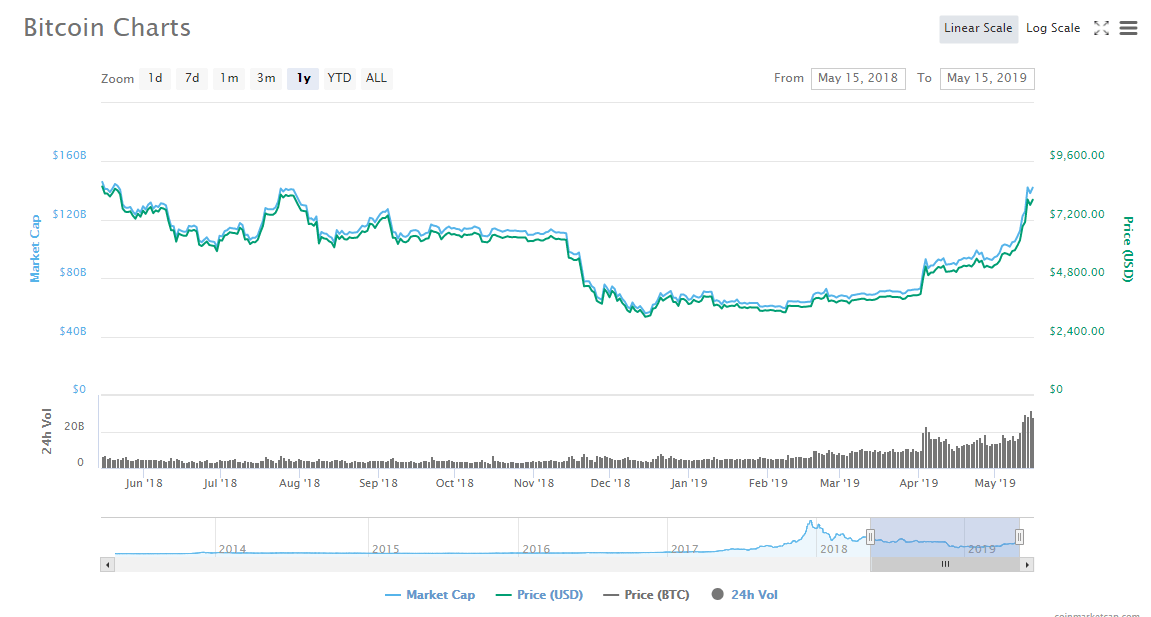

By CCN: The future’s so bright for crypto that investors need to wear shades. Travis Kling, CIO of crypto investment firm Ikigai Asset Management, is more bullish on bitcoin than ever. From any vantage point, bitcoin has turned a corner. Not only is the bitcoin price up nearly 50% in May (based on CoinMarketCap data), but it’s about doubled year-to-date. Also, BTC has rebounded 150% from year-end 2018 lows. It would take the risk pendulum swinging in the complete opposite direction for anything to get in bitcoin’s way now. In an interview with the Nasdaq’s Trade Talks, Kling stated:

“Any…questions that existed in the March/April timeframe about whether or not the crypto market had bottomed and what the chances were that we were going to revisit the lows, essentially all of that is out the window now. It would take some massive risk-off shift for assets globally for us to go retest the lows.”

In fact, Kling’s outlook for the balance of this year and into 2020 is “really bright.”

Fed-Fueled Crypto Rally

Of all people, Fed Chairman Jerome Powell could be to thank for the nearly parabolic bitcoin price. Kling said it was Powell who “put the bottom in for crypto markets.”

When the Fed did a 180-degree turn and turned dovish in late January, it set off a wave among global central banks to respond similarly. Hindsight is 20/20, and now it’s clear that this is what positioned the crypto market for the bull run. The evidence surfaced with Litecoin in early February after the cryptocurrency skyrocketed some 30% in a single day on robust trading volume. There’s been no stopping bitcoin, Litecoin, or the broader crypto market ever since.

“It is no coincidence that that was nine days after the Fed did their U-turn,” said Kling in reference to the Litecoin rally.

Bitcoin’s Higher Lows and Higher Highs

Incidentally, Travis Kling is a former hedge fund trader. Even though he was successful, Kling came to the realization that “the world doesn’t need another hedge fund manager. But the world does need this technology.” He remembers his roots, however, and cites a phenomenon used by hedge fund legend George Soros called “reflexivity.” Basically, it means “higher prices beget higher prices, and lower prices beget lower prices,” explained Kling.

And while Soros may be an equity investor, his reflexivity concept is more real in the crypto market than any other asset class, as per the Ikigai CIO. This is a result of the fact that the bitcoin price is fueled by the “network effect…the more people that use crypto the more valuable it is.”

Given the ramped-up pace of mainstream adoption, it could be to the moon for the bitcoin price a lot sooner than later.