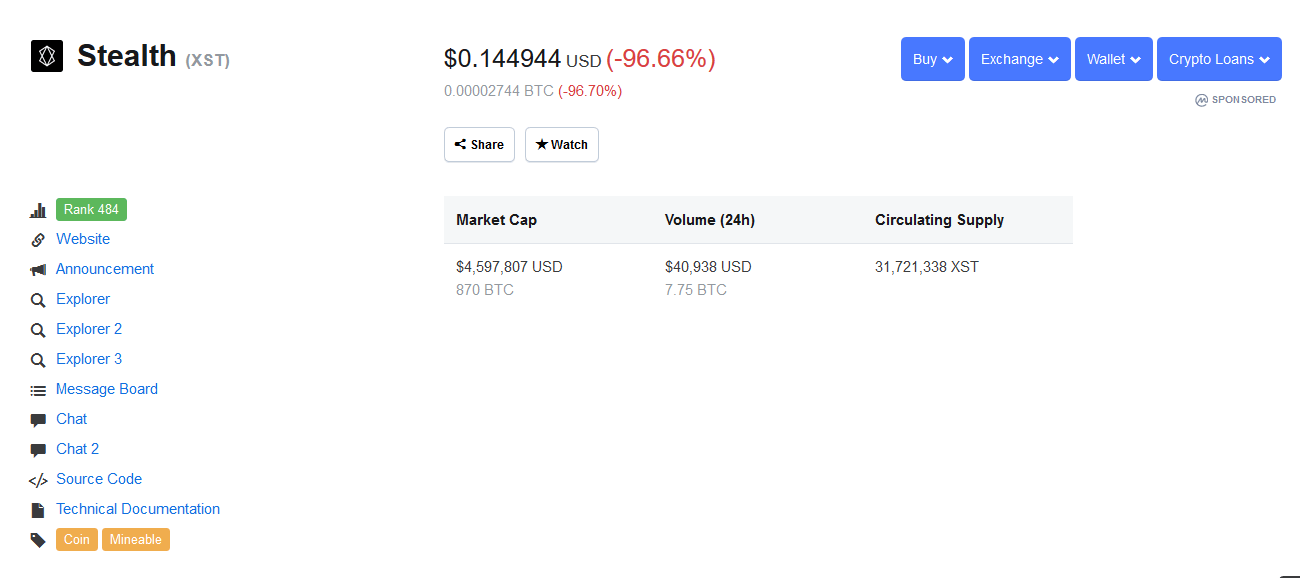

By CCN: Stealth (XST) is a coin that is listed as part of three pairs on two exchanges. One exchange is the venerable Bittrex, one of the few known to be not faking its volume, and another is one of which we’ve never heard. Yesterday, we noticed that XST spiked an incredible amount – nearly 3,700%, briefly pushing its market capitalization to more than $150 million.

$1,960 in Volume = $150 Million Market Capitalization?

Source: Coinmarketcap.com

Since then, the coin has deflated back to $0.14 per token. The volume today is much higher than the amount that led it to its price of $4.50 – which was under $2,000. The 24-hour volume by press time was more than $40,000 – a more than 800% increase.

If you know even a little about how markets work, it’s not hard to understand what happened here. Someone came in and decided to buy a great deal of XST – at its then low-price – and orders disappeared until the ladder was climbed to $4.50. XST holders and trading bots took note of this and dumped, dumped, dumped until the coin lost all its gains.

There’s nothing healthy about market activity like this.

Stealth Reaches All-Time-High

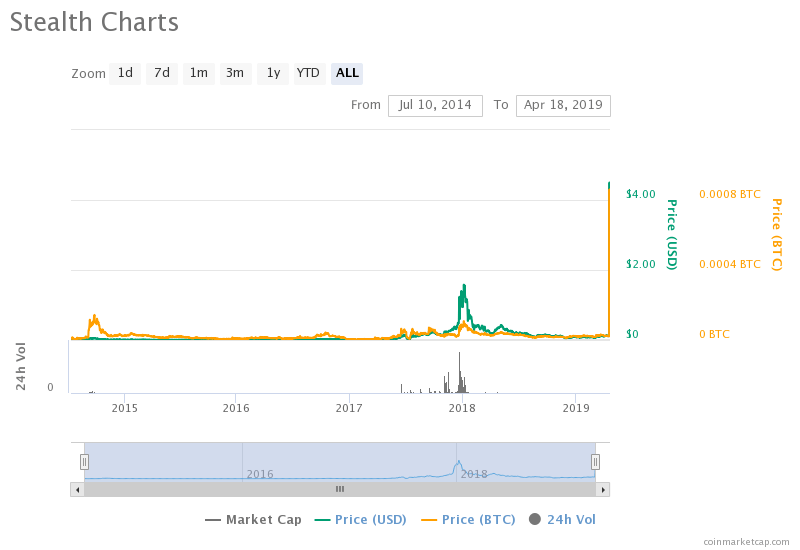

Stealth has been on the market since 2015, and yesterday’s highs were a drastic gain compared to any other time in its history.

Previously, at the crescendo of the 2017 bull run, in January 2018, it peaked over $1.

The actual price is not what we’re taking issue with, of course. It’s the tiny amount of volume that allowed the price and the market capitalization to get there. At their heart, both figures are simple pieces of math. Price is the last price paid for a token, while the market capitalization is that figure times the number of tokens in circulation.

Neither figure is overly reliable — especially in bitcoin; the price doesn’t tell the full story. There are fees and other matters of friction to get through to buy BTC. Sometimes it can be more; sometimes it can be less. It’s safer to view the “market rate” as a ballpark figure than an actual, useful metric – nevermind how fleeting it is at any given time.

Whoever had an interest in doing so was able to manipulate the XST market in such an extraordinary way that the token skyrocketed thousands of percent in 24 hours. The actual financial damage done is minimal – it’s possible that one or two individuals lost around $1960 while some others may have managed to cash out some long-held XST.

What’s XST?

And what is Stealth?

According to its website, it’s some mix between a privacy coin and Ripple – the system uses validators (like XRP) and “quantum proof-of-stake.” It’s compatible with the Ledger hardware wallet system.

Please note, this article isn’t intended to pass judgment on XST. We’re speaking more to the metrics used to measure crypto markets and how ridiculous they can be. Additionally, we have no suggestion on how to fix the issue. Perhaps a reader can comment with ideas. Probably daily volume should always precede price and “market capitalization” in real terms.

Because let’s be honest – there was never $150 million ready to buy XST. It’s arguable that all cryptocurrencies suffer from a lack of true liquidity – there’s no evidence, at any given time, that an entire blockchain could be liquidated for its “market capitalization.”