By CCN.com: Things are suddenly looking a lot rosier for Ethereum after a fruitful ten days in which it was courted by Elon Musk, welcomed by futures regulators, and integrated on Microsoft Azure.

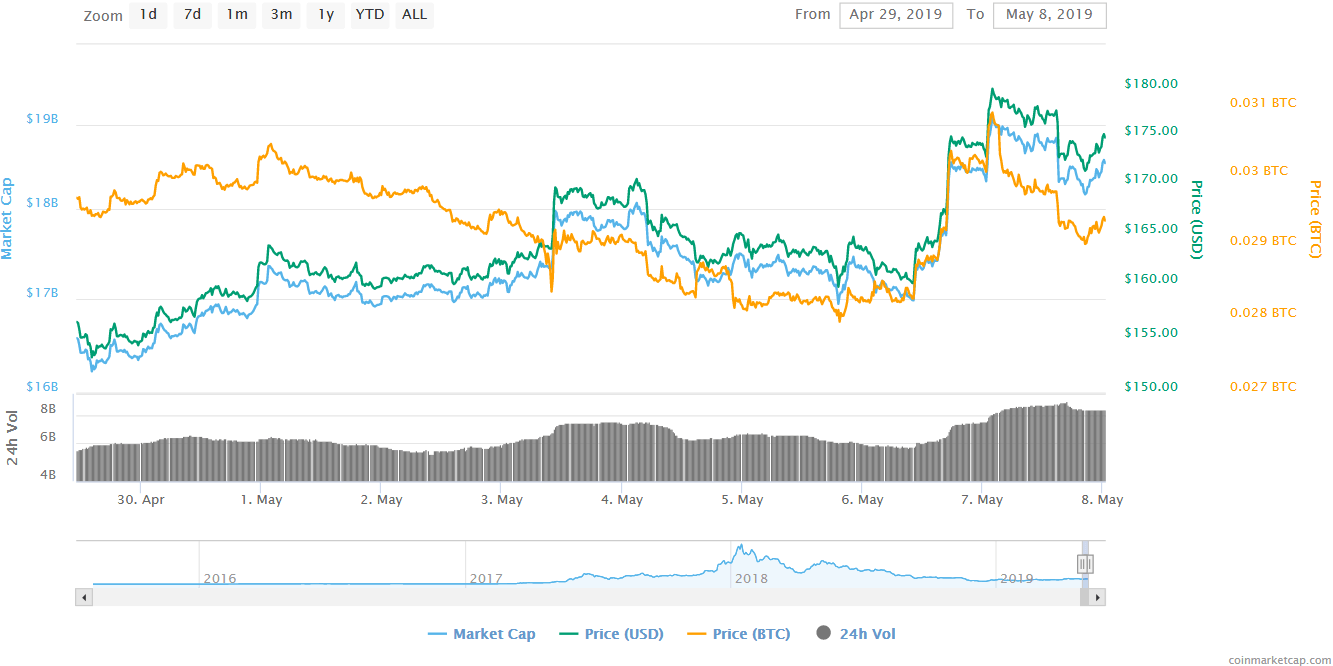

Markets responded positively to the increased attention on the No.2 cryptocurrency, sending the ETH price on a 17.5% surge which continues at the time of writing.

Elon Musk: The Tweet That Launched a Thousand Ether

It began with a tweet. When Elon Musk sent out a one word comment on April 29th, it sparked the beginning of a ten-day surge which returned 17.5% gains to Ethereum holders.

Between April 25th and May 8th, the unit value of ETH increased from $153.48 up to a peak of $180.39. A brief pullback saw it returned to the low $170 range, but momentum pushed it higher once more.

The Tesla CEO then queried what should be developed on the blockchain platform, and Ethereum CEO Vitalik Buterin responded with a 13-point list. Conducting casual business negotiations with Elon Musk on Twitter? Surely worth the combined marketing budgets of a thousand altcoins. And its effect on the ETH price was apparent.

Ethereum Dev Kit Added to Microsoft Azure

Although already present on Azure, Monday’s updated release sees Ethereum developers given more freedom on Microsoft’s cloud workshop.

The launch of the Visual Studio Code extension gives blockchain developers the chance to write code in Solidity and Truffle – two of Ethereum’s smart-contract programming languages.

Head of BuildAzure, and Microsoft MVP, Chris Pietschmann, suggested this was a sign of the computing giant’s intention to invest seriously in blockchain development. He said:

“This proves even further the investment and dedication that Microsoft is putting forth towards the use of Blockchain ledger technologies in the Enterprise, or even on the public blockchain networks.”

Indeed, Microsoft has presented an open door to blockchain developers for years now. When Factom (FCT) was added to Azure in 2015 it resulted in an instant price pump of 600%. In recent years other blockchain development kits have been added, including those for Stratis (STRAT) and Ontology (ONT), with varying degrees of market reaction.

ETH Futures Rumour Adds Fuel to the Fire

On May 6th the Ethereum price pump was extended further when a U.S. Commodity Futures Trading Commission (CFTC) official spoke off-record about a possible Ethereum futures market. The unnamed CFTC regulator was allegedly quoted as saying:

“I think we can get comfortable with an ether derivative being under our jurisdiction. If they came to us with a particular derivative that met our requirements, I think that there’s a good chance that it would be self-certified by us.”

Some have suggested a futures market would be a boost in the arm for Ethereum, after a period in which it came under heavy criticism for missed targets and lack of developments.

Notably, Bitcoin received the same boost in the arm in December 2017, when the announcement of the CME and CBOE futures markets hit the newsfeeds. Over the next 17 days the value of Bitcoin doubled, from $10,000 to $20,000.

However, in a perfect example of ‘buy the rumour, sell the news’, when the futures markets launched on December 18th, the value of Bitcoin sunk like a stone.

Click here for a real-time ethereum price chart.