By CCN: Warren Buffett, the Oracle of Omaha, once gave some investing advice that is incredibly timely now that bitcoin (BTC/USD) skyrocketed to a fresh 2019 high of $8,350 on Coinbase:

“To be a successful investor, you must divorce yourself from the fears and greed of the people around you.”

The unexpected rally may not be getting the media attention it deserves but, our analysis shows that people are beginning to hop on the bandwagon.

Unfortunately, they only do so after bitcoin is most likely about to conclude a rally. In this article, we show how many retail investors buy only after the price surge concludes.

Bitcoin Charts and Google Trends Data Show Undeniable Correlation

The bitcoin price appears to be inspiring FOMO in the hearts of retail investors. | Source: Shutterstock

In trading and investing, it is always good practice to consider the contrarian stance. For instance, if the overall sentiment is bearish, perhaps it’s an excellent time to be bullish – and vice-versa. We do this all the time because the herd is rarely correct. It seems that Google Trends supports our line of thinking.

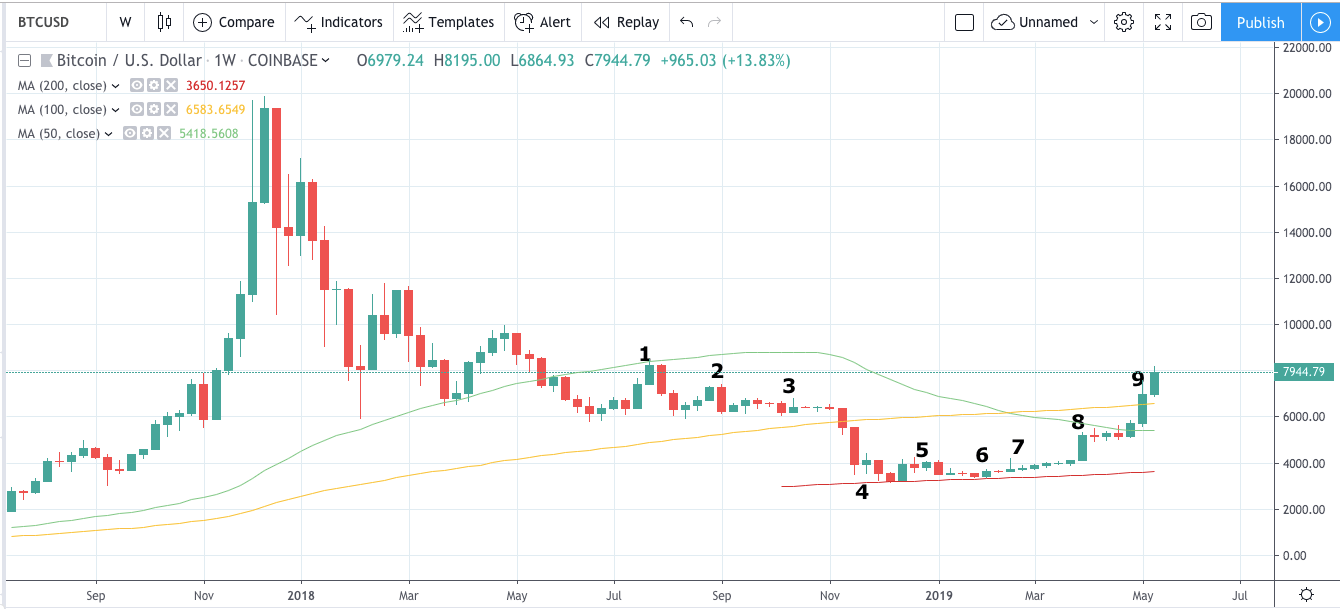

We plotted the interest for the search term “buy bitcoin” on Google Trends during the past 12 months, and correlated it with bitcoin’s price action on the weekly chart.

On the Google Trends chart, we were able to mark nine points where there was a spike or significant interest in the search term. For your reference, these are the dates when the search “buy bitcoin” bounced:

- July 22 – 28, 2018

- Sept. 02 – 08

- Oct. 14 – 20

- Nov. 25 – Dec. 01

- Dec. 30, 2018 – Jan. 05, 2019

- Feb. 03 – 09

- Feb. 24 – Mar. 02

- Mar. 31 – Apr. 06

- May 05 – 11

Dates when people showed interest in the search term “buy bitcoin” on Google Trends | Source: Google Trends

We then cross-referenced these dates to bitcoin’s weekly chart on Coinbase. We discovered that there’s only significant interest in the cryptocurrency either during a rally or after a bounce.

Bitcoin posted green weekly candles in eight out of the nine dates listed above. There was only one red candle, and that was in the week of September 3rd. At that time, the market was blowing off steam after going above $8,000.

The correlation between public interest and price action is undeniable. It indicates that people are only interested in buying bitcoin after a price surge. The link becomes more evident when you look at the relationship between the two variables in the last seven days.

Interest in “buy bitcoin” increased significantly in the last seven days. | Source: Google Trends

In this sample, the “buy bitcoin” search term peaked on May 12th and May 14th. If you look at bitcoin’s daily chart, these are the dates when the market appears to be hyper bullish.

Don’t Get Trampled When the Crypto Bulls Stampede

Considering all the data, there appears to be a link between the rise in price and the surge in interest in buying bitcoin.

Of course, correlation doesn’t mean causation. However, there is some evidence to suggest that FOMO likely drives the general public.

If this is true, then the legendary Warren Buffett is right. Here’s a slight modification to what he said: “You must divorce yourself from the fears and greed of the” herd “to be a successful investor.”