By CCN: Bitcoin is not an effective hedge against an uncertain economy or volatile stock market — despite what crypto evangelists vehemently insist. That’s the conclusion of a report that was just published in the Annals of Operations Research.

The paper is entitled “Market Risk and Bitcoin Returns,” and it was authored by Dimitrios Koutmos, an assistant finance professor at Worcester Polytechnic Institute in Massachusetts.

Report Touts Itself as a ‘Cautionary Note’

Koutmos says he’s sounding the alarm for investors, calling his report a “cautionary note” for the irrationally exuberant cryptocurrency enthusiast.

He says his research indicates that the bitcoin price is not as independent of external influences such as the general economy, stock market movements, and geopolitical uncertainty as its proponents claim.

So as the global economy slows down, buying crypto as a hedge against a recession or stock market crash is not advisable, Koutmos says.

The bitcoin price has made a startling recovery in 2019, but that doesn’t mean it’s distinguishing itself as an uncorrelated asset. | Source: Yahoo Finance

There’s apparently little correlation between the Dow Jones and BTC prices.

Professor: Bitcoin Is Not a Reliable Safety Net

In fact, Koutmos says the risks of investing in bitcoin outweigh the potential benefits of using it as a financial safety net.

“Bitcoin is emerging as a distinct asset class among investors given its seemingly detached price behavior relative to market and economic fundamentals. Its incomparably high returns in recent years has further fueled intense interest and investment into Bitcoin and cryptocurrencies at large.”

“This paper cautions that Bitcoin prices, despite their seemingly attractive independent behavior relative to economic variables, may still be exposed to the same types of market risks which afflict the performance of conventional financial assets.”

Koutmos: ‘Bitcoin Is Not a Unique Asset Class’

Koutmos looked at bitcoin prices between January 2013 and September 2017 and examined the degree to which they were affected by short-term interest rates, foreign exchange rates, and expected volatility in the stock markets. These are factors that heavily influence the movement of

he Dow Jones Industrial Average and global stock markets.

Koutmos found that interest rates and projected instability in the stock market and foreign exchanges were “important determinants of bitcoin returns,” especially during periods when the crypto market is less volatile.

In other words, these factors — combined with inflation and the general state of the economy — affected BTC prices as much as they affected any other asset.

Accordingly, Koutmos says bitcoin is not “a unique asset class whose price behavior is detached from economic fundamentals.”

Investment Manager: Bitcoin Is a Hedge against ‘Irresponsible’ Fed

This is an argument that crypto evangelists have repeatedly made. As CCN reported, crypto perma-bull Travis Kling, the founder of Ikigai Asset Management, made a similar contention in April 2019.

Kling says the Federal Reserve’s recent manipulation of interest rates has caused many people to lose faith in central banks. Consequently, this growing distrust has caused many people to flock to bitcoin, he claims.

In fact, Kling credited this escalating public cynicism toward the Fed for the recent bitcoin rally, which started in early-April.

Bitcoin Is a Hedge Against ‘Irresponsible’ Federal Reserve: Asset Manager https://t.co/FuO6dee7K3

— CCN.com (@CCNMarkets) April 4, 2019

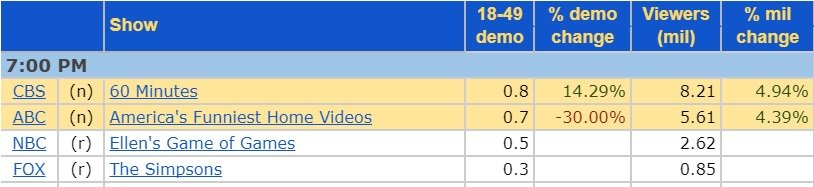

Crypto-Centric ’60 Minutes’ Episode Wooed 8.2 Million Viewers

No matter what your opinion is, one thing bitcoin hasn’t been hurting for recently is media exposure.

On May 19, crypto went primetime when the popular CBS news magazine show, “60 Minutes,” did a special on the budding market.

Bitcoin Searches Rocket to 13-Month High Amid ’60 Minutes’ Hype https://t.co/59dchmQXZY

— CCN.com (@CCNMarkets) May 19, 2019

While the mainstream media exposure didn’t produce an overnight price bump, it’s a surefire sign that crypto isn’t going anywhere, anytime soon. Want proof?

Last night’s episode of “60 Minutes” won its time slot (7 p.m. Eastern time) and scored a whopping 8.2 million viewers. So, is the crypto virus spreading? Only time will tell.